Get the free Admissions Tax Return - ci westminster co

Show details

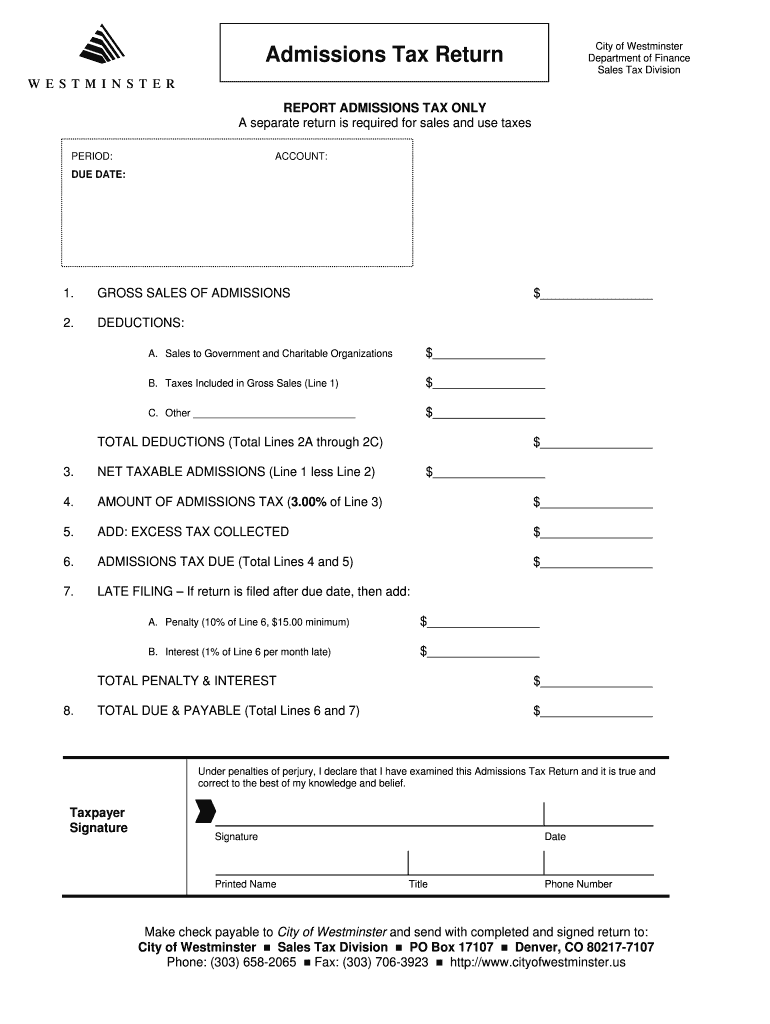

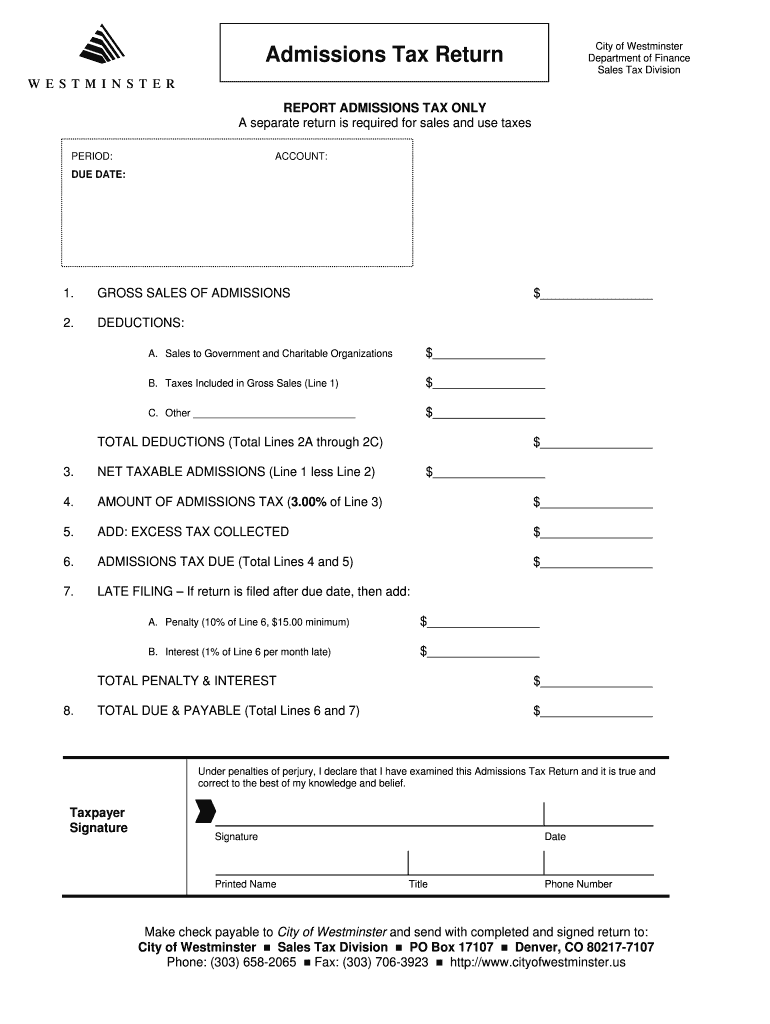

This form is used for taxpayers to report sales of admissions and related tax liabilities pursuant to Chapter 3 of Title IV of the Westminster Municipal Code.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign admissions tax return

Edit your admissions tax return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your admissions tax return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing admissions tax return online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit admissions tax return. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out admissions tax return

How to fill out Admissions Tax Return

01

Obtain the Admissions Tax Return form from the relevant tax authority's website or office.

02

Fill in your business name, address, and identification number at the top of the form.

03

Indicate the reporting period for which you are filing the return.

04

Calculate the total admissions collected during the reporting period by summing all ticket sales.

05

Determine the applicable tax rate on admissions and calculate the total tax owed based on your admissions revenue.

06

Deduct any allowable exemptions or discounts from your total admissions to arrive at the net taxable admissions.

07

Fill in the calculated tax amount in the designated section of the form.

08

Review the completed form for accuracy and ensure all required information is provided.

09

Sign and date the form where indicated.

10

Submit the form by the deadline to the appropriate tax authority, along with any payment if applicable.

Who needs Admissions Tax Return?

01

Businesses or organizations that charge an admission fee for entry to events, venues, or attractions.

02

Event organizers hosting ticketed events.

03

Amusement parks, theaters, museums, and other entertainment venues.

04

Any entity that is mandated by local or state regulations to collect and remit admissions tax.

Fill

form

: Try Risk Free

People Also Ask about

How to file an income tax return online in English?

Follow the below mentioned steps to file ITR via online mode: Login to the Income Tax portal. Go To 'File Income Tax Return' Select 'Assessment Year' Select Filing Status (Individual/ HUF/ Others) Select ITR Type (ITR 1 to ITR-7) Select Reason for filing ITR. Validate the income and other details. E-Verify.

What is the admissions tax in Washington state?

Tax Rate Maximum of one cent per 20 cents (5 percent) of the admission charge.

What is the SC Use Tax?

Use Tax applies when South Carolina Sales Tax hasn't been paid on an out-of-state purchase. Tangible goods that have been bought at retail to be used, stored, or consumed in South Carolina are subject to a statewide 6% Use Tax, plus any applicable Local Taxes. The purchaser pays the Use Tax.

What is the SC tuition tax credit?

The credit for each taxable year is equal to 50% of the tuition paid, not to exceed $1500 for a student attending a 4-year college or university or a 2-year college or university.

What is the admissions tax in Virginia?

Any county, except as provided in subsection C, is hereby authorized to levy a tax on admissions charged for attendance at any event. The tax shall not exceed 10 percent of the amount of charge for admission to any such event.

What is admissions tax sc?

Admissions Tax must be collected by all places of amusement when an admission fee has been charged. The tax is 5% of the paid admissions. If you operate a place of amusement, you must obtain an Admissions Tax License.

What is the admissions tax in South Carolina?

Admissions Tax must be collected by all places of amusement when an admission fee has been charged. The tax is 5% of the paid admissions. If you operate a place of amusement, you must obtain an Admissions Tax License. There is no charge for the license.

What is the SC tax rate?

South Carolina also has a 6.00 percent state sales tax rate and an average combined state and local sales tax rate of 7.50 percent. South Carolina has a 0.46 percent effective property tax rate on owner-occupied housing value. South Carolina does not have an estate tax or inheritance tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Admissions Tax Return?

The Admissions Tax Return is a form that businesses must file to report and pay taxes on the admissions fees they collect from patrons for entry to events or facilities.

Who is required to file Admissions Tax Return?

Businesses or organizations that sell tickets for events or charge admission fees for entry to venues or attractions are required to file the Admissions Tax Return.

How to fill out Admissions Tax Return?

To fill out the Admissions Tax Return, businesses must provide details such as the total admissions collected, the tax rate applicable, and the total tax owed, as well as any deductions if applicable.

What is the purpose of Admissions Tax Return?

The purpose of the Admissions Tax Return is to ensure that the appropriate taxes are collected and reported to the government for compliance and funding public services.

What information must be reported on Admissions Tax Return?

Information that must be reported includes the total admission fees collected, the applicable tax rate, total tax amount due, any credits or deductions, and the business contact information.

Fill out your admissions tax return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Admissions Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.