Get the free SC INFORMATION LETTER #89-30

Show details

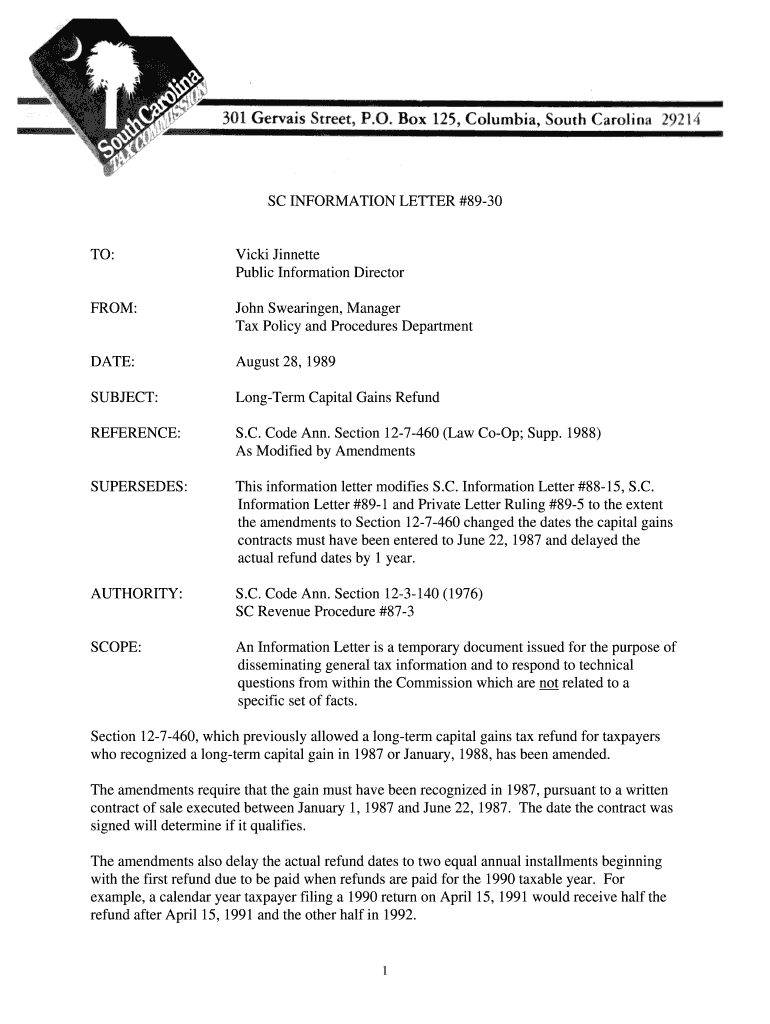

SC INFORMATION LETTER #8930TO:Vicki Annette

Public Information DirectorFROM:John Swearingen, Manager

Tax Policy and Procedures Departmental:August 28, 1989SUBJECT:Longer Capital Gains RefundREFERENCE:S.C.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sc information letter 89-30

Edit your sc information letter 89-30 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sc information letter 89-30 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sc information letter 89-30 online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sc information letter 89-30. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sc information letter 89-30

How to Fill Out SC Information Letter 89-30:

01

Start by reviewing the purpose of SC Information Letter 89-30. This letter is typically used by businesses or individuals who need to request specific information or clarification from the South Carolina Department of Revenue.

02

Gather all necessary information and documentation before starting to fill out the letter. This may include details about the specific tax matter or inquiry, as well as any supporting documents or forms.

03

Begin by including your contact information at the top of the letter. This should include your name, address, phone number, and any other relevant details.

04

Address the letter to the appropriate contact at the South Carolina Department of Revenue. Ensure that their name, title, and department are correctly spelled.

05

Start the main body of the letter by providing a clear and concise explanation of the purpose of your inquiry. Be specific about the information you are requesting or the issue you need clarification on.

06

Use a professional and courteous tone throughout the letter. Clearly state your intentions and avoid unnecessary jargon or technical terms.

07

If necessary, reference any relevant tax laws or regulations that are applicable to your inquiry. This can help the recipient understand the context of your request.

08

Conclude the letter by expressing your gratitude for their attention to the matter and providing your contact information again. This ensures that they can easily reach you if they have any follow-up questions or require further information.

09

Proofread the letter to eliminate any spelling or grammatical errors. Make sure the content is clear and that all relevant details are included.

10

Who needs SC Information Letter 89-30? Any individual or business that requires specific information or clarification from the South Carolina Department of Revenue regarding a tax matter or inquiry may need to use this letter. It is especially useful when standard forms or communication channels do not meet the specific needs of the situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify sc information letter 89-30 without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your sc information letter 89-30 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I make changes in sc information letter 89-30?

With pdfFiller, the editing process is straightforward. Open your sc information letter 89-30 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I make edits in sc information letter 89-30 without leaving Chrome?

sc information letter 89-30 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

What is sc information letter 89-30?

SC Information Letter 89-30 is a document issued by the South Carolina Department of Revenue that provides guidance on reporting certain tax information.

Who is required to file sc information letter 89-30?

Employers and payers who have withheld South Carolina income tax from employee wages or payments are required to file SC Information Letter 89-30.

How to fill out sc information letter 89-30?

SC Information Letter 89-30 can be filled out online through the South Carolina Department of Revenue's website or by downloading and mailing in the paper form.

What is the purpose of sc information letter 89-30?

The purpose of SC Information Letter 89-30 is to report the amount of South Carolina income tax withheld from employees or payments.

What information must be reported on sc information letter 89-30?

SC Information Letter 89-30 must include the employer or payer's information, the employee or payee's information, the total amount of South Carolina income tax withheld, and other relevant details.

Fill out your sc information letter 89-30 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sc Information Letter 89-30 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.