Get the free ASSET ALLOCATION PATTERN:

Show details

Jul 20, 2015 ... The particulars of ICICI Prudential Value Fund — Series 8, the mutual fund. Scheme offered under this KIM, have been prepared in accordance with the ...... English daily newspaper

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign asset allocation pattern

Edit your asset allocation pattern form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your asset allocation pattern form via URL. You can also download, print, or export forms to your preferred cloud storage service.

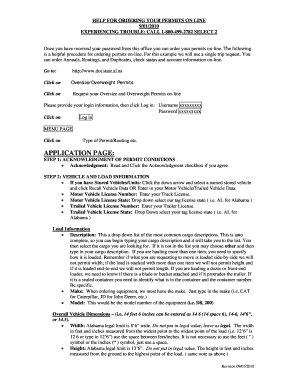

How to edit asset allocation pattern online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit asset allocation pattern. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

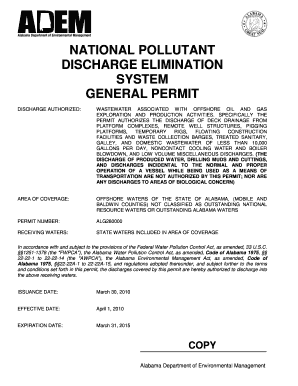

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

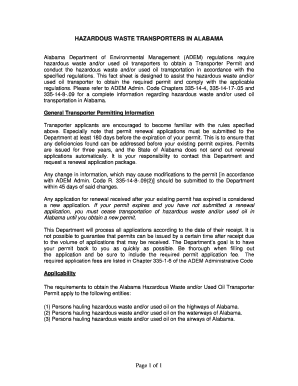

How to fill out asset allocation pattern

How to fill out asset allocation pattern:

01

Start by assessing your financial goals and risk tolerance. Understand what you want to achieve with your investments and how comfortable you are with taking risks.

02

Determine your time horizon for investment. Are you investing for short-term goals like buying a car or saving for a vacation, or do you have long-term goals such as retirement or funding your child's education?

03

Consider your investment horizon. How long do you plan to hold onto your investments? This will help you decide on the appropriate asset allocation mix.

04

Evaluate your current financial situation. Take into account your income, expenses, and existing assets. This will give you a better understanding of how much you can allocate towards different asset classes.

05

Understand different asset classes. Educate yourself on various investment options such as stocks, bonds, real estate, and cash. Each asset class comes with its own level of risk and return potential.

06

Determine the optimal asset allocation mix for you. This will depend on your risk tolerance, goals, and investment horizon. A common approach is to diversify your portfolio, spreading your investments across different asset classes to mitigate risk.

07

Consider rebalancing your portfolio. As market conditions change, your asset allocation can drift away from your desired mix. Regularly review your investments and adjust if necessary to maintain your intended allocation pattern.

Who needs asset allocation pattern:

01

Individuals planning for retirement: Asset allocation helps ensure that your investments are appropriately diversified and aligned with your long-term retirement goals.

02

Investors with different risk tolerances: Asset allocation allows you to tailor your investment portfolio based on your risk tolerance. Those who are more risk-averse may allocate more towards low-risk assets, while those comfortable with higher risks may allocate more towards higher-reward assets.

03

Investors with varying financial goals: Asset allocation pattern is beneficial for individuals with different financial goals such as down payment for a house, education funding, or starting a business. It helps structure your investments based on each specific goal.

04

Individuals seeking portfolio diversification: Asset allocation enables you to diversify your investments across different asset classes, reducing the impact of market volatility on your overall portfolio.

05

Those looking for a long-term investment strategy: Asset allocation is a strategic approach to investing and is particularly useful for individuals with a long time horizon. It helps in managing risk while maximizing potential returns over a longer period.

By following these steps and understanding who can benefit from asset allocation pattern, you can effectively fill out your asset allocation pattern and ensure that your investments align with your goals and risk tolerance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

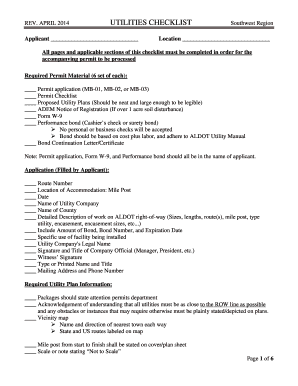

How do I modify my asset allocation pattern in Gmail?

asset allocation pattern and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit asset allocation pattern in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing asset allocation pattern and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How can I edit asset allocation pattern on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing asset allocation pattern, you need to install and log in to the app.

What is asset allocation pattern?

Asset allocation pattern refers to the distribution of investments across different asset classes in a portfolio.

Who is required to file asset allocation pattern?

Certain institutions or individuals may be required to file asset allocation pattern, depending on the regulations in their jurisdiction.

How to fill out asset allocation pattern?

Asset allocation pattern can be filled out by providing information on the types and percentages of assets held in a portfolio.

What is the purpose of asset allocation pattern?

The purpose of asset allocation pattern is to help investors achieve their financial goals while managing risk.

What information must be reported on asset allocation pattern?

Information such as the types of assets held, their percentages in the portfolio, and any changes in allocation over time must be reported on asset allocation pattern.

Fill out your asset allocation pattern online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Asset Allocation Pattern is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.