Get the free Federal Financial Report - Grantsgov

Show details

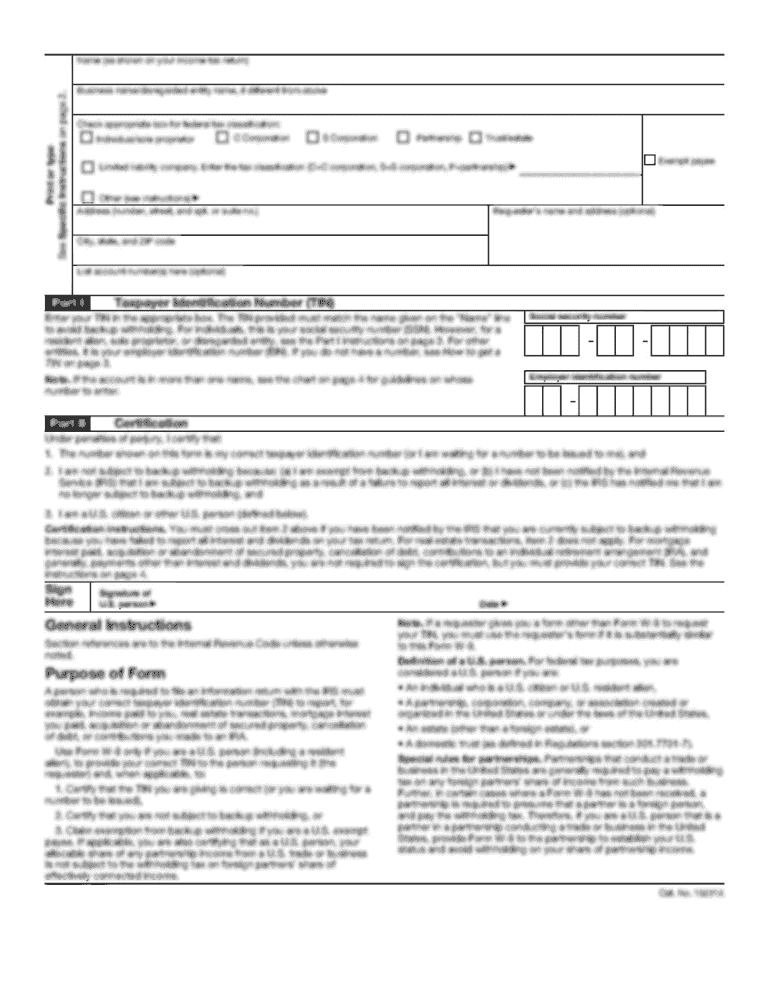

OMB Number: 4040-0014 Expiration Date: 01/31/2019 Federal Financial Report (Follow form Instructions) 1. Federal Agency and Organizational Element to Which Report is Submitted 2. Federal Grant or

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign federal financial report

Edit your federal financial report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your federal financial report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit federal financial report online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit federal financial report. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out federal financial report

How to fill out federal financial report:

01

Begin by gathering all necessary financial documents, such as income statements, balance sheets, and cash flow statements.

02

Familiarize yourself with the reporting guidelines provided by the federal agency or organization requesting the report. These guidelines will outline the specific information and formatting requirements for the report.

03

Start by providing basic information about your organization, including its name, address, and other relevant contact details.

04

Proceed to input financial data into the designated sections of the report. This may include revenue, expenses, assets, liabilities, and any other financial indicators required by the reporting guidelines.

05

Ensure accuracy and consistency in your reporting. Verify that all numbers and figures are correct before submitting the report.

06

Review the completed report to ensure that it meets the specific reporting requirements of the federal agency or organization.

07

Attach any supporting documents or additional information as required by the reporting guidelines.

08

Finally, submit the federal financial report by the designated deadline through the provided submission method (e.g., online portal, email, or physical mail).

Who needs federal financial report:

01

Nonprofit organizations: Many nonprofit organizations are required to submit federal financial reports to demonstrate their financial stability and compliance with legal and regulatory requirements.

02

Government agencies: Federal agencies often require financial reports from other government entities for budgeting and accountability purposes.

03

Grant recipients: Organizations that have received federal grants or funding may need to submit financial reports as a part of their grant agreement or adherence to funding requirements.

04

Research institutions: Some research institutions receiving federal funding must provide financial reports to ensure proper use and accountability of the allocated funds.

05

Contractors and vendors: Companies or individuals contracting with the federal government may be required to submit financial reports to demonstrate their financial stability and capability to fulfill their contractual obligations.

Fill

form

: Try Risk Free

People Also Ask about

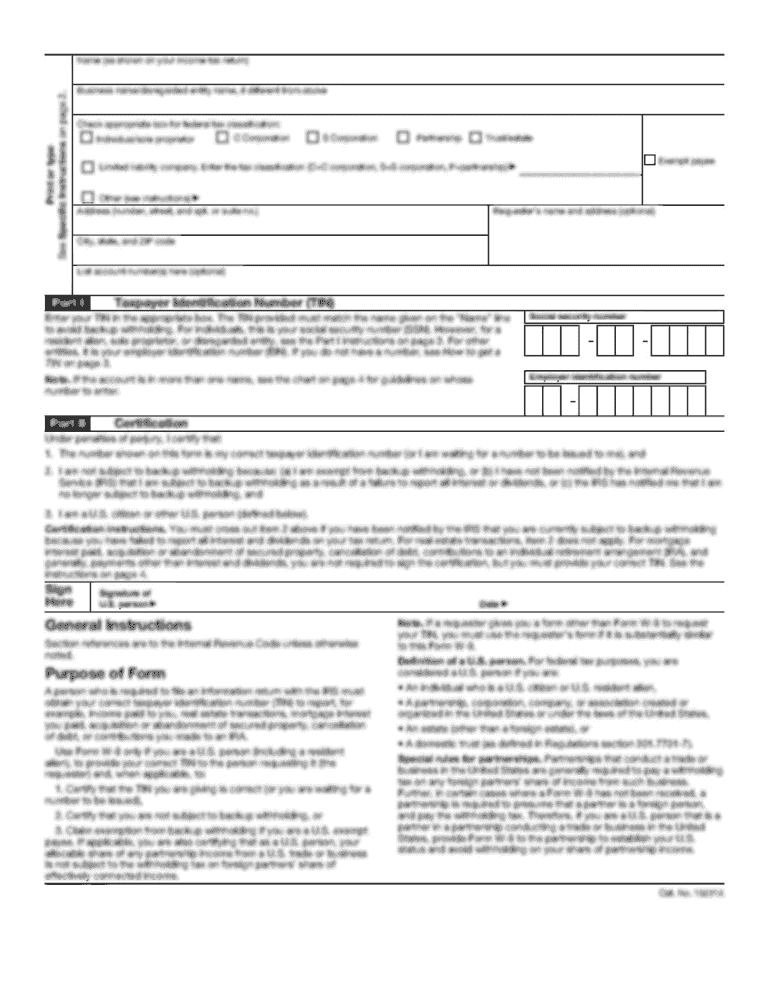

What is Federal Financial Report FFR or SF-425?

Standard Form SF-425 Federal Financial Report SF-425 is a standard form that recipients of federal funds under COPS Office grant programs (grantees) must use to report cumulative expenses incurred under each award. Grantees must submit one SF-425 per grant number every quarter.

What is Federal Financial Report FFR or SF 425?

Standard Form SF-425 Federal Financial Report SF-425 is a standard form that recipients of federal funds under COPS Office grant programs (grantees) must use to report cumulative expenses incurred under each award. Grantees must submit one SF-425 per grant number every quarter.

What is FFR reporting?

The Federal Financial Report (FFR) is a form that federal grant recipients are required to fill out and submit to their grant-awarding agency. The Consolidated FFR will allow grant recipients to submit all information related to the FFR in one system, rather than in multiple entry points.

What is the timeline for submission of FFR report?

At a minimum, recipients must submit the annual FFR via PMS by no later than 90 days after the end of each 12-month budget period (or incremental period (IP)) and the Final FFR by no later than 120 days after the end of the project period.

How do you initiate FFR in eRA Commons?

To submit an FFR report, it must first be saved. After completing the form, select the Save button on the FFR form to save the entered data. Once the Save button has been selected, the Submit button will appear at the top of the screen. Select the Submit button.

How do I complete FFR on just grants?

o Step 1: Click on the “Awards” tab on the left-hand menu and click on the FFR tab within the award. o Step 2: Find the award in the list and click on the “Award ID” link. o Step 3: Click on the Programmatic “Begin” button. You may need to scroll down the screen.

What is the federal financial report for grants?

The Federal Financial Report (FFR) is a form that federal grant recipients are required to fill out and submit to their grant-awarding agency. The Consolidated FFR will allow grant recipients to submit all information related to the FFR in one system, rather than in multiple entry points.

Who are the recipients of federal funds?

Recipients are any entity that has received federal money in the form of contracts, grants, loans, or other financial assistance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit federal financial report from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including federal financial report. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Where do I find federal financial report?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific federal financial report and other forms. Find the template you need and change it using powerful tools.

Can I sign the federal financial report electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your federal financial report in minutes.

What is federal financial report?

The federal financial report is a report that provides a summary of an organization's financial activities and financial position.

Who is required to file federal financial report?

Federal financial report is typically required to be filed by federal grant recipients, contractors, and other entities receiving federal funds.

How to fill out federal financial report?

To fill out a federal financial report, you will need to provide detailed information about the organization's financial activities, expenses, revenues, and assets.

What is the purpose of federal financial report?

The purpose of the federal financial report is to provide transparency and accountability in the use of federal funds by organizations receiving government grants or contracts.

What information must be reported on federal financial report?

The federal financial report must include details on the organization's financial activities, expenses, revenues, assets, and any other information required by the granting agency.

Fill out your federal financial report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Federal Financial Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.