Get the free Form 571-R Due Date Last Day To File Without Penalty NOTICE

Show details

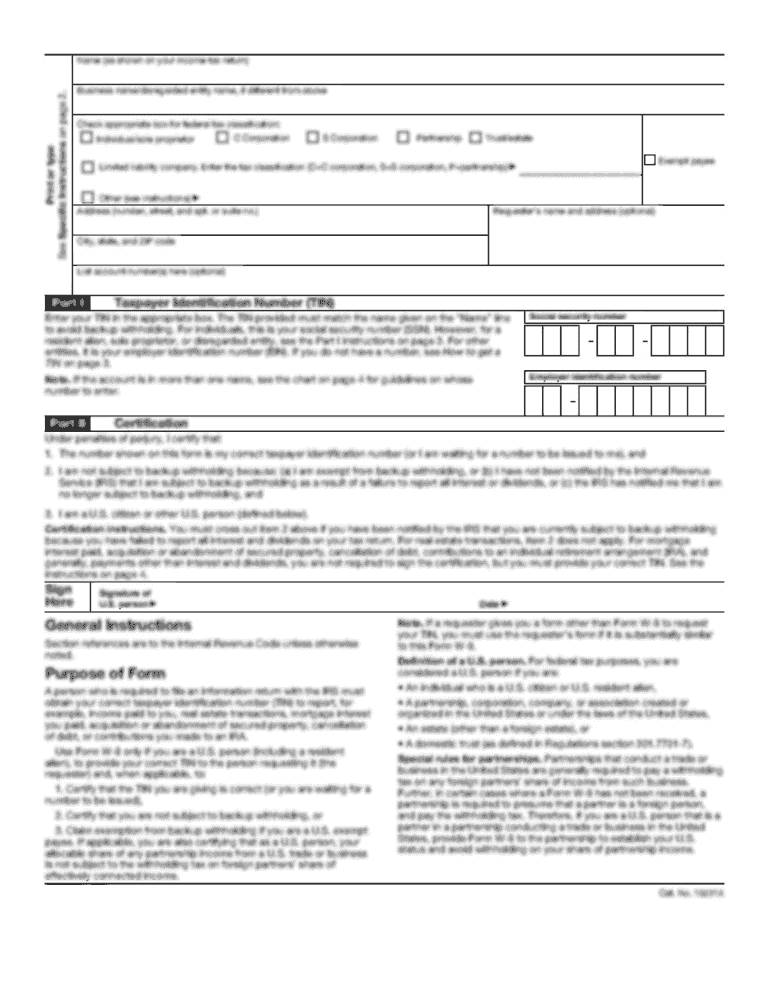

CARMEN CHU ASSESSORRECORDER SAN FRANCISCO OFFICE OF THE ASSESSORRECORDER Form 571R Due Date: April 1, 2016, Last Day To File Without Penalty: May 7, 2016, Account #: Online PIN #: NOTICE OF REQUIREMENT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 571-r due date

Edit your form 571-r due date form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 571-r due date form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 571-r due date online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 571-r due date. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 571-r due date

How to fill out form 571-r due date:

01

Obtain the form: First step in filling out form 571-r due date is to obtain the form itself. You can download it from the official website or request a copy from the relevant authority.

02

Read the instructions: Before proceeding to fill out the form, it is important to carefully read the instructions provided. These instructions will guide you through the process and ensure you provide the required information accurately.

03

Provide personal information: Begin by entering your personal information in the designated sections of the form. This may include your full name, address, contact details, and any other relevant information as requested.

04

Fill in the due date details: In the form, you will find sections where you need to input the due date information. This may include the specific date or a range of dates, depending on the purpose of the form. Make sure to accurately enter the due date information based on the requirements provided.

05

Include supporting documentation: Depending on the purpose of form 571-r due date, you may need to include supporting documentation along with the form. These could be documents that validate the due date provided or any other relevant information as instructed.

06

Review and double-check: Once you have filled out the form, take some time to review all the information you have entered before submitting it. Ensure there are no typos, errors, or missing details. Double-check that you have followed all the instructions accurately.

07

Submit the form: After thoroughly reviewing the form and confirming all information is correct, you can proceed to submit it. Follow the submission instructions as provided, whether it is by mail, online submission, or any other specified method.

08

Keep a copy for your records: It is always a good practice to keep a copy of the filled-out form and any supporting documentation for your records. This can be helpful in case you need to refer back to it or provide proof of submission in the future.

Who needs form 571-r due date?

01

Individuals with tax obligations: Form 571-r due date may be required for individuals who have tax obligations and need to report certain due dates to the relevant tax authority.

02

Businesses and organizations: Businesses and organizations that have specific due dates for reporting financial information or meeting other legal or regulatory requirements may also need to fill out form 571-r due date.

03

Contractors and freelancers: Independent contractors, freelancers, or self-employed individuals who need to report due dates for payments or other contractual obligations may be required to complete this form.

04

Government agencies: Government agencies or employees responsible for tracking and monitoring due dates for various purposes may use form 571-r due date to ensure compliance and timely reporting.

05

Legal entities: Certain legal entities such as trusts, partnerships, or corporations may have specific due dates that need to be reported using form 571-r due date.

06

Other individuals or entities: Depending on the specific requirements and regulations in your jurisdiction, there may be other individuals or entities that need to fill out form 571-r due date. It is important to consult with the relevant authority or seek professional advice to determine if you are required to complete this form.

Fill

form

: Try Risk Free

People Also Ask about

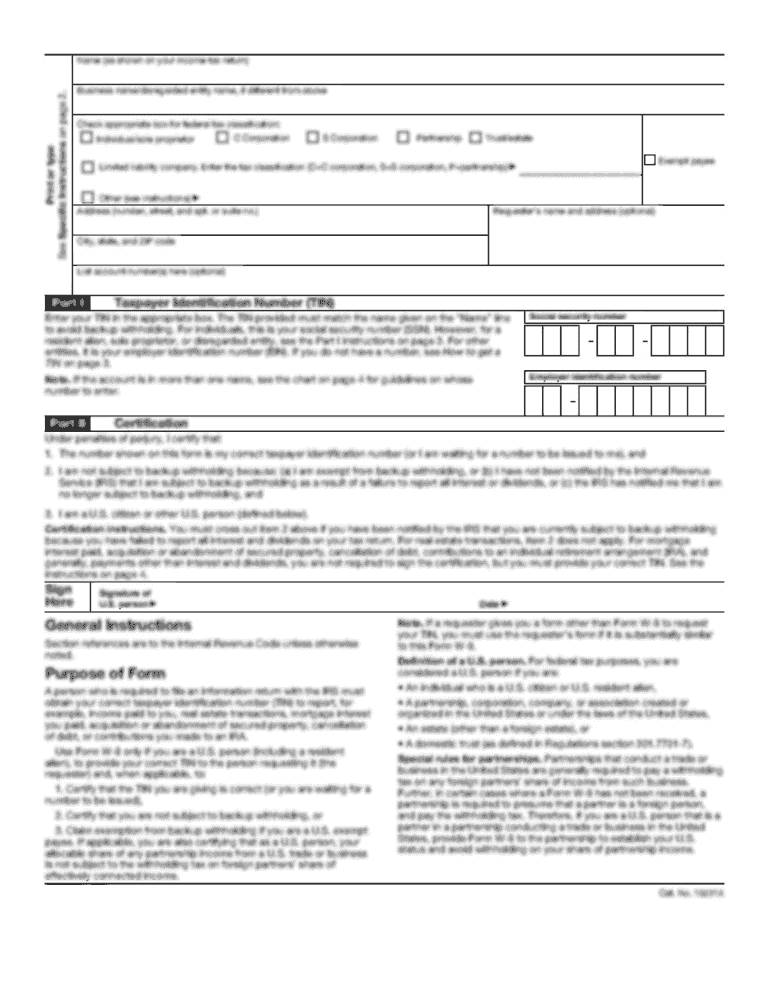

What is a 571l in San Francisco County?

Business property owners are required to file a property statement (Form 571-L) each year with the Office of the Assessor-Recorder detailing the acquisition cost of all supplies, equipment, fixtures, and improvements owned at each location within the City and County of San Francisco.

What is Form 571 L California property tax?

The Form 571L or 571A constitutes an official request that you declare all assessable business property situated in this county which you owned, claimed, possessed, controlled or managed on the tax lien date. The form is approved by the State Board of Equalization (BOE) but forms are administered by the county.

What needs to be reported on 571l?

Report all those business assets used in your business as of January 1. Business assets include, but are not limited to: Machinery and Equipment, Office Furniture and Equipment, Computers, Tools, Molds, Dies, Jigs, fixtures, and Supplies on Hand. * Cost includes sales tax, freight and installation.

What is a 571L in San Francisco County?

Business property owners are required to file a property statement (Form 571-L) each year with the Office of the Assessor-Recorder detailing the acquisition cost of all supplies, equipment, fixtures, and improvements owned at each location within the City and County of San Francisco.

What is the due date for 571l?

The 571-L is a standardized form approved by the California Board of Equalization. The due date is April 1.

Do I have to file a business property statement in California?

An annual filing of a Business Property Statement is a requirement of section 441(d) of the California Revenue and Taxation Code. Statements are sent in order to gather the most up to date information on the business property so that an accurate value can be determined.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 571-r due date?

Form 571-R is due on April 1st of each year.

Who is required to file form 571-r due date?

Property owners in California are required to file form 571-R.

How to fill out form 571-r due date?

Form 571-R can be filled out online or mailed to the county assessor's office.

What is the purpose of form 571-r due date?

Form 571-R is used to report business property assets to the county assessor for tax assessment purposes.

What information must be reported on form 571-r due date?

Information such as property location, description, cost, acquisition date, and equipment details must be reported on form 571-R.

How do I execute form 571-r due date online?

Completing and signing form 571-r due date online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit form 571-r due date straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing form 571-r due date right away.

How do I complete form 571-r due date on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your form 571-r due date. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your form 571-r due date online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 571-R Due Date is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.