Get the free Gift to Agency Report - tustinca

Show details

This document serves as a report for gifts received by an agency, including details about the donor, payment information, and verification of acceptance of the gift.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gift to agency report

Edit your gift to agency report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift to agency report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gift to agency report online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit gift to agency report. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

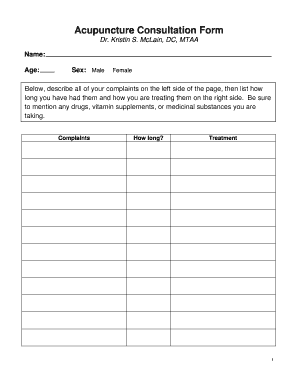

How to fill out gift to agency report

How to fill out Gift to Agency Report

01

Start by downloading the Gift to Agency Report form from the relevant agency's website.

02

Fill in your personal details at the top of the form, including your name, address, and contact information.

03

Provide the details of the agency receiving the gift, including the agency's name and address.

04

Describe the gift in detail, including its nature, value, and how it will be used by the agency.

05

Include the name and contact information of the person who is giving the gift.

06

Sign and date the form to confirm that all information provided is accurate and complete.

07

Submit the completed form according to the instructions provided, either electronically or by mail.

Who needs Gift to Agency Report?

01

Individuals or organizations that plan to make a donation or gift to a government agency or public organization.

02

Employees of agencies who need to report gifts received as part of compliance or transparency regulations.

03

Non-profit organizations that wish to document gifts for accounting or regulatory purposes.

Fill

form

: Try Risk Free

People Also Ask about

What are the federal government rules on gift giving?

You may accept unsolicited gifts that do not exceed $20 per occasion, up to $50 aggregated from a single source in any given calendar year. You may not accept cash or checks made out to you under any circumstance. Gift cards valued at $20 or less for specific vendors/restaurants are permissible.

Can you give a contractor a gift?

There's technically not an ethics rule against giving a gift to a contractor but many companies (especially larger ones) will have ethics policies similar to the government. If you do insist, make it a general non-monetary gift such as food and keep it low value.

What is the 20 50 gift rule?

Under the $20 rule, an employee may accept an unsolicited gift of $20 or less per occasion and no more than $50 in a calendar year from one person.

Can a federal employee give a gift to a contractor?

A gift of food and refreshments to a contractor employee does not violate Government ethics rules. The contractor employees may want to check with their contractor's rules before accepting (since many contractors have similar ethics rules). If the contractor employee brings a hospitality gift, it may not exceed $20.

On what occasion may you give your supervisor a gift valued over $10?

In recognition of infrequently occurring occasions of personal significance such as illness, a marriage, a death in the family, or the birth or adoption of a child (but not holidays or annually recurring events), and on occasions that terminate the superior/subordinate relationship; you may give gifts to an official

Can federal employees give contractors gifts?

A gift of food and refreshments to a contractor employee does not violate Government ethics rules. The contractor employees may want to check with their contractor's rules before accepting (since many contractors have similar ethics rules). If the contractor employee brings a hospitality gift, it may not exceed $20.

Is a gift to a contractor taxable?

In the US, for example, you might need to include the value of the gift on the 1099 form, and the contractor will need to account for it when filing their taxes. On the flip side, you may be able to report this on your taxes as a business expense and potentially deduct some or all of it against your income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Gift to Agency Report?

The Gift to Agency Report is a formal document submitted by employees to disclose any gifts they may receive in connection with their official duties to ensure transparency and prevent conflicts of interest.

Who is required to file Gift to Agency Report?

Employees of government agencies or organizations, as well as those in public service roles, are typically required to file the Gift to Agency Report when they receive gifts that exceed a certain value.

How to fill out Gift to Agency Report?

To fill out the Gift to Agency Report, employees must provide details such as the date of the gift, description of the gift, estimated value, and the name of the donor, ensuring all information is accurate and complete.

What is the purpose of Gift to Agency Report?

The purpose of the Gift to Agency Report is to maintain ethical standards in public service by ensuring that all potential conflicts of interest are disclosed, thereby promoting accountability.

What information must be reported on Gift to Agency Report?

The report must include the date the gift was received, a description of the gift, the estimated value, the name of the donor, and the circumstances under which the gift was received.

Fill out your gift to agency report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gift To Agency Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.