Get the free Dormant Accounts amp Unclaimed Property The Legal Perspective - hcul

Show details

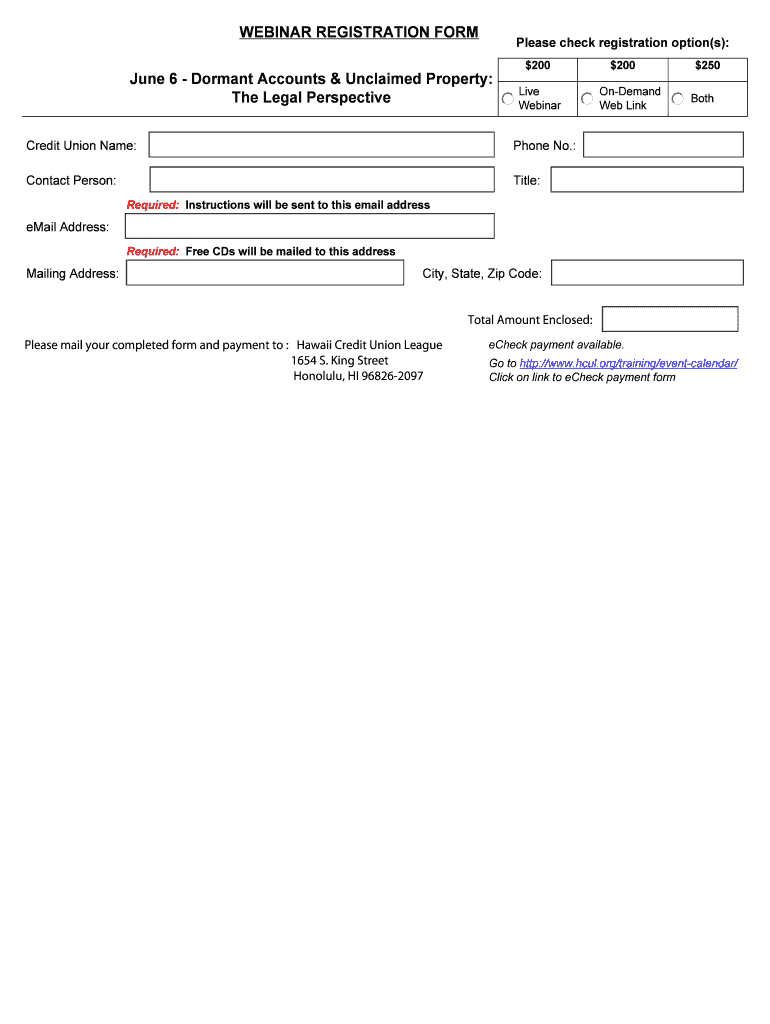

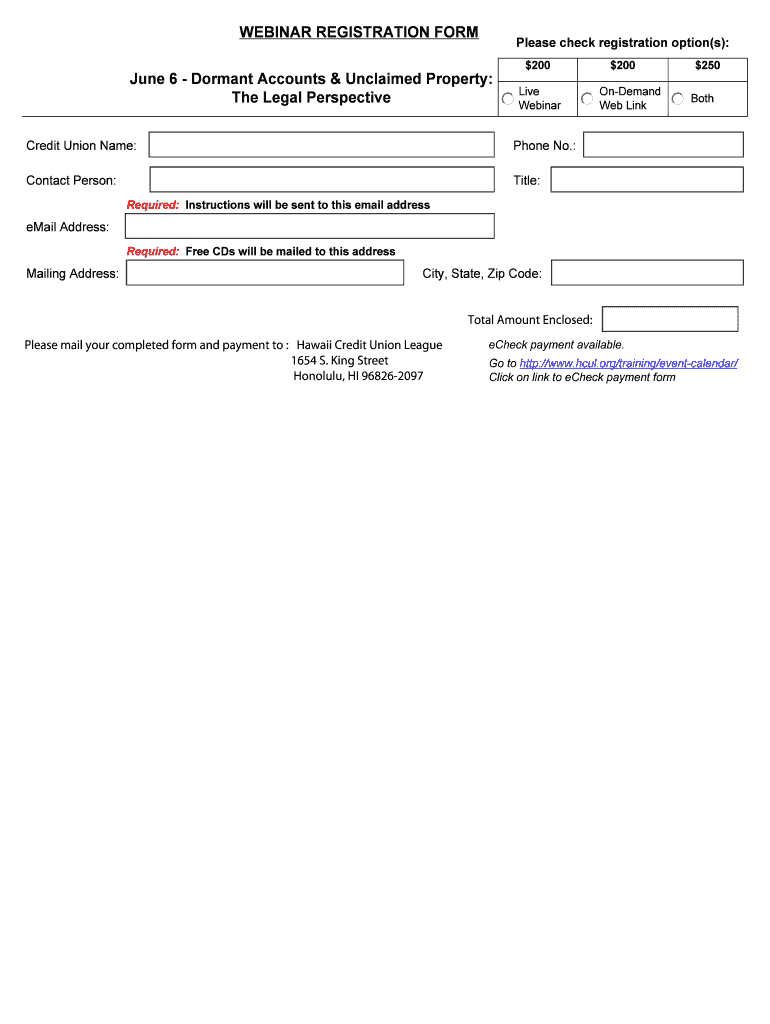

Reset Form Print Form Submit By Email Dormant Accounts & Unclaimed Property: The Legal Perspective Wednesday, June 6, 2012 9:00 a.m. 10:30 a.m. Hawaii Time Elizabeth Fast, JD & CPA, Spencer Fine Britt

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dormant accounts amp unclaimed

Edit your dormant accounts amp unclaimed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dormant accounts amp unclaimed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dormant accounts amp unclaimed online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit dormant accounts amp unclaimed. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dormant accounts amp unclaimed

How to Fill Out Dormant Accounts & Unclaimed:

01

Gather all relevant information: Start by collecting any paperwork or documentation related to the dormant account or unclaimed funds. This may include old bank statements, account numbers, Social Security numbers, or any other identifying information.

02

Contact the financial institution or agency: Reach out to the institution or agency that holds the dormant account or unclaimed funds. This could be a bank, credit union, insurance company, or even a government agency. Inquire about their specific requirements for reclaiming dormant accounts or unclaimed funds. They may provide you with a specific form to fill out or direct you to an online portal.

03

Complete the necessary paperwork: Fill out the required forms or provide the requested information accurately and completely. Be sure to double-check all the provided details to avoid any delays in processing your request. If you are unsure about any sections or have questions, don't hesitate to reach out to the institution or agency for clarification.

04

Provide proof of ownership or identification: Depending on the institution or agency's policies, you may need to provide additional documentation to prove your ownership or identity. This may include a valid photo ID, proof of address, previous account statements, or any other supporting documents.

05

Submit the completed paperwork: Once you have filled out all the necessary forms and gathered all required documentation, submit them to the institution or agency as instructed. Follow their preferred submission method, whether it is through mail, email, fax, or an online upload. Keep copies of all the submitted paperwork for your records.

06

Monitor the progress: After submitting the paperwork, keep track of the progress and follow up on your claim if necessary. Some institutions may have a specific timeframe in which they process dormant account or unclaimed fund requests. If you have not received any updates within the provided timeframe, consider contacting the institution or agency for an update.

Who Needs Dormant Accounts & Unclaimed:

01

Individuals with forgotten or neglected bank accounts: Dormant accounts may belong to individuals who have not accessed or made any transactions with their bank accounts for an extended period. This could be due to various reasons such as moving, changing banks, or simply forgetting about the account.

02

Beneficiaries of deceased individuals: In some cases, dormant accounts may belong to individuals who have passed away, and their beneficiaries are unaware of the funds. Relatives or heirs of the deceased may need to claim the dormant accounts on behalf of the deceased's estate.

03

Individuals with unclaimed funds from various sources: Unclaimed funds can arise from sources like uncollected insurance policies, unclaimed inheritances, forgotten retirement accounts, overpaid taxes, or uncashed checks. Anyone who believes they may have unclaimed funds related to these sources needs to go through the process of claiming them.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find dormant accounts amp unclaimed?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the dormant accounts amp unclaimed in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an electronic signature for the dormant accounts amp unclaimed in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your dormant accounts amp unclaimed in seconds.

How do I fill out dormant accounts amp unclaimed using my mobile device?

Use the pdfFiller mobile app to fill out and sign dormant accounts amp unclaimed. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is dormant accounts amp unclaimed?

Dormant accounts are accounts that have had no activity for an extended period of time, and unclaimed refers to funds that have been left untouched by the account owner.

Who is required to file dormant accounts amp unclaimed?

Financial institutions and companies holding such accounts are required to file dormant accounts and unclaimed funds.

How to fill out dormant accounts amp unclaimed?

Dormant accounts and unclaimed funds are typically reported to the relevant government authority using specific forms or online portals provided by the authorities.

What is the purpose of dormant accounts amp unclaimed?

The purpose of filing dormant accounts and unclaimed funds is to reunite the funds with their rightful owners or beneficiaries and prevent loss of assets.

What information must be reported on dormant accounts amp unclaimed?

Information such as account holder details, account balance, last activity date, contact information, and any other relevant data must be reported on dormant accounts and unclaimed funds.

Fill out your dormant accounts amp unclaimed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dormant Accounts Amp Unclaimed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.