Get the free Understanding Flood Insurance

Show details

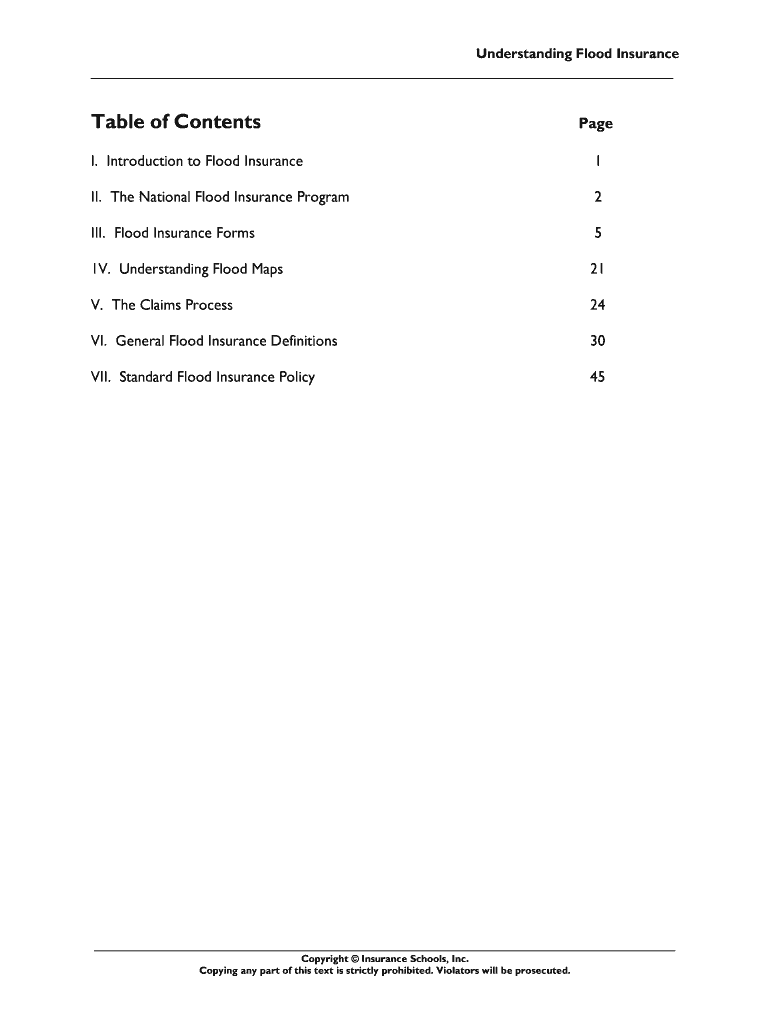

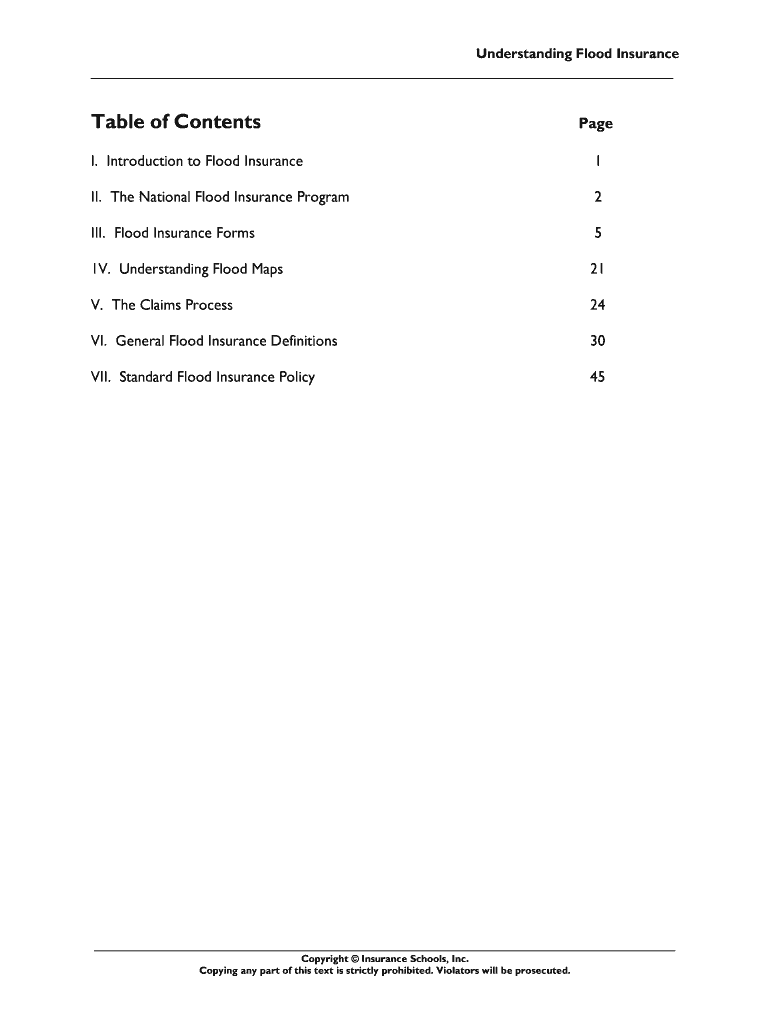

Understanding Flood Insurance Table of Contents Page I. Introduction to Flood Insurance 1 II. The National Flood Insurance Program 2 III. Flood Insurance Forms 5 1V. Understanding Flood Maps 21 V.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign understanding flood insurance

Edit your understanding flood insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your understanding flood insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit understanding flood insurance online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit understanding flood insurance. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out understanding flood insurance

How to fill out understanding flood insurance:

01

Start by researching different insurance providers that offer flood insurance coverage. Look for reputable companies with good customer reviews and strong financial stability.

02

Familiarize yourself with the basics of flood insurance, such as the coverage limits, deductible options, and types of property that can be covered. This will help you understand what to expect when filling out the insurance application.

03

Gather all the necessary information and documents needed to fill out the application. This may include details about your property, such as the address, construction type, and value. You may also need to provide information about your personal belongings that you want to be covered by the flood insurance policy.

04

Carefully fill out the application form, making sure to provide accurate and complete information. Double-check all the details before submitting the form to avoid any mistakes or delays in the processing of your application.

05

If you have any questions or need assistance, don't hesitate to reach out to the insurance company's customer service. They can provide guidance and clarification on any confusing aspects of the flood insurance application.

06

Once you've submitted the application, make sure to review the policy documents and understand the terms and conditions of the flood insurance coverage. It's essential to know what is covered and what is not, as well as any limitations or exclusions that may apply.

07

Keep your flood insurance policy documents in a safe and easily accessible place. It's crucial to have them readily available in case you need to file a claim in the future.

Who needs understanding flood insurance:

01

Homeowners living in areas prone to flooding, such as coastal regions or near rivers, lakes, or other bodies of water.

02

Business owners with properties located in flood zones or areas at high risk of flooding.

03

Renters who want to protect their personal belongings from potential flood damage.

04

Landlords or property managers who want to safeguard their investment properties against flood-related losses.

05

Individuals or families who have experienced previous flooding incidents and want to mitigate financial risks in the future.

06

Lenders or financial institutions that require flood insurance coverage for properties in flood-prone areas as a condition for mortgage approval.

07

Anyone who wants to be prepared and financially protected in the event of a flood, regardless of their geographical location.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify understanding flood insurance without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your understanding flood insurance into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I complete understanding flood insurance online?

Filling out and eSigning understanding flood insurance is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I edit understanding flood insurance on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign understanding flood insurance on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is understanding flood insurance?

Understanding flood insurance involves knowing the coverage provided by a flood insurance policy, the risks it protects against, and the process for filing a claim in the event of a flood.

Who is required to file understanding flood insurance?

Property owners located in flood-prone areas or areas that require flood insurance as a condition of a mortgage are required to have flood insurance and should have an understanding of their policy.

How to fill out understanding flood insurance?

To fill out understanding flood insurance, property owners should review their policy, understand the coverage limits, and be prepared to provide accurate information about their property and belongings in case of a flood.

What is the purpose of understanding flood insurance?

The purpose of understanding flood insurance is to protect property owners from the financial losses that can occur as a result of flood damage.

What information must be reported on understanding flood insurance?

Information that must be reported on understanding flood insurance includes property details, coverage limits, deductible amounts, and any additional coverage options selected.

Fill out your understanding flood insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Understanding Flood Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.