Get the free RCMA 401K PROFIT SHARING PLAN ADOPTION AGREEMENTPPA

Show details

RCMP 401(K) PROFIT SHARING PLAN ADOPTION AGREEMENT(PPA) Before completing this agreement, be sure to carefully review your Merrill Lynch Prototype Defined Contribution Plan and Trust Base Document

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rcma 401k profit sharing

Edit your rcma 401k profit sharing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rcma 401k profit sharing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rcma 401k profit sharing online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit rcma 401k profit sharing. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rcma 401k profit sharing

How to fill out rcma 401k profit sharing:

01

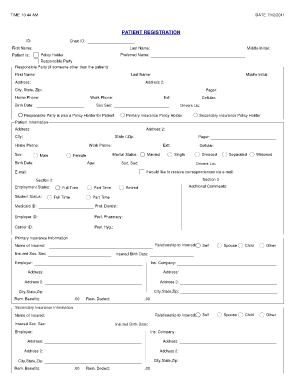

Obtain the necessary forms: Begin by requesting the rcma 401k profit sharing forms from your employer or plan administrator. These forms typically include the necessary information and instructions for completing the process.

02

Provide personal information: Fill in the required fields with your personal information, such as your name, address, Social Security number, and employment details. Ensure that all the information provided is accurate and up to date.

03

Determine your contribution level: Decide on the amount or percentage of your earnings you wish to contribute to the rcma 401k profit sharing plan. This contribution level may be subject to certain limits set by the IRS, so ensure you adhere to any restrictions.

04

Select investment options: Review the investment options available within the rcma 401k profit sharing plan. Consider your risk tolerance, goals, and desired asset allocation before making your investment selections. Seek professional advice if needed.

05

Designate beneficiaries: Designate beneficiaries who will receive the funds in your rcma 401k profit sharing account in the event of your death. This step is crucial to ensure that your assets are distributed according to your wishes. Provide the necessary information, such as your beneficiaries' names, dates of birth, and relationship to you.

06

Understand vesting rules: Familiarize yourself with the vesting rules of the rcma 401k profit sharing plan. Vesting determines the portion of employer contributions you are entitled to keep if you leave the company before a specific period. It is essential to know how much of the employer's contribution will be yours to retain based on the vesting schedule.

07

Review and submit the forms: Carefully review all the information you have provided before submitting the rcma 401k profit sharing forms. Ensure that there are no errors or omissions that could delay the process or cause complications later on.

08

Seek clarification if needed: If you encounter any confusion or have questions while filling out the rcma 401k profit sharing forms, contact your employer's HR department or plan administrator for assistance. It is important to understand the process fully to maximize the benefits of participating in the profit sharing plan.

Who needs rcma 401k profit sharing?

01

Employees seeking retirement savings options: rcma 401k profit sharing is beneficial for employees who are looking to save and invest for their retirement. By participating in the plan, they can take advantage of potential employer contributions, tax advantages, and long-term growth potential.

02

Employers aiming to provide retirement benefits: rcma 401k profit sharing can be an attractive incentive for employers wishing to attract and retain talent. By offering profit sharing, employers can contribute a portion of their profits to eligible employees' retirement accounts, fostering employee loyalty and long-term commitment.

03

Companies looking for tax advantages: Participating in rcma 401k profit sharing can provide companies with tax advantages. Employer contributions to the plan are typically tax-deductible, reducing overall taxable income for the business. This can result in potential tax savings and help companies manage their financial obligations more effectively.

Fill

form

: Try Risk Free

People Also Ask about

Does a volume submitter plan have an adoption agreement?

Our Prototype and Volume Submitter plans are pre-approved plans by the Internal Revenue Service. These plans consists of a basic plan document and an adoption agreement.

What is an adopting employer in a retirement plan?

The adopting employer is 401k vocabulary to refer to the self-employed business that is adopting/sponsoring the solo 401k plan. For example, if you are a sole proprietor, your name will be listed as the adopting employer. If the adopting employer is an LLC, then the LLC name will be listed as the adopting employer.

What is an adoption agreement in a 401k?

An adopting employer is an employer that adopts a pre-approved plan that is offered by a provider. An adopting employer must sign the pre-approved plan when it first adopts the plan and must sign a new plan for a restatement.

What is an adopting employer for 401k?

The adopting employer is 401k vocabulary to refer to the self-employed business that is adopting/sponsoring the solo 401k plan. For example, if you are a sole proprietor, your name will be listed as the adopting employer.

What is the difference between safe harbor and profit sharing?

Profit sharing contribution basics That means employees do not need to make 401(k) deferrals themselves to receive them. In contrast to safe harbor nonelective contributions, profit sharing contributions are discretionary – which means you don't have to make them every year.

What is an adoption agreement for a 401k plan?

The adoption agreement contains the options (and blanks) for the employer to complete and is also where the employer signs the plan. A single document plan does not use an adoption agreement, and the options and alternative paragraphs available for selection by the employer are contained throughout the single document.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is rcma 401k profit sharing?

RCMA 401k profit sharing is a retirement plan sponsored by RCMA that allows employees to contribute a portion of their salary to a tax-deferred account, with employer contributions to maximize retirement savings.

Who is required to file rcma 401k profit sharing?

Employers who sponsor the RCMA 401k profit sharing plan are required to file the necessary paperwork and reports with the IRS and Department of Labor.

How to fill out rcma 401k profit sharing?

Employers must gather relevant employee information, contribution details, and financial data to accurately complete the required forms for filing RCMA 401k profit sharing.

What is the purpose of rcma 401k profit sharing?

The purpose of RCMA 401k profit sharing is to provide employees with a retirement savings vehicle that allows for tax-deferred contributions and potential employer matching contributions to help employees save for retirement.

What information must be reported on rcma 401k profit sharing?

Information such as employee contributions, employer matching contributions, investment performance, participant details, and plan expenses must be reported on RCMA 401k profit sharing forms.

How can I modify rcma 401k profit sharing without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including rcma 401k profit sharing. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I complete rcma 401k profit sharing online?

Easy online rcma 401k profit sharing completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit rcma 401k profit sharing straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing rcma 401k profit sharing right away.

Fill out your rcma 401k profit sharing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rcma 401k Profit Sharing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.