Get the free Sample Loan Summary

Show details

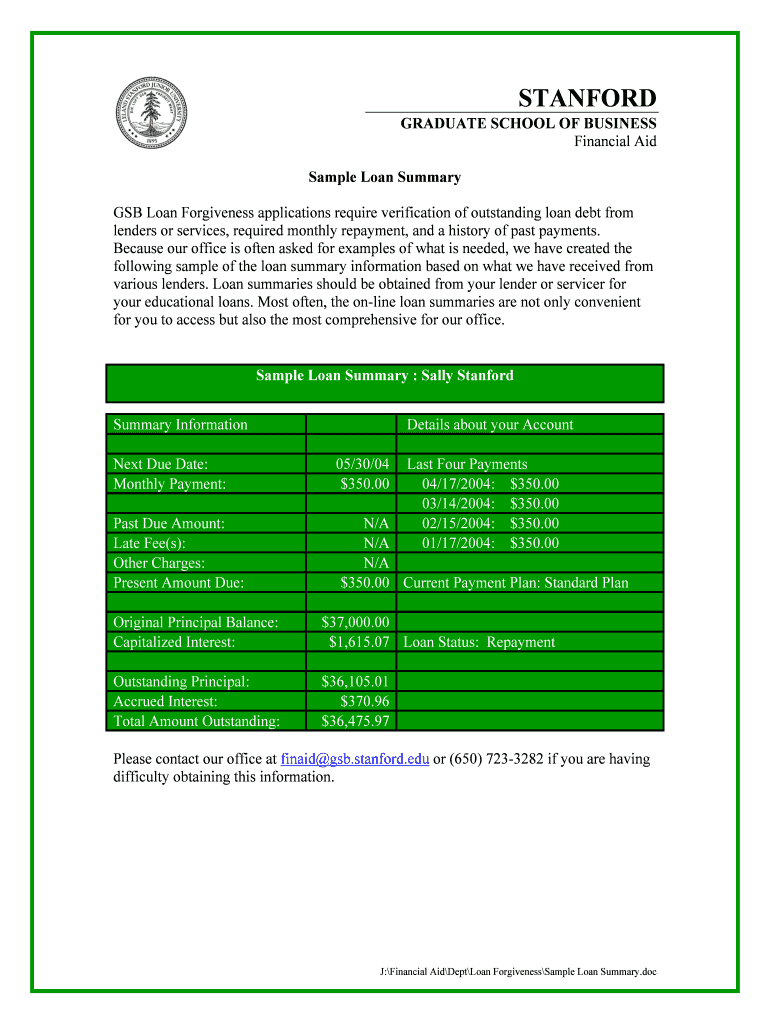

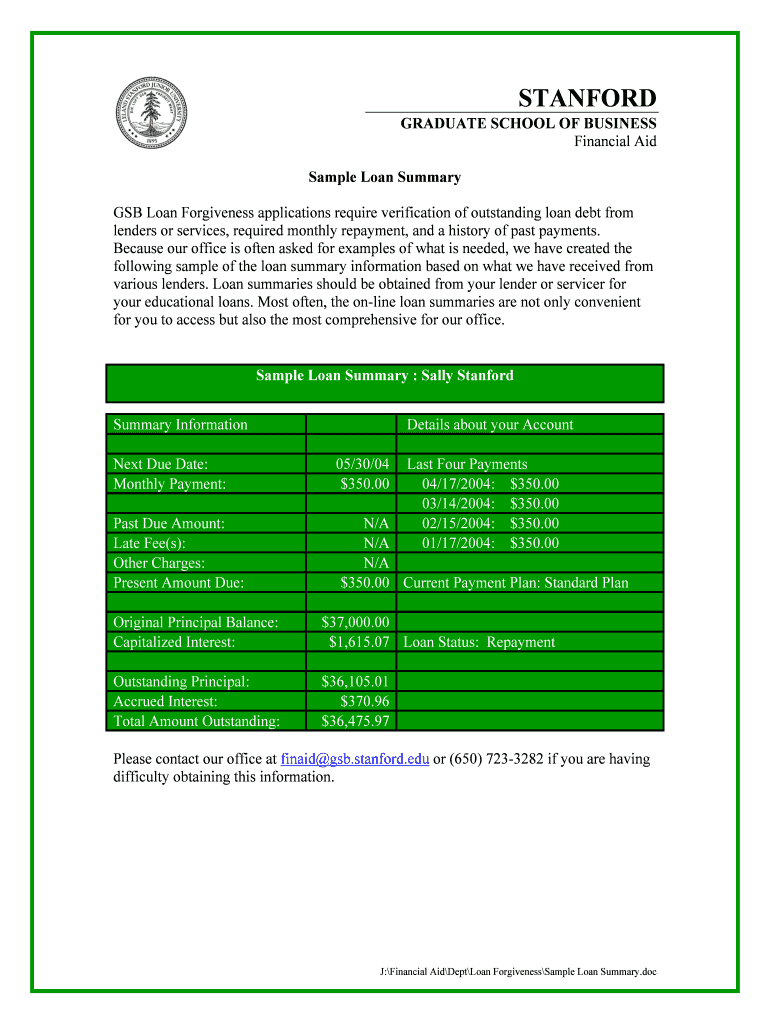

STANFORD

GRADUATE SCHOOL OF BUSINESS

Financial Aid

Sample Loan Summary

GB Loan Forgiveness applications require verification of outstanding loan debt from

lenders or services, required monthly repayment,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sample loan summary

Edit your sample loan summary form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sample loan summary form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sample loan summary online

Follow the guidelines below to use a professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sample loan summary. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sample loan summary

How to fill out a sample loan summary:

Start by entering your personal information:

01

Provide your full name, contact information, and address.

02

Include your social security number or any other unique identification number required by the lender.

Proceed with the loan details:

01

Specify the type of loan you are applying for (e.g., personal loan, mortgage, auto loan).

02

State the loan amount you are requesting.

03

Indicate the purpose of the loan (e.g., debt consolidation, home purchase, car financing).

04

Mention the desired repayment term (e.g., 3 years, 30 years).

Include your financial information:

01

Provide details about your income sources, such as employment, self-employment, or investments.

02

Disclose your monthly income.

03

Declare any additional sources of income that could contribute to the loan repayment.

Outline your credit history:

01

Include information about your credit score and any significant credit events, such as bankruptcies or foreclosures.

02

Mention any outstanding debts or loans you currently have, including credit card balances or student loans.

03

Provide details about your previous loan repayments, emphasizing any defaults or delinquencies.

Add collateral information (if applicable):

01

If you are applying for a secured loan, list the assets you are willing to pledge as collateral.

02

Include a description and estimated value of each asset, such as real estate, vehicles, or valuable possessions.

Specify your references:

01

Provide contact information for individuals who can vouch for your character and reliability, such as friends, family members, or professional acquaintances.

02

Include their names, addresses, and phone numbers.

Who needs a sample loan summary?

01

Individuals applying for loans from financial institutions, such as banks, credit unions, or online lenders.

02

Entrepreneurs seeking business loans from lenders or investors.

03

Individuals or companies considering loan options for investing in real estate or other ventures.

Remember to follow any specific instructions provided by the lender when filling out a loan summary, as requirements may vary.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find sample loan summary?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific sample loan summary and other forms. Find the template you want and tweak it with powerful editing tools.

How do I fill out the sample loan summary form on my smartphone?

Use the pdfFiller mobile app to complete and sign sample loan summary on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit sample loan summary on an Android device?

The pdfFiller app for Android allows you to edit PDF files like sample loan summary. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is sample loan summary?

Sample loan summary is a document that provides a summary of a loan, including the borrower's information, loan amount, interest rate, and repayment terms.

Who is required to file sample loan summary?

Lenders or financial institutions are required to file sample loan summary for each loan that they provide to borrowers.

How to fill out sample loan summary?

To fill out sample loan summary, you need to provide all the necessary information about the loan, including borrower details, loan amount, interest rate, and repayment terms.

What is the purpose of sample loan summary?

The purpose of sample loan summary is to provide a clear and concise summary of a loan, making it easier for borrowers to understand the terms and conditions of the loan.

What information must be reported on sample loan summary?

The information that must be reported on sample loan summary includes borrower's name, loan amount, interest rate, loan term, and repayment schedule.

Fill out your sample loan summary online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sample Loan Summary is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.