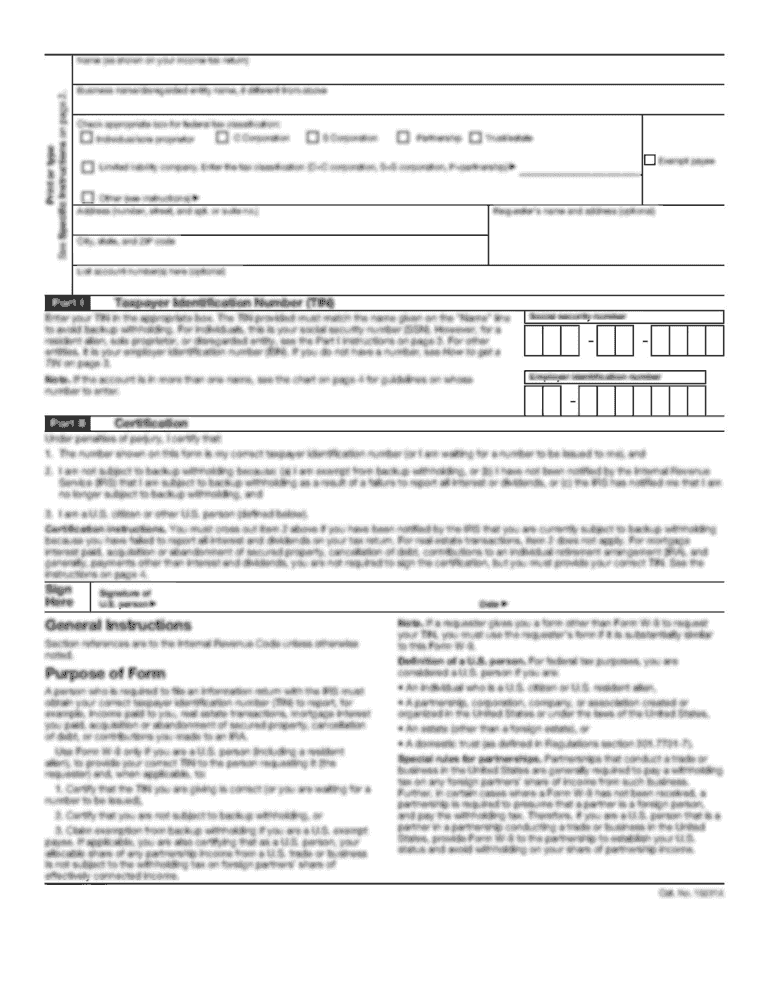

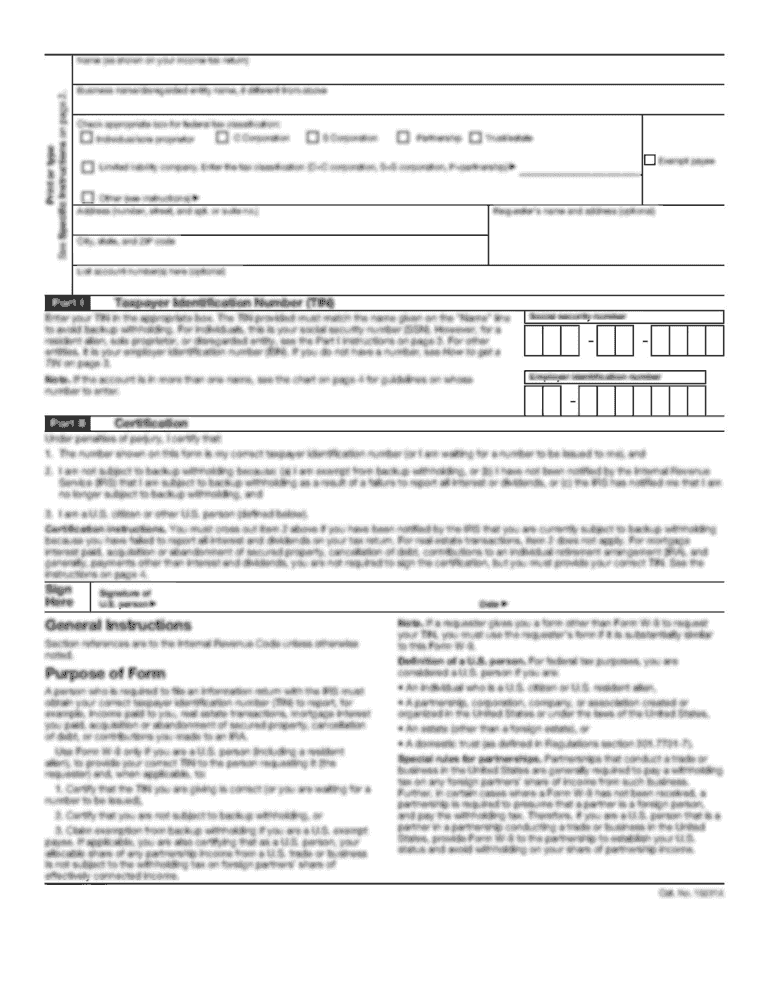

AZ Russell Sigler Application for COD Customers only 2013-2026 free printable template

Show details

Russell Signer, Inc 9702 W Tonto Street Mollison, AZ 85353 Creditapps@siglers.com Phone: 6233885100 Fax: 6233885408 Russell Signer, Inc Application for COD ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AZ Russell Sigler Application for COD Customers

Edit your AZ Russell Sigler Application for COD Customers form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AZ Russell Sigler Application for COD Customers form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AZ Russell Sigler Application for COD Customers online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AZ Russell Sigler Application for COD Customers. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out AZ Russell Sigler Application for COD Customers

How to fill out AZ Russell Sigler Application for COD Customers only

01

Visit the AZ Russell Sigler website and navigate to the application section.

02

Download the COD Customer Application form in PDF format.

03

Fill out the required fields, including your company name, address, and contact information.

04

Provide your tax identification number and any necessary business licenses.

05

Indicate your preferred payment terms and any special instructions.

06

Review your application for completeness and accuracy.

07

Sign and date the application.

08

Submit the completed application via email or mail as instructed on the form.

Who needs AZ Russell Sigler Application for COD Customers only?

01

Businesses that wish to establish a credit account with AZ Russell Sigler for cash on delivery transactions.

02

Companies that require funds to be settled at the time of delivery.

Fill

form

: Try Risk Free

People Also Ask about

What percentage should I choose for Arizona withholding?

The new default Arizona withholding rate is 2.0%. What if the employee wants their Arizona taxes to be overwithheld? Employees will still have the option of selecting a higher Arizona withholding rate than their wages might dictate and there is still a line to add an additional amount of Arizona withholding.

What percentage should I withhold for Arizona taxes 2023?

If hiring a new employee prior to January 1, 2023, should the employer withhold 2.0% in the first pay period following January 1, 2023? Employeer may implement the new Form A-4 immediately, but may choose to default to 2.7% within the two first pay period after January 31, 2023.

What is AZ form 120?

A corporation licensed by ADHS as a Dual Use Licensee (Dual Licensee) that elected to operate on a for-profit basis, must file an Arizona corporate income tax return, Arizona Form 120 or Arizona Form 120A, to report the income and expenses of ALL its operations for the taxable year.

What is the best percentage for Arizona withholding 2023?

The employer should select 2.0% on behalf of the employee. The new default Arizona withholding rate is 2.0%.

What is the new tax form for Arizona 2023?

Effective January 31, 2023, employers must provide Arizona employees with an updated Form A-4, which reflects the State's lower individual income tax rates. Arizona employers are required to make Arizona Form A-4 available to employees at all times and to inform them of Arizona's withholding election options.

What is the normal Arizona withholding percentage?

The new default Arizona withholding rate is 2.0%. What if the employee wants their Arizona taxes to be overwithheld? Employees will still have the option of selecting a higher Arizona withholding rate than their wages might dictate and there is still a line to add an additional amount of Arizona withholding.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit AZ Russell Sigler Application for COD Customers online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your AZ Russell Sigler Application for COD Customers and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I sign the AZ Russell Sigler Application for COD Customers electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your AZ Russell Sigler Application for COD Customers.

How do I fill out AZ Russell Sigler Application for COD Customers using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign AZ Russell Sigler Application for COD Customers and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is AZ Russell Sigler Application for COD Customers only?

The AZ Russell Sigler Application for COD Customers only is a form used by customers who wish to engage in cash on delivery transactions with AZ Russell Sigler.

Who is required to file AZ Russell Sigler Application for COD Customers only?

Customers who want to establish a COD account with AZ Russell Sigler are required to file this application.

How to fill out AZ Russell Sigler Application for COD Customers only?

To fill out the application, provide required personal and business information, sign the document, and submit it to AZ Russell Sigler.

What is the purpose of AZ Russell Sigler Application for COD Customers only?

The purpose of the application is to facilitate a formal agreement between AZ Russell Sigler and customers for COD transactions.

What information must be reported on AZ Russell Sigler Application for COD Customers only?

Required information typically includes customer name, address, contact details, business identification, and payment preferences.

Fill out your AZ Russell Sigler Application for COD Customers online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AZ Russell Sigler Application For COD Customers is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.