CERT-119 2000-2025 free printable template

Show details

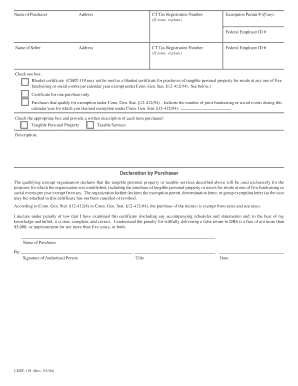

State of Connecticut Department of Revenue Services Taxpayer Services Division 25 Sigourney Street Hartford CT 061065032 CERT119 (Revised 06/00) Certificate for Purchases of Tangible Personal Property

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign exemption renewal expire form

Edit your exempt renewal expire form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your exemption years form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit exemption certificate organizations online

To use the services of a skilled PDF editor, follow these steps below:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit exempt exemption filed form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out qualifying organizations form

How to fill out CERT-119

01

Start by downloading the CERT-119 form from the official website.

02

Carefully read the instructions provided at the top of the form.

03

Fill out your personal information, including your name, address, and contact details.

04

Provide specific details about the incident or event that the form is related to.

05

Ensure that you accurately report any relevant dates and times associated with the incident.

06

If applicable, include any additional documentation or evidence that supports your case.

07

Review the entire form for accuracy and completeness.

08

Sign and date the form at the designated section.

09

Submit the completed CERT-119 form to the appropriate authority as instructed.

Who needs CERT-119?

01

Individuals or organizations involved in specific incidents that require reporting.

02

Those seeking to document an event for legal or regulatory purposes.

03

Persons needing to file a claim or seek assistance related to the reported event.

Fill

form

: Try Risk Free

People Also Ask about

How do I claim exemptions on my tax form?

To claim exempt, write EXEMPT under line 4c. You may claim EXEMPT from withholding if: o Last year you had a right to a full refund of All federal tax income and o This year you expect a full refund of ALL federal income tax. NOTE: if you claim EXEMPT you must complete a new W-4 annually in February.

What IRS form do I use to claim exemptions?

Exemption From Withholding If an employee qualifies, he or she can also use Form W-4 to tell you not to deduct any federal income tax from his or her wages. To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year.

What IRS form do I need to change exemptions?

Change Your Withholding Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer.

Should I claim exemption on tax form?

Who Should Be Filing Exempt on Taxes? As noted above, you can claim an exemption from federal withholdings if you expect a refund of all federal income tax withheld because you expect to have no tax liability and had no tax liability in the previous tax year.

What does it mean to claim exemption on tax form?

An exemption is a dollar amount that can be deducted from an individual's total income, thereby reducing. the taxable income. Taxpayers may be able to claim two kinds of exemptions: • Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse)

Why would you claim yourself as an exemption?

If your gross income is over the filing threshold and no one can claim you as a dependent, you can claim a personal exemption for yourself when you file your return. You can also claim an exemption for your spouse if you file a joint return.

Should I claim myself as an exemption on w4?

“Should I declare myself exempt from withholding?” No, it's not a good idea to claim you're exempt simply in order to get a bigger paycheck. By certifying you are exempt, your employer wouldn't withhold any federal income tax amounts during the year, and that would result in a large tax bill due in April.

Is it better to claim an exemption or not?

Filing for exemption from withholding won't cause you to pay any less in taxes. If you owe taxes but file as exempt, you'll have to pay the full tax bill when you file your taxes next year. Not only that, but the IRS can charge you additional penalties for failing to withhold.

What does it mean to be filed as an exemption?

An exemption is a dollar amount that can be deducted from an individual's total income, thereby reducing. the taxable income. Taxpayers may be able to claim two kinds of exemptions: • Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit exemption ny form online?

The editing procedure is simple with pdfFiller. Open your exemption ny form in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out the exemption ny form form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign exemption ny form and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit exemption ny form on an Android device?

The pdfFiller app for Android allows you to edit PDF files like exemption ny form. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is CERT-119?

CERT-119 is a compliance form used by businesses to report certain information to regulatory authorities.

Who is required to file CERT-119?

Entities that handle specific regulated activities are required to file CERT-119.

How to fill out CERT-119?

To fill out CERT-119, gather the required information, complete each section accurately, and submit it to the appropriate regulatory body by the specified deadline.

What is the purpose of CERT-119?

The purpose of CERT-119 is to ensure compliance with regulations and provide necessary transparency to regulatory authorities.

What information must be reported on CERT-119?

The information that must be reported on CERT-119 typically includes business identification details, activities being reported, and any relevant compliance data.

Fill out your exemption ny form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Exemption Ny Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.