Get the free Tax Treaty Relief bApplicationb for Other Income Earnings 0901-O - ftp bir gov

Show details

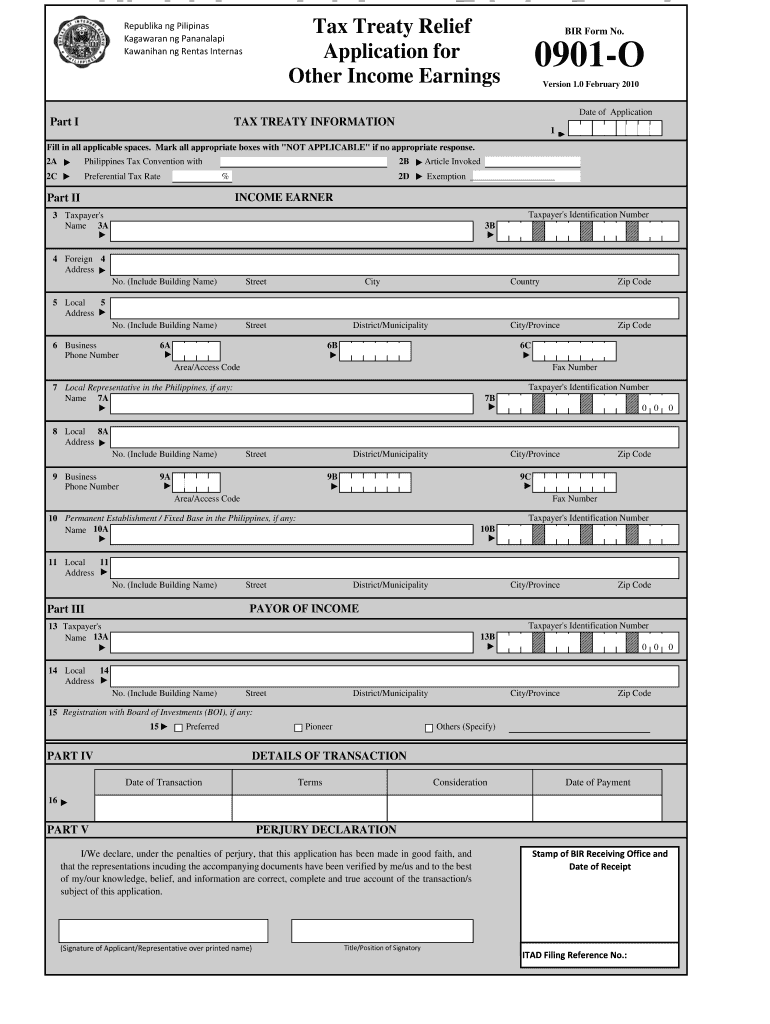

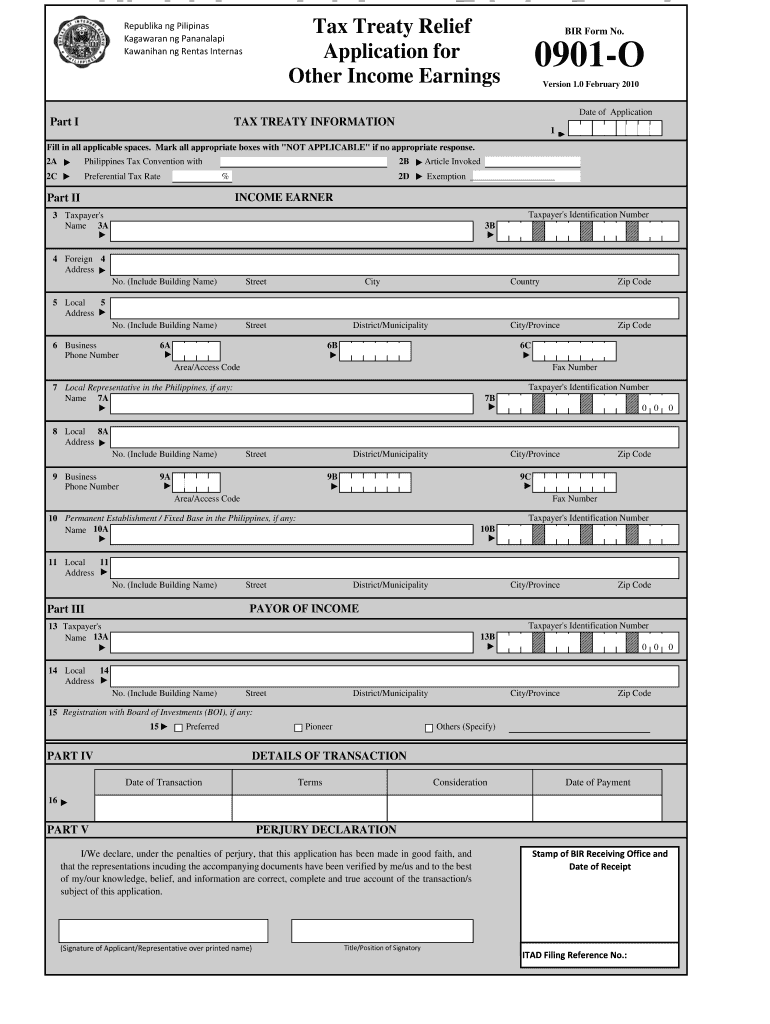

Tax Treaty Relief Application for Other Income Earnings Republican NG Filipinas Catamaran NG Pananalapi Hawaiian NG Rental Internal BIR Form No. 0901O Version 1.0 February 2010 Date of Application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax treaty relief bapplicationb

Edit your tax treaty relief bapplicationb form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax treaty relief bapplicationb form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax treaty relief bapplicationb online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax treaty relief bapplicationb. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax treaty relief bapplicationb

How to fill out tax treaty relief application:

01

Gather necessary information: Before starting the application, gather all the required information such as your personal details, tax identification number, country of residence, and the tax treaty you are seeking relief under. This will make the process smoother.

02

Download the application form: Visit the website of the tax authority or the relevant government agency and download the tax treaty relief application form. Make sure you are using the latest version of the form.

03

Fill in personal details: Start by filling in your personal details accurately. Include your full name, address, contact information, and tax identification number. Provide any additional information that is required, such as your date of birth or passport number.

04

Specify the tax treaty: Indicate the specific tax treaty for which you are seeking relief. Clearly mention the countries involved in the treaty and the relevant article or provision that grants the relief.

05

State the relevant income: Provide detailed information about the income for which you are seeking tax treaty relief. Include the nature of the income, the source country, and the amount earned. If you have multiple types of income, use separate sections or schedules to clearly outline each.

06

Attach supporting documents: Gather any necessary supporting documents to validate your claim for treaty relief. This may include copies of relevant tax forms, proof of residency, or certificates of income earned from the source country. Ensure that all documents are legible, organized and properly labeled.

07

Complete additional sections: Depending on the specific requirements of the application form, you may need to complete additional sections. These may include providing information about your tax obligations in both the source country and your country of residence, or disclosing any other relevant financial details.

08

Review and sign: Once you have filled out the application form, review all the information to ensure its accuracy and completeness. Make any necessary corrections before signing and dating the form. Double-check that you have included all the required supporting documents.

Who needs tax treaty relief application:

01

Individuals with earnings from international sources: Individuals who earn income from international sources and want to benefit from the tax treaty between their country of residence and the source country may need tax treaty relief application. This applies to various types of income such as dividends, interest, royalties, or salaries earned abroad.

02

Non-residents subject to double taxation: Non-residents who are subject to taxation in both their country of residence and the source country may need tax treaty relief application. The tax treaty can provide relief from double taxation by allowing the taxpayer to either claim an exemption, a reduced tax rate, or a tax credit.

03

Entities doing business internationally: Companies, partnerships, or other entities conducting business internationally and seeking relief from double taxation or preferential tax treatment may need tax treaty relief application. This can apply to various scenarios such as companies receiving dividends from subsidiaries in other countries or engaging in cross-border trade.

Remember, it is always recommended to consult with a tax professional or seek guidance from the relevant tax authority to ensure you are correctly filling out the tax treaty relief application and complying with any specific requirements or deadlines.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my tax treaty relief bapplicationb in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign tax treaty relief bapplicationb and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I create an eSignature for the tax treaty relief bapplicationb in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your tax treaty relief bapplicationb right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out tax treaty relief bapplicationb using my mobile device?

Use the pdfFiller mobile app to fill out and sign tax treaty relief bapplicationb. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is tax treaty relief application?

Tax treaty relief application is a request for relief from certain taxes under a tax treaty between two countries.

Who is required to file tax treaty relief application?

Individuals or entities that are eligible for tax treaty benefits and wish to claim them must file a tax treaty relief application.

How to fill out tax treaty relief application?

Taxpayers must provide detailed information about their residency status, income, and tax treaty eligibility in the tax treaty relief application form.

What is the purpose of tax treaty relief application?

The purpose of tax treaty relief application is to reduce or eliminate the double taxation of income that may occur when a taxpayer is subject to tax in two different countries.

What information must be reported on tax treaty relief application?

Taxpayers must report their personal information, residency status, income sources, and details of the applicable tax treaty on the tax treaty relief application.

Fill out your tax treaty relief bapplicationb online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Treaty Relief Bapplicationb is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.