Get the free Questions TaxProfessionalsand Answers for

Show details

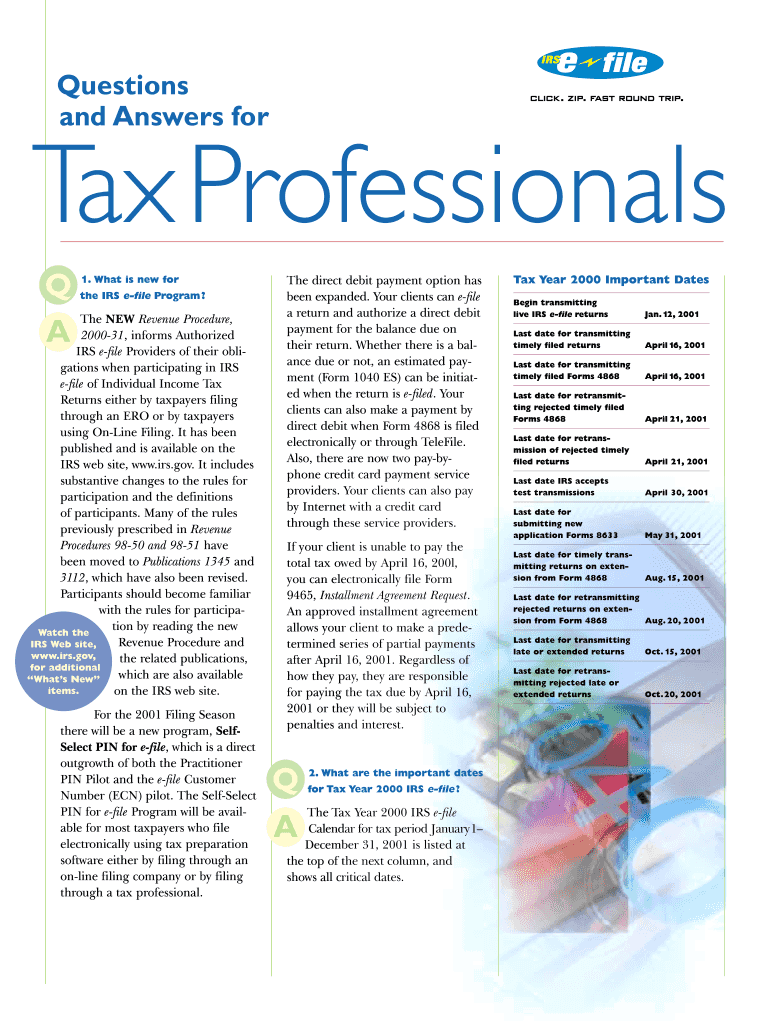

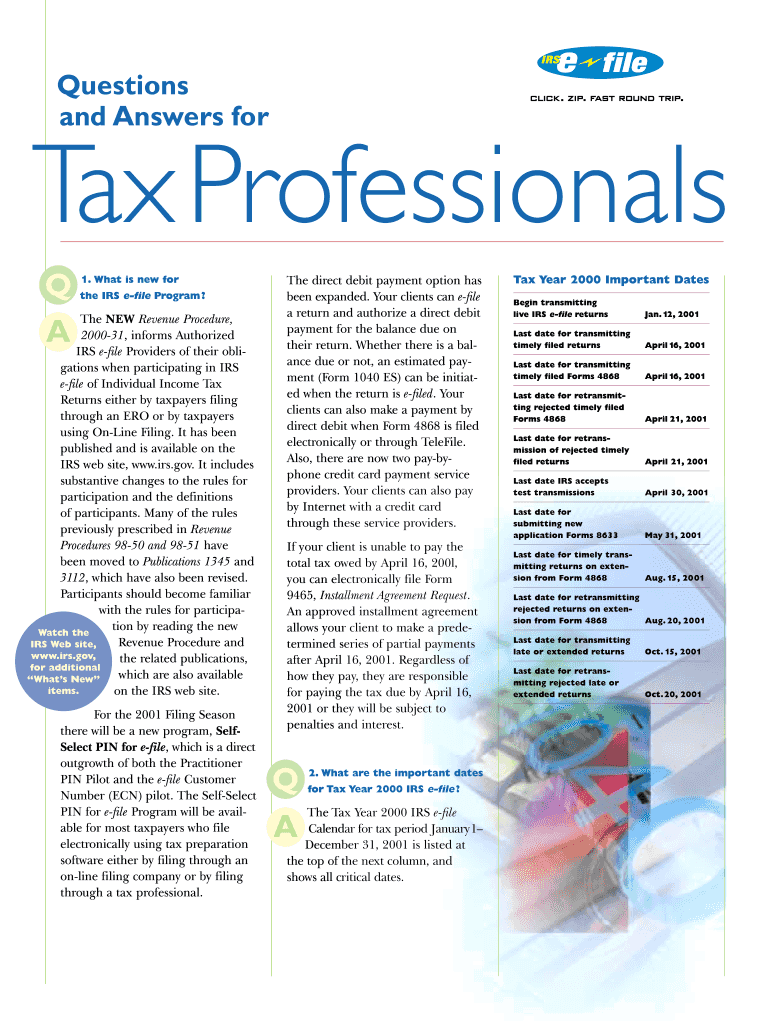

File Index Main Menu Questions and Answers for click. Zip. Fast round trip. Tax Professionals Q A 1. What is new for the IRS file Program ? The NEW Revenue Procedure, 200031, informs Authorized IRS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign questions taxprofessionalsand answers for

Edit your questions taxprofessionalsand answers for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your questions taxprofessionalsand answers for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing questions taxprofessionalsand answers for online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit questions taxprofessionalsand answers for. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out questions taxprofessionalsand answers for

How to fill out questions taxprofessionalsand answers:

01

Start by gathering all relevant information regarding the tax professionals and their expertise.

02

Create a list of questions that you specifically want the tax professionals to answer. These questions should relate to their experience, qualifications, services offered, and any other relevant information you need to know.

03

Organize the questions in a logical and structured manner, ensuring that they cover all the important aspects you want to learn about.

04

Prioritize the questions based on their importance or urgency so that you can get the most crucial information first.

05

Research the tax professionals' background, client reviews, testimonials, and any other available resources to understand their reputation and credibility.

06

Send the questions to the tax professionals via email, contact form, or any other means of communication they provide.

07

Give them a reasonable timeline to respond to your questions, but also be flexible in case they need additional time.

08

Once you receive the answers, carefully review and analyze them to determine whether they align with your expectations and requirements.

09

If needed, follow up with any additional queries or clarifications to ensure you have a complete understanding of the tax professionals' capabilities and suitability for your needs.

Who needs questions taxprofessionalsand answers for?

01

Individual taxpayers: People who need tax professionals to assist them in filing their personal income taxes or dealing with other tax-related matters.

02

Business owners: Entrepreneurs, startups, and small to large businesses requiring tax professionals to handle their corporate taxes, payroll taxes, financial strategies, and related matters.

03

Non-profit organizations: Charities, foundations, and other non-profit entities seeking tax professionals with expertise in handling their unique tax situations, such as tax-exempt status filings and compliance.

04

Freelancers and independent contractors: Individuals who work on a freelance or contract basis and need tax professionals to guide them through the complexities of self-employment taxes and deductions.

05

Individuals with complex financial situations: People with complex investments, multiple properties, international income, or other intricate financial arrangements that require specialized tax knowledge.

Overall, anyone who wants professional help and guidance in navigating the complexities of tax laws and regulations can benefit from seeking questions taxprofessionalsand answers.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete questions taxprofessionalsand answers for on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your questions taxprofessionalsand answers for. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I edit questions taxprofessionalsand answers for on an Android device?

The pdfFiller app for Android allows you to edit PDF files like questions taxprofessionalsand answers for. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

How do I fill out questions taxprofessionalsand answers for on an Android device?

Use the pdfFiller Android app to finish your questions taxprofessionalsand answers for and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your questions taxprofessionalsand answers for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Questions Taxprofessionalsand Answers For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.