Get the free LOCAL MOTOR FUEL TAX RETAIL REMITTANCE RETURN

Show details

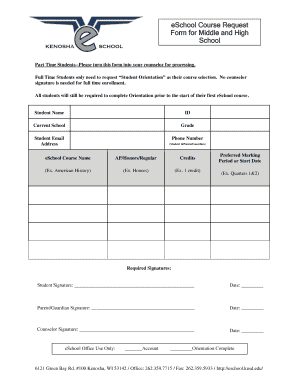

This document is used for remitting the local motor fuel tax for businesses in Champaign, Illinois. It details the required information for reporting gasoline and diesel purchases, tax calculations,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign local motor fuel tax

Edit your local motor fuel tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your local motor fuel tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit local motor fuel tax online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit local motor fuel tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out local motor fuel tax

How to fill out LOCAL MOTOR FUEL TAX RETAIL REMITTANCE RETURN

01

Obtain the LOCAL MOTOR FUEL TAX RETAIL REMITTANCE RETURN form from the official tax authority's website or office.

02

Enter your business name and address in the designated fields.

03

Fill out the period for which the fuel tax is being reported.

04

Report the total gallons of fuel sold during the reporting period.

05

Calculate the local motor fuel tax due based on the gallons sold and the applicable tax rate.

06

Deduct any applicable credits or exemptions from the total tax due.

07

Calculate the total amount due after applying any deductions.

08

Sign and date the return to certify its accuracy.

09

Submit the completed form along with any payment required to the appropriate tax authority by the deadline.

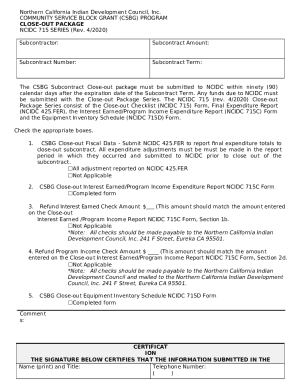

Who needs LOCAL MOTOR FUEL TAX RETAIL REMITTANCE RETURN?

01

Businesses that sell motor fuel to consumers, including gas stations and fuel distributors.

02

Any entity that is responsible for collecting local motor fuel taxes on fuel sales.

Fill

form

: Try Risk Free

People Also Ask about

What is a local option use tax?

For definitional purposes, ―local option‖ refers to taxes that are levied with state approval by city, county, and special district governments, including school districts.

What is the local option fuel tax in Florida?

336.021. (e) An additional tax of between 1 cent and 11 cents per net gallon may be imposed on motor fuel by each county, which shall be designated as the “local option fuel tax.” This tax shall be levied and used as provided in s. 336.025. (f)1.

What is the motor fuel tax in Illinois?

Illinois Gov. J.B. Pritzker doubled the state's gasoline tax in 2019 with automatic annual increases. The state motor fuel tax is 47 cents and will increase to 48.3 cents on July 1.

Do local governments pay fuel tax?

Yes, government agencies — particularly state and local governments — are exempt from paying certain Federal Excise Taxes (FET) under specific conditions.

What is the motor fuel tax in Wisconsin?

The excise tax on motor vehicle fuel is 30.9¢ per gallon [sec. 78.01(1), Wis. Stats.]. Who must obtain a motor vehicle fuel tax license?

What are local taxes?

What Is a Local Tax? A local tax is an assessment by a state, county, or municipality to fund public services ranging from schools and highways to garbage collection and sewer maintenance. Local taxes come in many forms, from property taxes and payroll taxes to sales taxes and licensing fees.

What is the local option fuel tax?

Local Option Fuel Taxes A tax of 1 to 5 cents on every net gallon of motor fuel sold within a county. Diesel fuel is not subject to this tax. Funds may also be used to meet the requirements of the capital improvements element of an adopted local government comprehensive plan.

What is the Ohio motor fuel tax?

The Motor Vehicle Fuel Tax Law is set forth in Chapter 5735 Re vised Code. Section 5735.05, Revised Code, levies upon all dealers of motor vehicle fuel an excise tax of two cents per gallon upon the use, distribution or sale by them of motor vehicle fuel.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

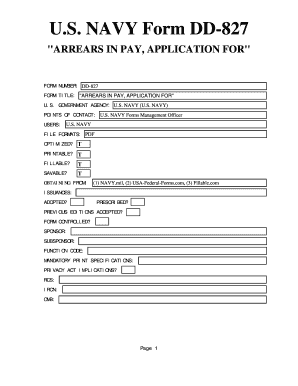

What is LOCAL MOTOR FUEL TAX RETAIL REMITTANCE RETURN?

The LOCAL MOTOR FUEL TAX RETAIL REMITTANCE RETURN is a form that retailers use to report and remit local motor fuel taxes collected from customers on fuel sales.

Who is required to file LOCAL MOTOR FUEL TAX RETAIL REMITTANCE RETURN?

Retailers who sell motor fuel and collect local motor fuel taxes are required to file the LOCAL MOTOR FUEL TAX RETAIL REMITTANCE RETURN.

How to fill out LOCAL MOTOR FUEL TAX RETAIL REMITTANCE RETURN?

To fill out the LOCAL MOTOR FUEL TAX RETAIL REMITTANCE RETURN, retailers need to provide details such as total fuel sales, the amount of local motor fuel tax collected, and any deductions or exemptions applicable, along with the appropriate signatures and dates.

What is the purpose of LOCAL MOTOR FUEL TAX RETAIL REMITTANCE RETURN?

The purpose of the LOCAL MOTOR FUEL TAX RETAIL REMITTANCE RETURN is to ensure proper reporting and remittance of local motor fuel taxes, which fund local infrastructure and community services.

What information must be reported on LOCAL MOTOR FUEL TAX RETAIL REMITTANCE RETURN?

The information that must be reported includes the retailer's details, total gallons of fuel sold, total local motor fuel tax collected, any applicable deductions, and the payment amount.

Fill out your local motor fuel tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Local Motor Fuel Tax is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.