Get the free What have average investment asset class risk premiums been over long periods - Pers...

Show details

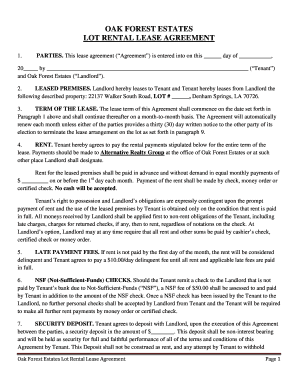

What have average investment asset class risk premiums been over long periods? Personal Investment Management Investment Returns and Securities Market RI... Personal Finance, Investment Management,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign what have average investment

Edit your what have average investment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your what have average investment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing what have average investment online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit what have average investment. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out what have average investment

To fill out what have average investment, follow these steps:

01

Start by gathering all relevant financial information, including your current assets, income, and expenses. This will provide you with a clear understanding of your financial standing.

02

Calculate your average investment by adding up the value of all your investments and dividing it by the number of investments. This will give you an average investment value.

03

Determine your investment goals. Consider factors such as your risk tolerance, investment timeframe, and desired returns. This will help you decide the type of investments that align with your objectives.

04

Research different investment options. Look for investment vehicles that suit your risk tolerance and investment goals. These may include stocks, bonds, mutual funds, real estate, or other alternatives.

05

Consult with a financial advisor or investment professional. They can provide expert guidance and help you make informed decisions based on your specific circumstances.

06

Develop a diversified investment portfolio. Allocate your investments across different asset classes to minimize risk and maximize potential returns.

07

Regularly review and monitor your investments. Keep track of the performance of your investments and make adjustments when necessary. This will ensure that your portfolio remains aligned with your financial goals.

Who needs what have average investment?

01

Individuals planning for retirement: Determining the average investment can be beneficial for those saving for retirement. It helps them assess if they are on track to meet their financial goals.

02

Investors managing multiple investments: Individuals with a diverse investment portfolio need to calculate the average investment to have a clear understanding of their overall investment performance.

03

Financial advisors and planners: Professionals in the finance industry may need to calculate the average investment to provide accurate advice and recommendations to their clients.

In conclusion, filling out what have average investment requires gathering financial information, setting investment goals, researching investment options, seeking professional advice, creating a diversified portfolio, and monitoring investments. It is relevant for individuals planning for retirement, investors managing multiple investments, or financial advisors and planners.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in what have average investment without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your what have average investment, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an electronic signature for the what have average investment in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your what have average investment in seconds.

How do I edit what have average investment on an iOS device?

You certainly can. You can quickly edit, distribute, and sign what have average investment on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is what have average investment?

What have average investment refers to the average amount of money invested in a particular asset or portfolio over a specified period of time.

Who is required to file what have average investment?

Investors and financial institutions are typically required to file information about their average investments.

How to fill out what have average investment?

To fill out what have average investment, individuals and organizations need to provide details about the investments made, the duration of the investments, and the returns generated.

What is the purpose of what have average investment?

The purpose of what have average investment is to assess the performance of an investment portfolio and make informed decisions about future investments.

What information must be reported on what have average investment?

Information such as the types of investments, the average amount invested, the returns generated, and the duration of the investments must be reported on what have average investment.

Fill out your what have average investment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

What Have Average Investment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.