Get the free PROPERTY CONTROL AND DEPRECIATION RECORD DA FORM 4078 JUN 1973 - apd army

Show details

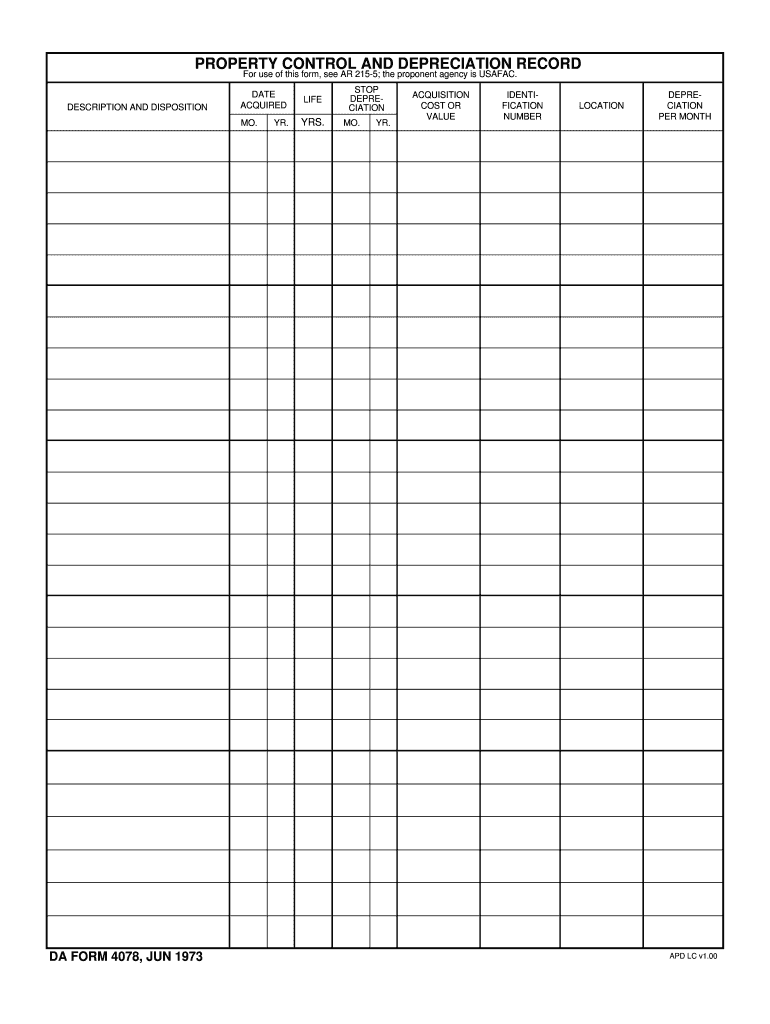

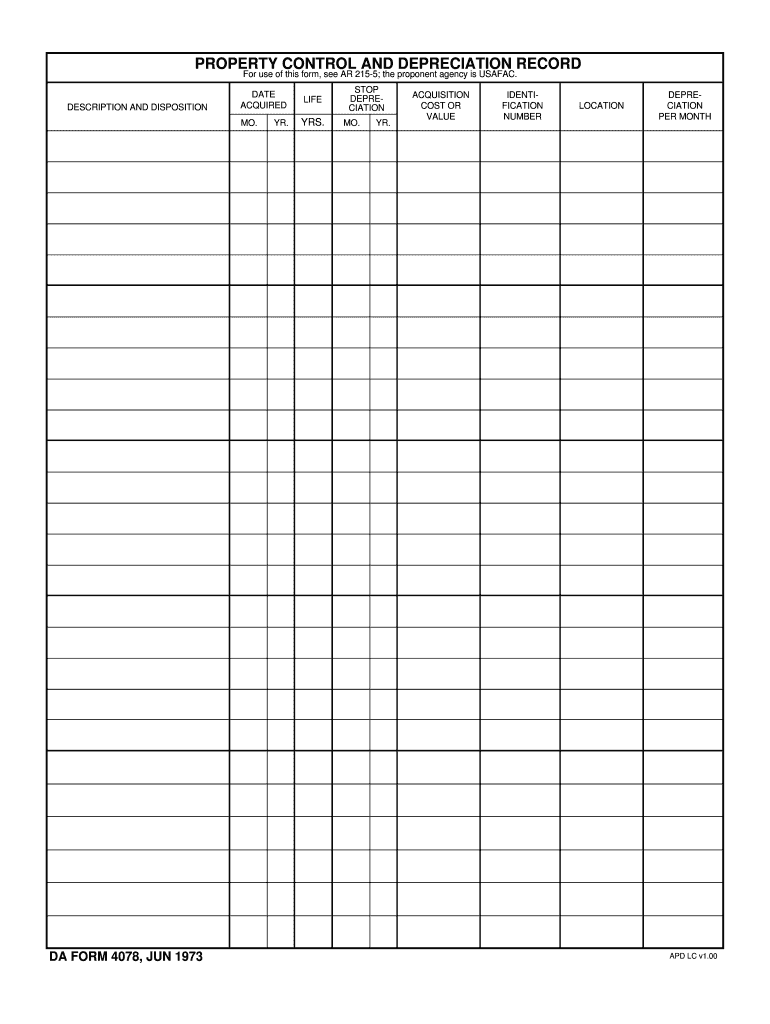

PROPERTY CONTROL AND DEPRECIATION RECORD For use of this form, see AR 2155; the proponent agency is USA FAC. DA FORM 4078, JUN 1973 LIFE MO. DESCRIPTION AND DISPOSITION DATE ACQUIRED YRS. YR. STOP

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property control and depreciation

Edit your property control and depreciation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property control and depreciation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing property control and depreciation online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit property control and depreciation. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property control and depreciation

How to fill out property control and depreciation?

01

Start by gathering all the necessary information about your property. This includes details such as the purchase date, cost, useful life, and any improvements made.

02

Review any applicable laws and regulations regarding property control and depreciation. This will help ensure that you are following proper accounting practices and guidelines.

03

Determine the appropriate method of depreciation to use for your property. Common methods include straight-line depreciation, declining balance depreciation, and units-of-production depreciation.

04

Calculate the annual depreciation expense for each property. This can be done by dividing the cost of the property by its useful life. For example, if a property cost $10,000 and has a useful life of 5 years, the annual depreciation expense would be $2,000 ($10,000 divided by 5).

05

Keep accurate records of your property control and depreciation. This includes maintaining a fixed asset register and documenting any changes or additions to your property.

Who needs property control and depreciation?

01

Businesses of all sizes and industries can benefit from property control and depreciation. It allows them to accurately track and manage their assets, as well as account for the decrease in value over time.

02

Property control helps businesses prevent loss or theft of their assets. By implementing proper controls, businesses can ensure that their valuable property is accounted for and properly utilized.

03

Depreciation is particularly important for businesses that own and use tangible assets, such as buildings, vehicles, and machinery. It helps them accurately reflect the decrease in value of these assets on their financial statements.

In summary, property control and depreciation are essential for businesses to effectively manage their assets and accurately report their financial position. By following the proper procedures for filling out property control and depreciation, businesses can ensure compliance with accounting standards and make informed decisions regarding their assets.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send property control and depreciation for eSignature?

When you're ready to share your property control and depreciation, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an electronic signature for signing my property control and depreciation in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your property control and depreciation directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How can I edit property control and depreciation on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing property control and depreciation.

What is property control and depreciation?

Property control and depreciation refers to the process of tracking and managing an organization's assets, as well as accounting for the decrease in value of those assets over time.

Who is required to file property control and depreciation?

Businesses and organizations that own and use tangible assets are required to file property control and depreciation reports.

How to fill out property control and depreciation?

Property control and depreciation reports are typically filled out by recording all relevant information about the organization's assets, including their initial cost, useful life, and any depreciation methods used.

What is the purpose of property control and depreciation?

The purpose of property control and depreciation is to accurately track the value of an organization's assets over time, as well as to comply with accounting standards and regulations.

What information must be reported on property control and depreciation?

Information that must be reported on property control and depreciation includes the description of the asset, its initial cost, date of acquisition, useful life, and any depreciation taken.

Fill out your property control and depreciation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Control And Depreciation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.