Get the free Form Short Form Return of Organization Exempt From Income Tax 990 EZ OMB No 15451150...

Show details

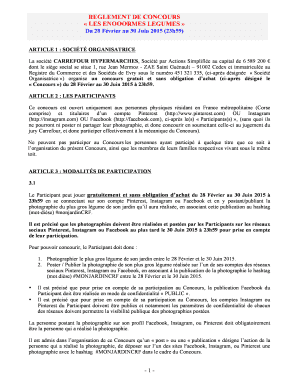

Form Short Form Return of Organization Exempt From Income Tax 990 EZ OMB No 15451150 2012 Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung benefit trust or

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form short form return

Edit your form short form return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form short form return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form short form return online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form short form return. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form short form return

How to fill out Form Short Form Return:

01

Gather all necessary information: Before starting to fill out the form, gather all the required information such as personal details, financial information, and any supporting documents that may be needed.

02

Read the instructions: Carefully read the instructions provided with the form. This will help you understand the purpose of the form and provide guidance on how to properly complete it.

03

Begin with personal information: Start by filling out the personal information section of the form. This usually includes details such as your name, address, contact information, and social security number.

04

Provide financial information: Proceed to fill out the financial information section of the form. This may involve reporting your income, deductions, and any other relevant financial details as instructed.

05

Double-check for accuracy: Once you have filled out all the required sections, take the time to review your entries for accuracy. Mistakes or inaccuracies may lead to delays or rejections of your form.

06

Sign and date the form: Once you are satisfied with the information provided, sign and date the form as required. This signifies that the information is true and accurate to the best of your knowledge.

Who needs Form Short Form Return:

01

Individuals filing taxes: Anyone who needs to file their federal income tax return may need to use Form Short Form Return. This form is typically used by individuals with simpler tax situations, such as those who do not have dependents and have limited deductions.

02

Those with straightforward financial situations: Form Short Form Return is designed for individuals with straightforward financial situations. It may not be suitable for those with complex financial arrangements, multiple sources of income, or extensive itemized deductions.

03

Taxpayers looking for a simplified process: Some individuals may prefer to use Form Short Form Return because it offers a simpler and less time-consuming process compared to more complex tax forms. It may be beneficial for those with few tax obligations and who qualify for the form's streamlined requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form short form return in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign form short form return and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send form short form return for eSignature?

To distribute your form short form return, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I complete form short form return on an Android device?

Complete your form short form return and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your form short form return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Short Form Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.