Get the free ZEN

Show details

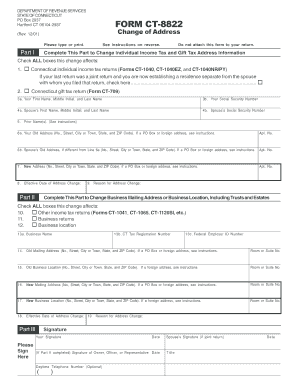

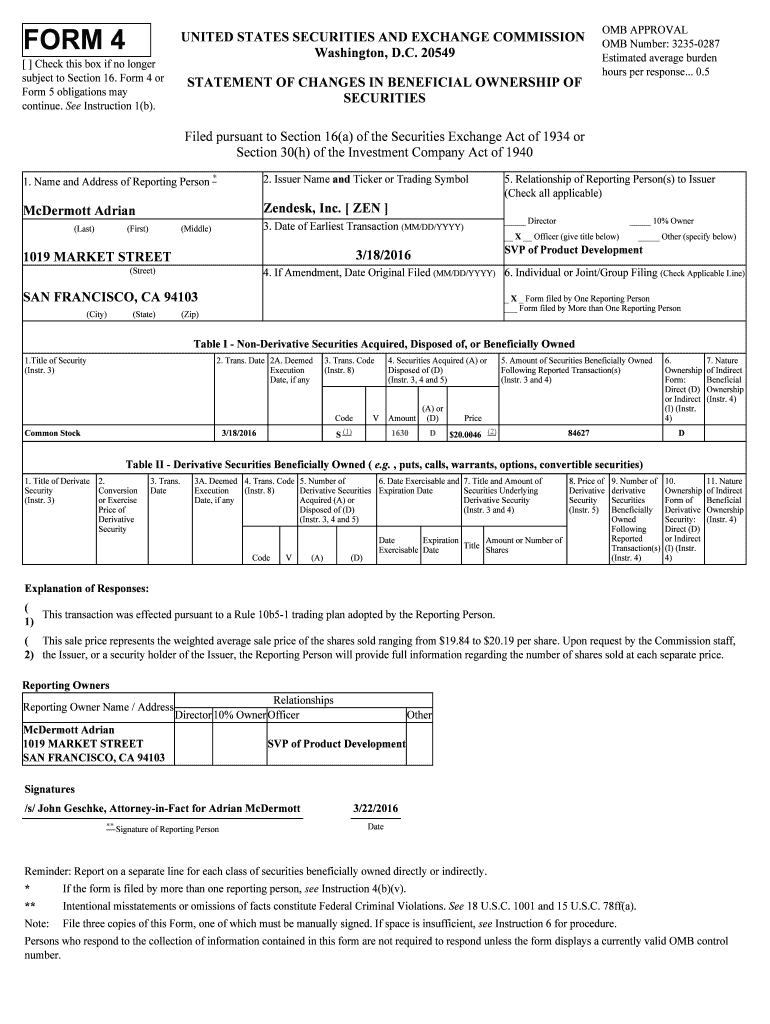

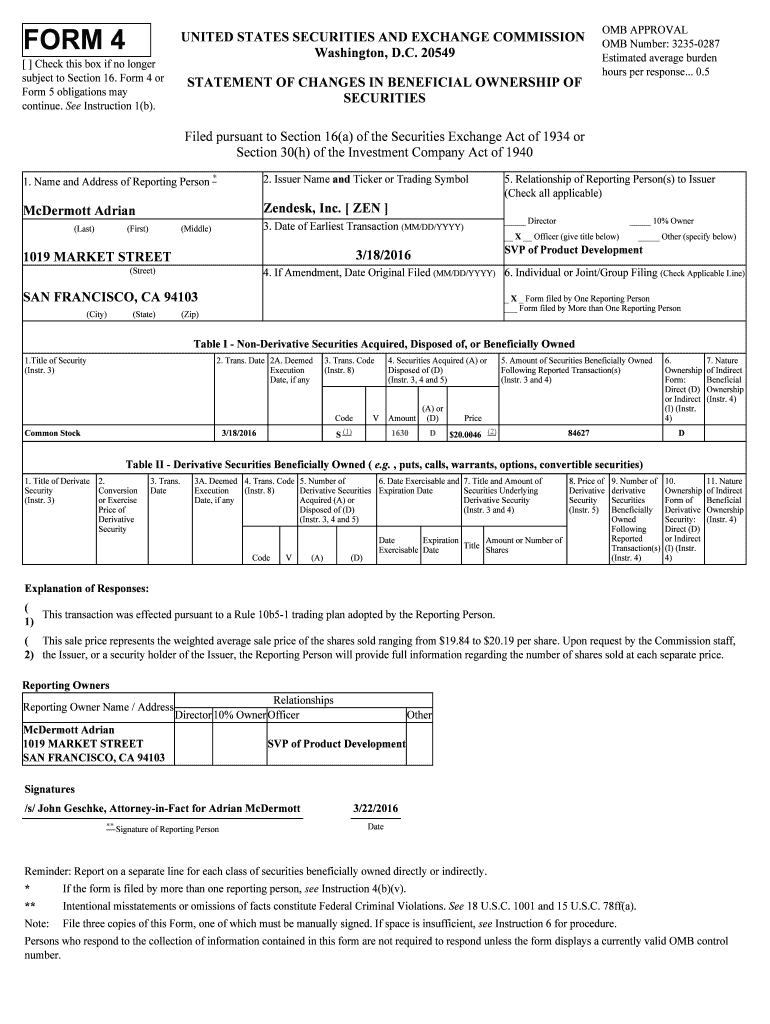

FORM 4 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b). STATEMENT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign zen

Edit your zen form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your zen form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing zen online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit zen. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out zen

How to fill out zen:

01

Start by creating a peaceful and quiet environment. Find a calm space where you won't be easily distracted. This could be a designated meditation area or simply a quiet corner of a room.

02

Sit comfortably in a crossed-leg position or on a cushion. Keep your back straight, but not rigid, allowing for natural alignment of your spine. Rest your hands on your lap or knees.

03

Close your eyes or softly gaze at a fixed point in front of you. Take a few deep breaths, inhaling through your nose and exhaling through your mouth. Allow your body to relax with each breath.

04

Bring your attention to your breath. Observe the sensation of each inhale and exhale. Notice the rhythm and flow of your breath without trying to control it.

05

As thoughts arise, gently acknowledge them without judgment and let them pass. Bring your attention back to your breath each time you get distracted. Let go of any attachments or worries that may come up.

06

Embrace the present moment and practice mindfulness. Pay attention to the sensations in your body, sounds in your environment, and any emotions that arise. Stay fully present and aware in the moment.

07

Practice compassion and non-attachment. Allow whatever thoughts or feelings that arise to exist without clinging onto them. Let go of expectations and judgments. Be kind to yourself and others.

Who needs zen:

01

Anyone looking to reduce stress and anxiety. Zen practices can help individuals find inner calmness, manage their emotions, and cope with daily life challenges.

02

People seeking clarity and focus. Zen meditation and mindfulness techniques can enhance concentration, improve decision-making skills, and increase overall productivity.

03

Individuals desiring personal growth and self-discovery. Zen encourages self-reflection, self-awareness, and inner exploration, leading to greater self-acceptance and understanding.

04

Those seeking spiritual connection. Zen is deeply rooted in Buddhist teachings and philosophy, offering a path towards spiritual enlightenment, awakening, and a deeper connection to oneself and the universe.

05

Anyone interested in improving sleep quality and overall well-being. Engaging in zen practices can promote deep relaxation, alleviate insomnia, and enhance overall mental and physical health.

Overall, zen is for anyone who wishes to cultivate mindfulness, find inner peace, and live a more balanced and meaningful life.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my zen directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign zen and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send zen to be eSigned by others?

Once your zen is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit zen straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing zen.

What is zen?

Zen is a type of tax form that individuals and businesses must file with the tax authorities.

Who is required to file zen?

Individuals and businesses who meet certain income or revenue thresholds are required to file the zen form.

How to fill out zen?

Zen can be filled out either online or through paper forms, by providing accurate information about income, deductions, and other relevant tax details.

What is the purpose of zen?

The purpose of zen is to report income, deductions, and other financial details to the tax authorities in order to calculate and pay the correct amount of taxes.

What information must be reported on zen?

Information such as income, deductions, tax credits, and any payments made throughout the tax year must be reported on the zen form.

Fill out your zen online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Zen is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.