Get the free PAYROLL QUERIES - sao georgia

Show details

This document provides a comprehensive list of payroll queries and their purposes, including details about the specific data returned by each query.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payroll queries - sao

Edit your payroll queries - sao form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payroll queries - sao form via URL. You can also download, print, or export forms to your preferred cloud storage service.

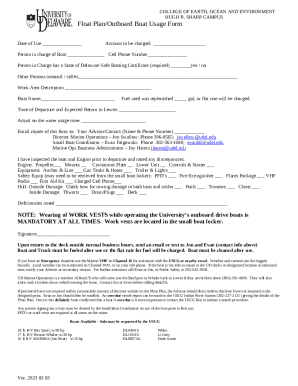

Editing payroll queries - sao online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit payroll queries - sao. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

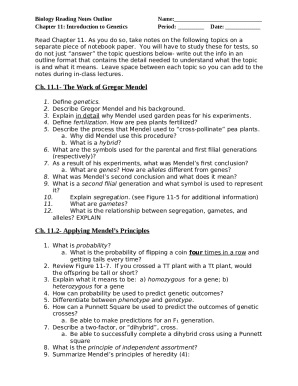

How to fill out payroll queries - sao

How to fill out PAYROLL QUERIES

01

Gather necessary employee information, including names and identification numbers.

02

Access the payroll query form provided by the HR department.

03

Fill in the employee's details accurately in the designated fields.

04

Specify the nature of the query, such as salary discrepancies or leave balance issues.

05

Attach any relevant documents that support your query, such as pay stubs or timecards.

06

Review the completed form for any errors or missing information.

07

Submit the payroll query form to the payroll department via the specified method (email, in-person, etc.).

08

Keep a copy of the submitted form for your records.

Who needs PAYROLL QUERIES?

01

Employees who have questions or discrepancies regarding their pay.

02

HR personnel managing payroll inquiries.

03

Managers seeking clarification on payroll-related issues for their team members.

04

Accountants handling payroll processing and adjustments.

05

Anyone needing information about benefits or deductions related to payroll.

Fill

form

: Try Risk Free

People Also Ask about

How to prepare a payroll statement?

We've outlined eight key payroll preparation steps to follow so you can manage your payment systems with confidence. Establish a payroll policy & method. Collect & manage employee data. Calculate taxes & other deductions. Determine gross & net pay. Process & record payments. Prepare & distribute payslips.

What is a payroll questionnaire?

A payroll questionnaire often helps in evaluating the controls in an organization's payroll process. This payroll questionnaire is made to focus on the business activities of hiring personnel, terminating personnel, recording time, managing payroll accounting and so on.

What does payroll query mean?

Payroll Queries are questions and concerns that employees have about their paychecks. They are important because they make sure that employees are paid properly and on time. They also give companies a way to find out about problems with payroll and deal with them.

How do I ask for payroll?

How to ask for your paycheck politely Review the payment terms. Before contacting anyone for payment, review the terms of service regarding payment. Determine who to contact. Decide how to contact them. Prepare a polite message. Share supporting materials. Follow up as needed.

What is the payroll answer?

Payroll is compensation a business must pay to its employees for a set period or on a given date. It's usually managed by the accounting or human resources department of a company but small business payrolls might be handled directly by the owner or an associate.

What is the meaning of payroll check?

Definitions of payroll check. noun. a check issued in payment of wages or salary. synonyms: paycheck. bank check, check, cheque.

What is a payroll query?

Payroll Queries are questions and concerns that employees have about their paychecks. They are important because they make sure that employees are paid properly and on time. They also give companies a way to find out about problems with payroll and deal with them.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PAYROLL QUERIES?

Payroll queries refer to the requests for information regarding payroll processing, including the calculations of employee wages, deductions, and other payroll-related concerns.

Who is required to file PAYROLL QUERIES?

Employers and payroll administrators are typically required to file payroll queries, especially when there are discrepancies or requests for clarification regarding payroll calculations.

How to fill out PAYROLL QUERIES?

To fill out payroll queries, individuals should include relevant employee information, the specific issue or question being raised, supporting documentation if applicable, and the desired resolution or information needed.

What is the purpose of PAYROLL QUERIES?

The purpose of payroll queries is to address concerns about payroll discrepancies, ensure accurate payment to employees, and clarify any misunderstandings regarding payroll processes.

What information must be reported on PAYROLL QUERIES?

Information that must be reported on payroll queries includes employee details, payroll period, specific issues or discrepancies, and any associated documentation that supports the query.

Fill out your payroll queries - sao online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payroll Queries - Sao is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.