Get the free CREDIT CONTROL AND DEBT COLLECTION POLICY

Show details

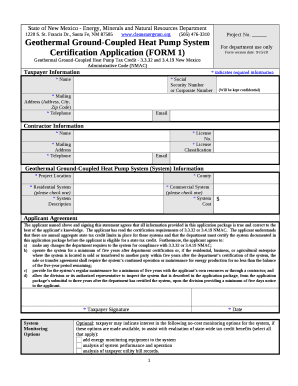

NAZI LOCAL MUNICIPALITY MP324 CREDIT CONTROL AND DEBT COLLECTION POLICY Reviewed, 05 June 2015, Resolution NKM: GCM: A061/2015-Page 1 VISION A leading local municipality that empowers its communities

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit control and debt

Edit your credit control and debt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit control and debt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit control and debt online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credit control and debt. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit control and debt

01

To fill out credit control and debt, start by gathering all relevant financial documents such as bank statements, invoices, and credit card statements.

02

Identify all outstanding debts and create a comprehensive list of creditors, the amount owed, and the due dates for each debt.

03

Prioritize your debts based on their urgency and importance. Consider factors such as interest rates, late payment penalties, and the consequences of defaulting on certain debts.

04

Develop a budget that takes into account your income, expenses, and debt repayments. This will help you determine how much you can afford to pay towards each debt on a monthly basis.

05

Negotiate with your creditors if you are experiencing financial hardship or struggling to make payments. Many creditors are willing to work out payment plans or offer debt consolidation options.

06

Take advantage of credit control measures such as setting up automatic payment reminders, reviewing your credit report regularly, and monitoring your spending habits.

07

Seek professional advice if you are overwhelmed with debt or unable to manage your finances effectively. Credit counseling agencies and financial advisors can provide guidance and assistance in developing a debt management plan.

Who needs credit control and debt?

01

Individuals facing financial difficulties: Credit control and debt management can be beneficial for individuals who are struggling to make ends meet or find themselves drowning in debt. By implementing effective credit control measures, they can gain control over their finances and work towards eliminating debt.

02

Small business owners: Credit control and debt are crucial for small business owners who need to manage their cash flow, ensure timely customer payments, and minimize bad debts. Effective credit control practices can help them avoid financial struggles and maintain a healthy business.

03

Financial institutions: Credit control and debt management are crucial for financial institutions such as banks and credit unions. These institutions need to ensure that borrowers are creditworthy and capable of repaying their debts. Proper credit control measures reduce the risk of defaults, protect the institution's assets, and maintain their financial stability.

In conclusion, filling out credit control and debt requires organizing financial documents, prioritizing debts, budgeting effectively, negotiating with creditors, and implementing credit control measures. This process is beneficial for individuals facing financial difficulties, small business owners, and financial institutions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is credit control and debt?

Credit control involves managing the credit that is extended to customers, while debt refers to the amount of money that is owed to a business by its customers.

Who is required to file credit control and debt?

Businesses that extend credit to customers are required to file credit control and debt.

How to fill out credit control and debt?

Credit control and debt can be filled out by documenting the credit terms extended to customers and keeping track of the amounts owed.

What is the purpose of credit control and debt?

The purpose of credit control and debt is to ensure that businesses are managing their credit effectively and collecting debts in a timely manner.

What information must be reported on credit control and debt?

Information such as the amount of credit extended, terms of credit, outstanding debts, and payment history must be reported on credit control and debt.

How can I manage my credit control and debt directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your credit control and debt and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I edit credit control and debt on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing credit control and debt.

How do I fill out credit control and debt on an Android device?

On an Android device, use the pdfFiller mobile app to finish your credit control and debt. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your credit control and debt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Control And Debt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.