Get the free Property Tax Levy

Show details

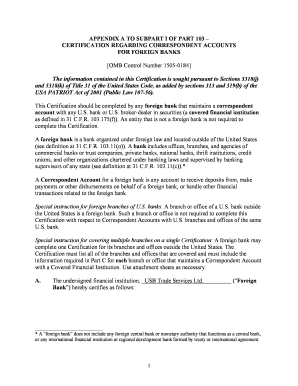

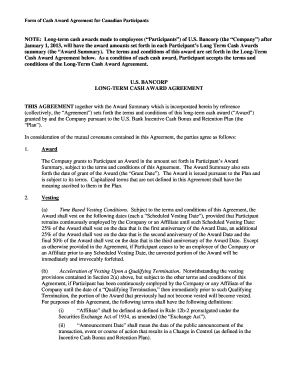

McClair City Council AGENDA November 12, 2014 7:00 City Council Meeting Flag Salute Roll Call Public Hearings: Public Comment: Property Tax Levy Proposed Budget * Three Minute Limit Minutes: (Tab

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property tax levy

Edit your property tax levy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property tax levy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit property tax levy online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit property tax levy. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property tax levy

How to fill out property tax levy:

01

Gather all necessary documents: Before filling out a property tax levy, make sure you have all the relevant documents in hand. This includes your property tax assessment, income statements, and any other supporting documents required by your local tax authority.

02

Understand the requirements: Familiarize yourself with the specific requirements for filling out a property tax levy in your jurisdiction. Each location may have slightly different guidelines, so it's important to be aware of what is expected of you.

03

Provide accurate information: Ensure that all the information you provide in the property tax levy form is accurate and up-to-date. This includes details about your property, income, and any exemptions or deductions you may be eligible for. Inaccurate information can lead to penalties or delays in processing.

04

Seek professional advice if needed: If you're unsure about how to properly fill out the property tax levy form or if you have complex financial situations, it may be wise to seek the help of a tax professional. They can provide guidance and ensure that everything is filled out correctly.

05

Review and submit: Once you have completed the property tax levy form, carefully review all the information for any errors or omissions. Double-check that you haven't missed any important sections or documents. Once you are confident that everything is in order, submit the form according to the instructions provided by your local tax authority.

Who needs property tax levy?

01

Property owners: Property tax levy is typically required for individuals who own real estate or other types of property. It is one way for local governments to collect revenue to fund public services and infrastructure.

02

Homeowners: Homeowners, including those who reside in single-family houses, condominiums, or townhomes, are often responsible for paying property taxes. The property tax levy helps finance local government initiatives such as schools, police and fire departments, and public parks.

03

Business owners: In addition to residential properties, commercial properties are also subject to property tax levy. Business owners are generally required to pay property taxes on their commercial buildings, offices, and other real estate assets.

04

Landlords: Property tax levy can also apply to landlords who own rental properties. Landlords often pass on a portion of the property taxes to their tenants as part of the rent to cover the expenses associated with the property.

05

Property developers: Property developers who acquire land for future developments or construction projects may also be subject to property tax levy. It is important for developers to accurately assess and report the value of the property in order to determine the correct amount of property taxes owed.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my property tax levy in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your property tax levy right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I complete property tax levy on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your property tax levy from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Can I edit property tax levy on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share property tax levy on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is property tax levy?

Property tax levy is the amount of money that a government requires a property owner to pay based on the value of their property.

Who is required to file property tax levy?

Property owners are required to file property tax levy.

How to fill out property tax levy?

Property tax levy can be filled out by submitting a form provided by the local tax authority with all the required information about the property.

What is the purpose of property tax levy?

The purpose of property tax levy is to generate revenue for the government to fund public services and infrastructure.

What information must be reported on property tax levy?

Property tax levy typically requires information such as property value, ownership details, and any exemptions or deductions that may apply.

Fill out your property tax levy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Tax Levy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.