Get the free BUDGETING FOR LIFE AFTER COLLEGE WORKSHEET 1 of 6 - portervillecollege

Show details

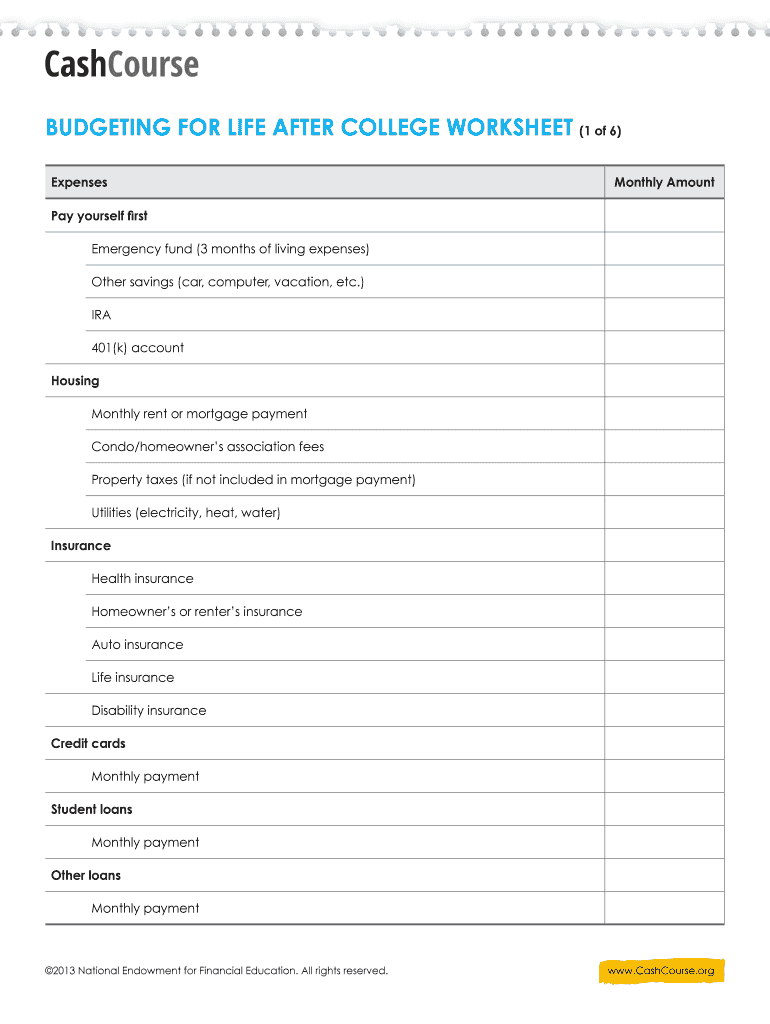

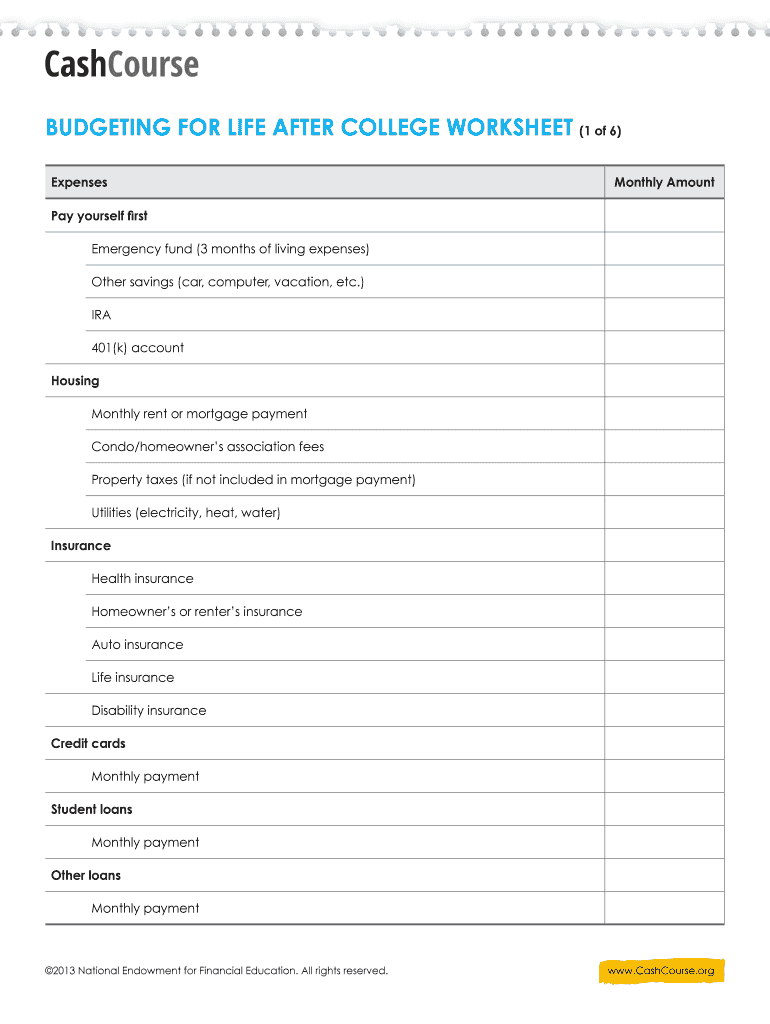

BUDGETING FOR LIFE AFTER COLLEGE WORKSHEET (1 of 6) Expenses Monthly Amount Pay yourself first Emergency fund (3 months of living expenses) Other savings (car, computer, vacation, etc.) IRA 401(k)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign budgeting for life after

Edit your budgeting for life after form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your budgeting for life after form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit budgeting for life after online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit budgeting for life after. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out budgeting for life after

How to fill out budgeting for life after:

01

Start by assessing your current financial situation. Take into account your income, expenses, debts, and any other financial obligations. This will give you a clear picture of where you stand financially.

02

Determine your financial goals for the future. Are you planning for retirement? Saving for a down payment on a home? Paying off debt? Identifying your goals will help you prioritize your spending and saving.

03

Create a realistic budget. Based on your income and expenses, allocate amounts for different categories such as housing, transportation, groceries, entertainment, savings, and debt repayment. It's important to be realistic and not overspend in any category.

04

Track your expenses. Keep a record of all your expenses and review them regularly to see where you can cut back or make adjustments. This will help you stay on track with your budget and identify any areas where you may be overspending.

05

Save for emergencies. Set aside a portion of your income each month into an emergency fund. This will provide a safety net for unexpected expenses and help you avoid falling into debt.

06

Plan for retirement. If you're not already doing so, start contributing to a retirement account such as a 401(k) or an IRA. Take advantage of any employer matching contributions and consider increasing your contributions over time.

07

Seek professional advice if needed. If you're unsure about budgeting or need help with financial planning, consider consulting with a financial advisor. They can provide guidance tailored to your specific situation and help you make informed decisions.

Who needs budgeting for life after?

01

Recent graduates and young adults: Budgeting for life after is crucial for those who are just starting their careers and need to manage their income, expenses, and savings effectively.

02

Individuals nearing retirement: Planning for retirement requires careful budgeting to ensure a comfortable and financially secure future.

03

Anyone with financial goals: Whether you want to save for a down payment on a house, pay off debt, or achieve any other financial goal, budgeting is essential to stay on track and make progress towards your objectives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit budgeting for life after from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including budgeting for life after, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I create an electronic signature for signing my budgeting for life after in Gmail?

Create your eSignature using pdfFiller and then eSign your budgeting for life after immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit budgeting for life after on an Android device?

You can edit, sign, and distribute budgeting for life after on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is budgeting for life after?

Budgeting for life after is the process of creating a financial plan to ensure financial stability and security after retirement or any other life event.

Who is required to file budgeting for life after?

Anyone who wants to plan for their financial future and ensure they have enough savings to support themselves after retirement is encouraged to file a budget for life after.

How to fill out budgeting for life after?

To fill out budgeting for life after, one can start by calculating their current expenses, estimating future expenses, setting savings goals, and reviewing their financial plan regularly to make necessary adjustments.

What is the purpose of budgeting for life after?

The purpose of budgeting for life after is to ensure financial stability and security after retirement or any other life event by setting savings goals, managing expenses, and creating a plan to achieve financial independence.

What information must be reported on budgeting for life after?

Information that must be reported on budgeting for life after includes current expenses, estimated future expenses, savings goals, investment accounts, retirement accounts, and any other financial assets or liabilities.

Fill out your budgeting for life after online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Budgeting For Life After is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.