CT M-3 - City of Bridgeport free printable template

Show details

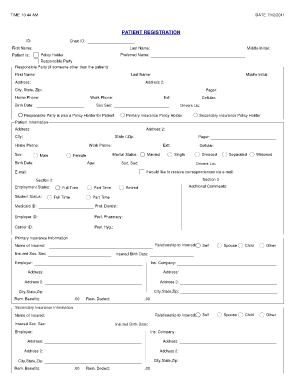

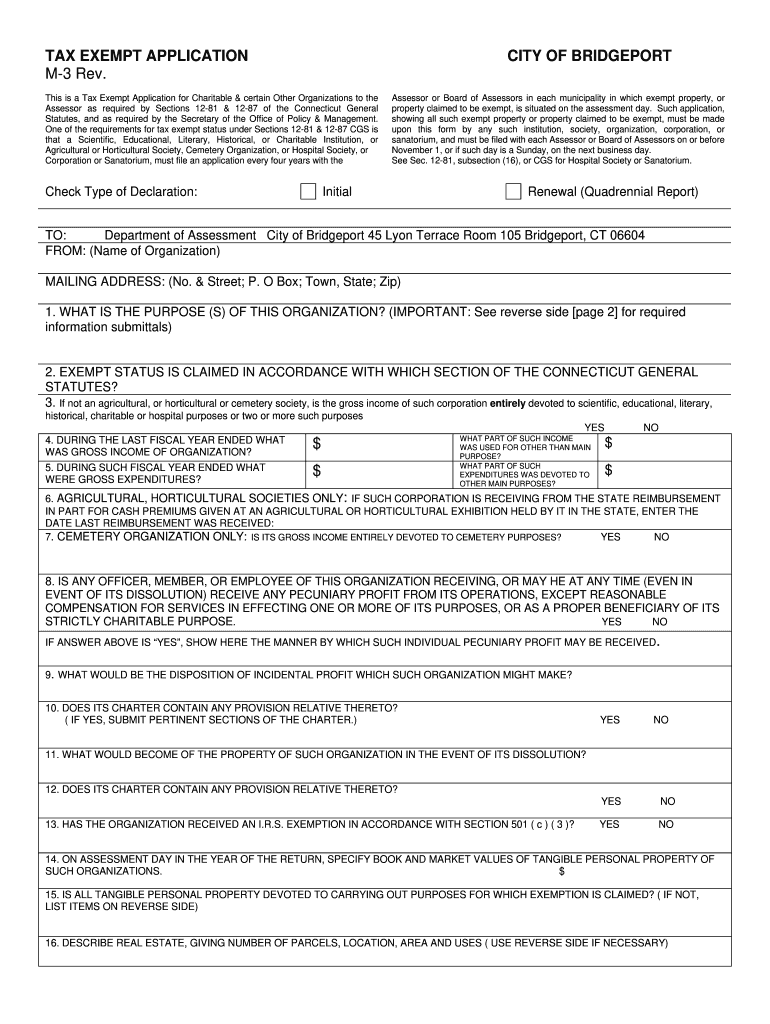

TAX EXEMPT APPLICATION M-3 Rev. CITY OF BRIDGEPORT This is a Tax Exempt Application for Charitable & certain Other Organizations to the Assessor as required by Sections 12-81 & 12-87 of the Connecticut

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign connecticut bridgeport exempt m 3 form printable

Edit your bridgeport exempt application m 3 fillable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT M-3 - City of Bridgeport form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CT M-3 - City of Bridgeport online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CT M-3 - City of Bridgeport. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out CT M-3 - City of Bridgeport

How to fill out CT M-3 - City of Bridgeport

01

Obtain the CT M-3 form from the City of Bridgeport's official website or city hall.

02

Provide your name and contact information in the designated fields.

03

Enter your business details, including the business name, address, and tax identification number.

04

Indicate the type of business entity you have (sole proprietorship, partnership, corporation, etc.).

05

Complete the financial sections, detailing revenue, expenses, and any tax deductions.

06

Review the form for accuracy and completeness.

07

Sign and date the form in the appropriate section.

08

Submit the completed form to the City of Bridgeport's tax department by the specified deadline.

Who needs CT M-3 - City of Bridgeport?

01

Businesses operating within the City of Bridgeport that are subject to local taxes.

02

Business owners who need to report their financial activities and pay local business taxes.

03

Sole proprietors, partnerships, and corporations that need to comply with local regulations.

Fill

form

: Try Risk Free

People Also Ask about

What items are exempt from CT sales tax?

Sales Tax Exemptions in Connecticut Several exemptions are certain types of safety gear, some types of groceries, certain types of clothing, children's car seats, children's bicycle helmets, college textbooks, compact fluorescent light bulbs, most types of medical equipment, and certain motor vehicles.

What is the tax exempt form for lodging in CT?

CERT-112 allows an exempt entity to purchase meals or lodging, or both, tax exempt for a single event and may not be used for repeat purchases.

What is exempt from CT sales tax?

Several exemptions are certain types of safety gear, some types of groceries, certain types of clothing, children's car seats, children's bicycle helmets, college textbooks, compact fluorescent light bulbs, most types of medical equipment, and certain motor vehicles.

How much are Bridgeport taxes?

The minimum combined 2023 sales tax rate for Bridgeport, Connecticut is 6.35%. This is the total of state, county and city sales tax rates.

What is subject to sales tax in CT?

Connecticut General Statutes, Chapter 219, Sales and Use Taxes, imposes the Connecticut sales and use tax on the gross receipts from the sale of tangible personal property at retail, from the rental or leasing of tangible personal property, and on the gross receipts from the rendering of certain services. Conn. Gen.

What is Bridgeport tax mill rate?

For more information about Property Tax Assessment, please see the Tax Assessors Page. One mill is equal to $1.00 of tax for each $1,000 of assessment. For the fiscal year 2021-2022 it is 43.45 mills for real & personal property and 45 mills for motor vehicles.

What is the mill rate for bridgeport car tax?

One mill is equal to $1.00 of tax for each $1,000 of assessment. For the fiscal year 2021-2022 it is 43.45 mills for real & personal property and 45 mills for motor vehicles.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute CT M-3 - City of Bridgeport online?

Easy online CT M-3 - City of Bridgeport completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I fill out CT M-3 - City of Bridgeport using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign CT M-3 - City of Bridgeport and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit CT M-3 - City of Bridgeport on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute CT M-3 - City of Bridgeport from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is CT M-3 - City of Bridgeport?

CT M-3 is a municipal tax form used by the City of Bridgeport, Connecticut for reporting business activity and calculating local business taxes.

Who is required to file CT M-3 - City of Bridgeport?

Businesses operating within the City of Bridgeport that meet certain income thresholds or have specific business activities are required to file CT M-3.

How to fill out CT M-3 - City of Bridgeport?

To fill out CT M-3, businesses need to provide their identification information, report their gross receipts, and calculate any applicable taxes based on the provided information.

What is the purpose of CT M-3 - City of Bridgeport?

The purpose of CT M-3 is to assess and collect local business taxes, ensuring that businesses contribute to municipal services and infrastructure.

What information must be reported on CT M-3 - City of Bridgeport?

CT M-3 requires reporting of business identification, gross receipts, business expenses, and any applicable deductions or exemptions.

Fill out your CT M-3 - City of Bridgeport online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT M-3 - City Of Bridgeport is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.