Get the free Monthly Tax Update Newsletter

Show details

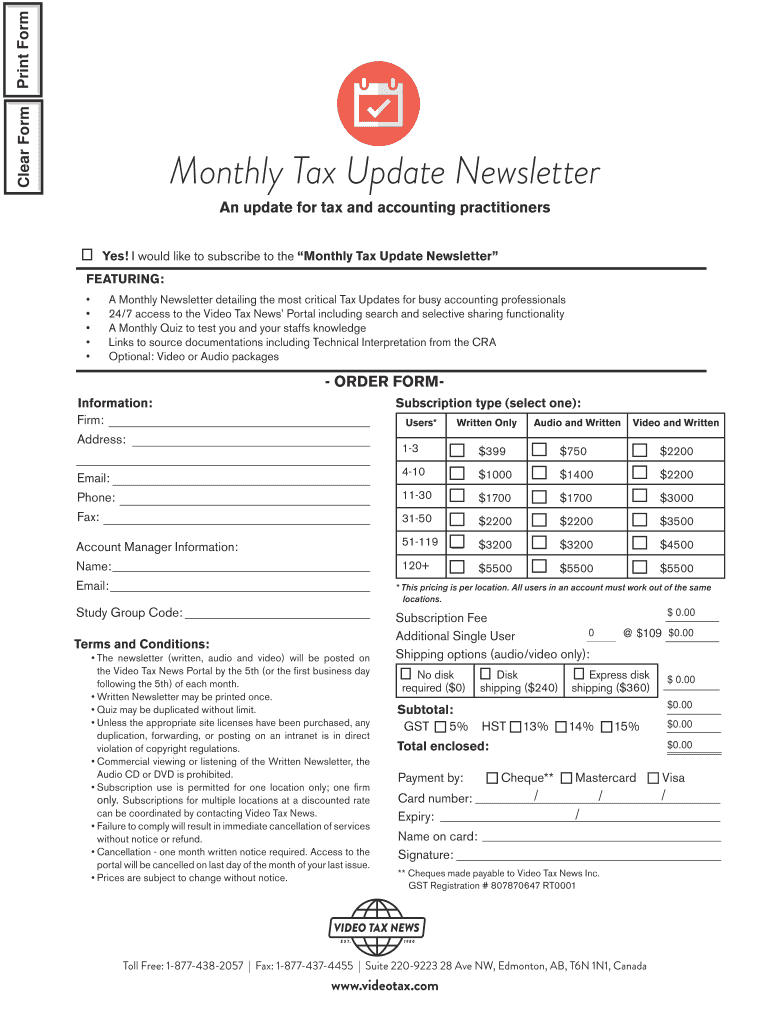

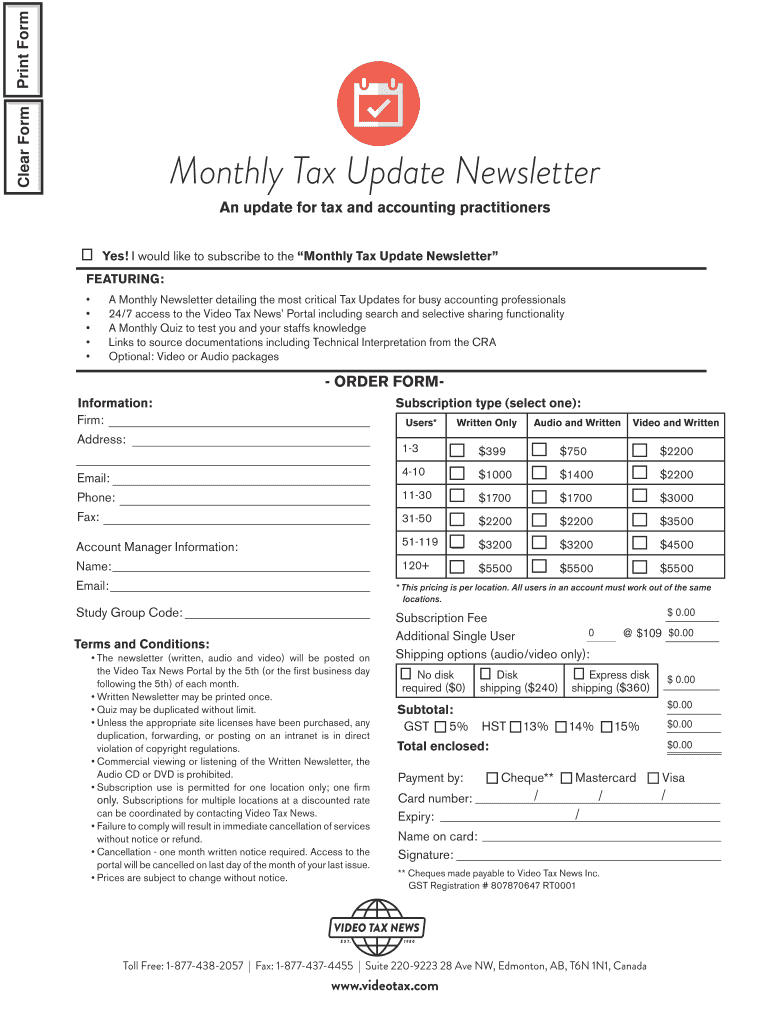

Print Form Clear Form Monthly Tax Update Newsletter An update for tax and accounting practitioners Yes! I would like to subscribe to the Monthly Tax Update Newsletter FEATURING: A Monthly Newsletter

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign monthly tax update newsletter

Edit your monthly tax update newsletter form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your monthly tax update newsletter form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing monthly tax update newsletter online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit monthly tax update newsletter. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out monthly tax update newsletter

01

To fill out a monthly tax update newsletter, start by gathering relevant tax information and updates from trusted sources. This could include changes in tax laws, regulations, or important dates for filing taxes.

02

Organize the information in a clear and concise manner. Use headings, bullet points, or tables to present the information in a visually appealing way. Make sure to include any necessary explanations or details to help readers understand the updates.

03

Consider the target audience of the newsletter. Are you targeting individuals, businesses, or both? Tailor the content to their specific needs and interests. For example, individuals may be more interested in personal income tax updates, while businesses may need information on corporate taxes or deductions.

04

Prioritize the most important updates and information at the beginning of the newsletter. This will catch the reader's attention and ensure they are aware of any immediate actions they need to take.

05

Include practical tips or advice relating to the tax updates. This could include strategies for maximizing deductions, avoiding common tax pitfalls, or suggestions for tax planning.

06

Provide contact information for further inquiries. Include your company's contact details, such as a phone number or email address, so readers can reach out with any questions or concerns.

Who needs a monthly tax update newsletter?

01

Individuals who want to stay up-to-date with changes in tax laws and regulations that may affect their personal finances. This could include new deductions, credits, or filing requirements.

02

Small business owners who need to navigate complex tax laws and regulations. They may be interested in updates related to payroll taxes, sales taxes, or estimated tax payments.

03

Tax professionals who need to stay informed about changes in tax laws and regulations so they can provide accurate and up-to-date advice to their clients.

04

Entrepreneurs or individuals considering starting a business who want to understand the tax implications and requirements involved in running a business.

In summary, filling out a monthly tax update newsletter involves gathering relevant tax information, organizing it in a clear and concise manner, tailoring the content to the target audience, prioritizing key updates, providing practical tips, and including contact information for further inquiries. The newsletter is beneficial for individuals, small business owners, tax professionals, and entrepreneurs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit monthly tax update newsletter in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing monthly tax update newsletter and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I sign the monthly tax update newsletter electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I complete monthly tax update newsletter on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your monthly tax update newsletter, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is monthly tax update newsletter?

The monthly tax update newsletter is a communication sent out regularly to provide subscribers with updates on tax-related information.

Who is required to file monthly tax update newsletter?

All businesses and individuals who are required to report and pay taxes must file the monthly tax update newsletter.

How to fill out monthly tax update newsletter?

To fill out the monthly tax update newsletter, you will need to provide accurate information about your income, expenses, deductions, and any other relevant tax-related details.

What is the purpose of monthly tax update newsletter?

The purpose of the monthly tax update newsletter is to keep taxpayers informed about any changes in tax laws, regulations, and deadlines.

What information must be reported on monthly tax update newsletter?

The monthly tax update newsletter must include details about income, expenses, deductions, tax credits, and any other relevant tax information.

Fill out your monthly tax update newsletter online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Monthly Tax Update Newsletter is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.