Get the free WHAT IS NOT COVERED LIMITATIONS AND EXCLUSIONS AND TERMS - ique blob core windows

Show details

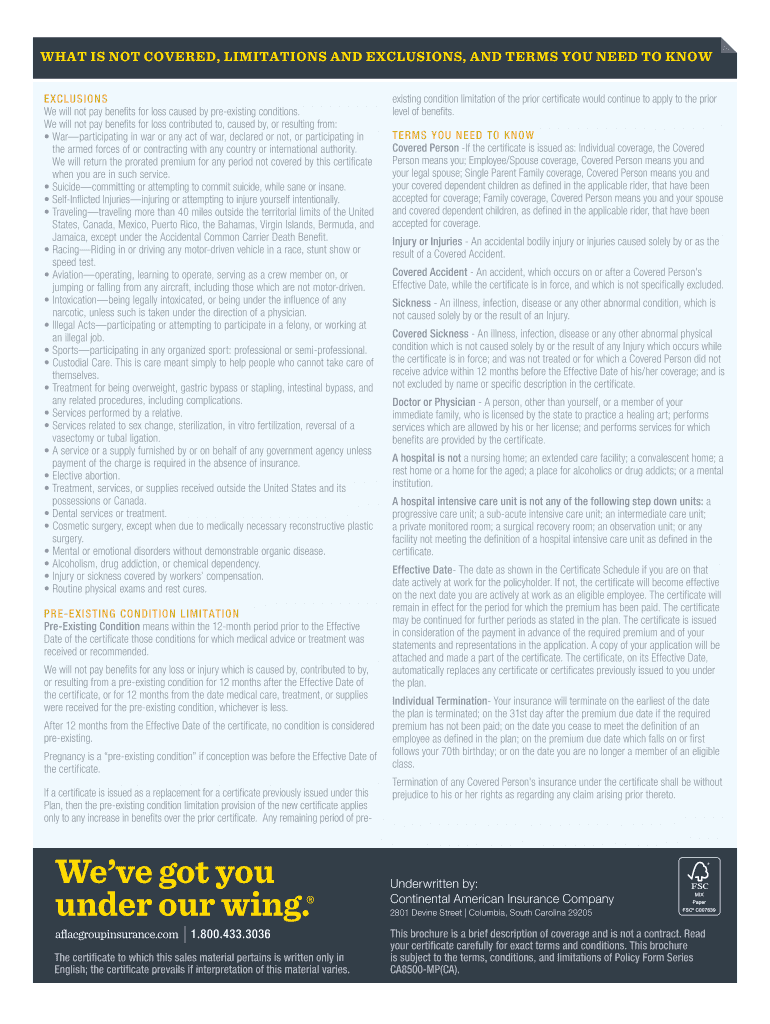

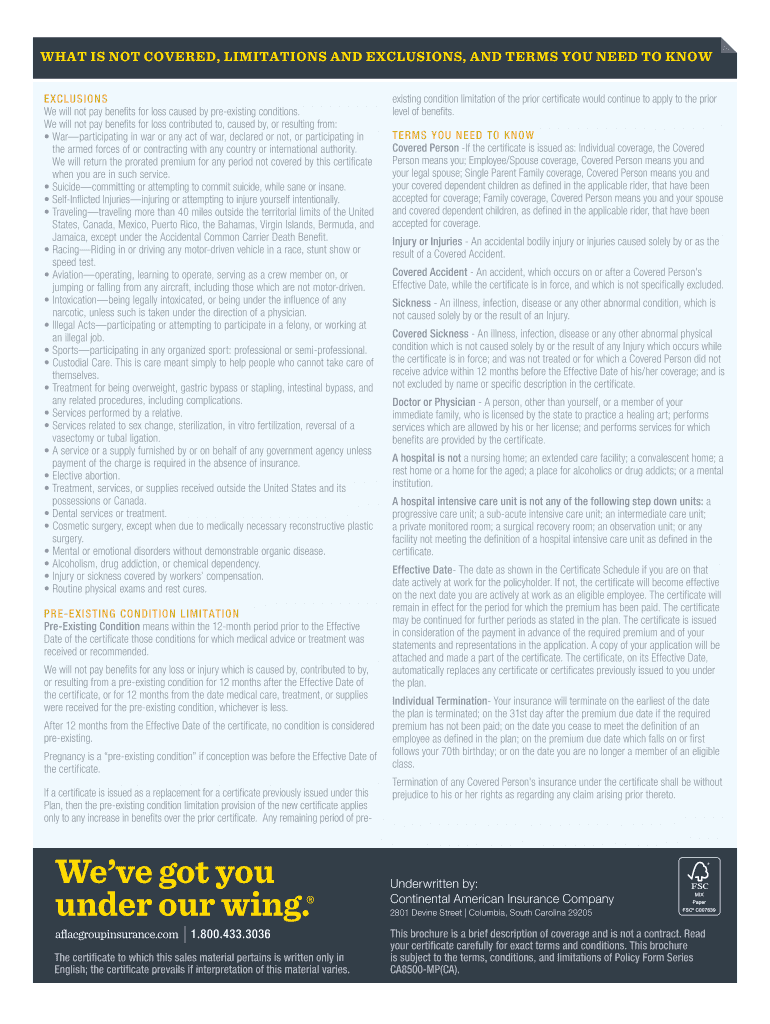

WHAT IS NOT COVERED, LIMITATIONS AND EXCLUSIONS, AND TERMS YOU NEED TO KNOW E X CL U S I ON S We will not pay benefits for loss caused by preexisting conditions. We will not pay benefits for loss

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign what is not covered

Edit your what is not covered form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your what is not covered form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing what is not covered online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit what is not covered. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out what is not covered

How to fill out what is not covered:

01

Gather all relevant information: Start by reviewing your insurance policy documents and understanding what is covered and what is not. Make a list of the specific items or situations that are not covered.

02

Check for additional coverage options: Research and explore any additional coverage options that may be available to you. This could include add-on policies or endorsements that address the gaps in your existing coverage.

03

Evaluate your risks: Assess your current situation and identify any potential risks or vulnerabilities that are not covered by your insurance policy. For example, consider factors such as your location, lifestyle, or specific assets that may need extra protection.

04

Seek professional advice: If you are unsure about any aspect of your insurance coverage or need assistance in filling out what is not covered, it is highly recommended to consult a licensed insurance agent or broker. They can provide expert guidance tailored to your specific needs.

05

Consider alternative risk management strategies: Apart from insurance, there might be other ways to mitigate certain risks. For instance, installing security systems for your property or implementing safety measures for your business can help reduce potential losses or liability.

Who needs what is not covered:

01

Individuals with specific risks: People who have unique circumstances, such as owning valuable assets, engaging in high-risk activities, or living in disaster-prone areas, may need to pay close attention to what is not covered by their insurance policies. They should ensure they have suitable coverage for these specific risks.

02

Business owners: Entrepreneurs and business owners must carefully review their commercial insurance policies to determine what risks or liabilities are excluded. Additionally, they may need to consider specialized coverage for their particular industry or operations.

03

Those seeking comprehensive protection: Some individuals or families may simply desire comprehensive protection against a wide range of risks. They may want to fill out what is not covered to ensure peace of mind and safeguard their financial well-being.

04

Policyholders experiencing changes: Life events, such as purchasing a new home, getting married, starting a family, or acquiring additional assets, may warrant a review and adjustment of existing insurance coverage. This helps them understand what is not covered and make the necessary changes to protect their evolving needs.

Remember, it is crucial to carefully review your insurance policy, seek professional advice, and evaluate any potential gaps in coverage to ensure adequate protection for yourself, your loved ones, or your business.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my what is not covered in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your what is not covered and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I edit what is not covered on an iOS device?

You certainly can. You can quickly edit, distribute, and sign what is not covered on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete what is not covered on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your what is not covered. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is what is not covered?

What is not covered refers to any items, services, or expenses that are not eligible for insurance coverage or reimbursement.

Who is required to file what is not covered?

Individuals or organizations responsible for administering insurance plans are required to file what is not covered.

How to fill out what is not covered?

To fill out what is not covered, carefully review the insurance policy or plan documents to determine what items or services are excluded from coverage.

What is the purpose of what is not covered?

The purpose of what is not covered is to clarify any limitations or restrictions on insurance coverage and to provide transparency to the policyholder.

What information must be reported on what is not covered?

Information regarding specific items, services, or expenses that are not covered by the insurance policy must be reported on what is not covered.

Fill out your what is not covered online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

What Is Not Covered is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.