Get the free Taxpayers Subsidise Private Money Creation - mpra ub uni-muenchen

Show details

MP A R Munich Personal Repel Archive Taxpayers Subsidize Private Money Creation. Ralph S. Mus grave 20 March 2016 Online at https://mpra.ub.unimuenchen.de/70162/ MPA Paper No. 70162, posted 21 March

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign taxpayers subsidise private money

Edit your taxpayers subsidise private money form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taxpayers subsidise private money form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing taxpayers subsidise private money online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit taxpayers subsidise private money. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out taxpayers subsidise private money

How to fill out taxpayers subsidise private money:

01

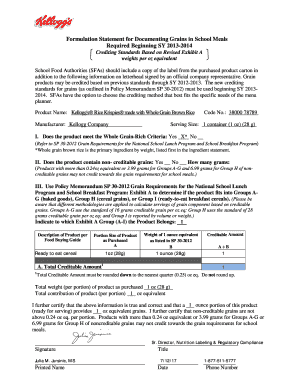

Gather all necessary documentation and information related to the private money being subsidized. This may include financial statements, invoices, receipts, and any other supporting documents.

02

Determine the eligibility criteria for taxpayer subsidy of private money. Different jurisdictions or programs may have specific requirements or limitations.

03

Fill out the appropriate application or form provided by the relevant authority or agency. Provide accurate and complete information to ensure a smooth processing of the subsidy request.

04

Include any additional documentation or evidence that supports the need for taxpayer subsidy of private money. This may include proof of financial hardship, economic impact, or any special circumstances.

05

Review the completed application and double-check for any errors or omissions before submitting it. It is essential to ensure the accuracy of all provided information to avoid delays or rejections.

06

Submit the application and any required supporting documents as instructed. Pay attention to the submission deadline, if applicable.

07

Monitor the progress of the subsidy request. This can be done by regularly checking the status online, contacting the relevant authority, or seeking updates through email or phone.

08

If the subsidy application is approved, follow any additional instructions provided by the authority. This may include providing further documentation, attending meetings or workshops, or complying with certain conditions to receive the subsidy.

09

If the subsidy application is denied, consider reviewing the reasons for rejection and determine if any appeals or alternative options are available. Seek assistance from professionals or advisors if needed.

10

Keep records of all submitted documents, correspondence, and communications related to the subsidy application for future reference or potential audits.

Who needs taxpayers subsidise private money?

01

Individuals or households facing financial hardship or economic difficulties may need taxpayers to subsidize their private money. This can help them cover essential expenses or mitigate financial burdens.

02

Small businesses or startups that are struggling to meet their financial obligations due to various reasons may require taxpayer subsidies to keep their operations running or prevent layoffs.

03

Industries or sectors that are crucial for the overall economy or have suffered significant setbacks may rely on taxpayer subsidies to stimulate growth, maintain employment, or prevent market failures.

04

Non-profit organizations or charitable institutions may benefit from taxpayer subsidies to support their charitable activities, provide essential services, or carry out community-oriented initiatives.

05

Educational institutions, research centers, or cultural organizations often rely on taxpayer subsidies to fund scholarships, research projects, infrastructure development, or artistic endeavors.

06

Individuals or entities involved in innovative or environmentally-friendly projects may seek taxpayer subsidies to promote sustainability, technological advancements, or renewable energy initiatives.

07

Certain sectors or demographics, such as healthcare, childcare, or elder care, may require taxpayer subsidies to ensure access to vital services and support for vulnerable populations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my taxpayers subsidise private money directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your taxpayers subsidise private money along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send taxpayers subsidise private money for eSignature?

To distribute your taxpayers subsidise private money, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I sign the taxpayers subsidise private money electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your taxpayers subsidise private money in seconds.

What is taxpayers subsidise private money?

Taxpayers subsidise private money when government funds are used to support private businesses or individuals in various forms such as grants, subsidies, or tax breaks.

Who is required to file taxpayers subsidise private money?

Entities or individuals who receive taxpayers subsidise private money are required to file reports with the government to disclose how the funds are being used.

How to fill out taxpayers subsidise private money?

To fill out taxpayers subsidise private money, recipients must accurately report the details of the funds received, how they are being used, and any impact or outcomes achieved.

What is the purpose of taxpayers subsidise private money?

The purpose of taxpayers subsidise private money is to stimulate economic growth, support innovation, create jobs, or provide assistance to individuals or businesses in need.

What information must be reported on taxpayers subsidise private money?

Information that must be reported on taxpayers subsidise private money includes the amount of funds received, the purpose of the funds, how they were used, and any results or outcomes achieved.

Fill out your taxpayers subsidise private money online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Taxpayers Subsidise Private Money is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.