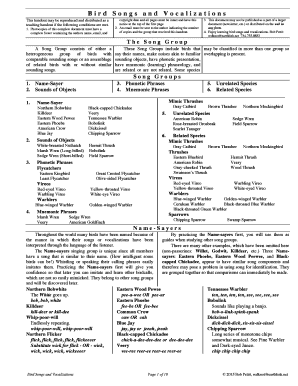

Get the free SENIOR PARCEL TAX EXEMPTION APPLICATION 2016-2017

Show details

CABRILLOUNIFIEDSCHOOLDISTRICT SENIORPARCELTAXEXEMPTIONAPPLICATION DEADLINEforFILING:June30,2016noexceptions Tobecompletedbythepersonaged65orolderasofJuly1,2016,who owns andresidesatthepropertyforwhichtheexemptionisclaimed.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign senior parcel tax exemption

Edit your senior parcel tax exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your senior parcel tax exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

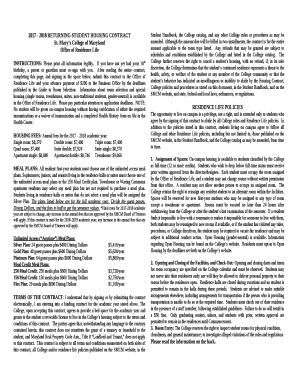

Editing senior parcel tax exemption online

Follow the steps down below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit senior parcel tax exemption. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out senior parcel tax exemption

How to fill out senior parcel tax exemption:

01

Obtain the necessary forms: The first step in filling out a senior parcel tax exemption is to acquire the required forms. These forms can usually be obtained from the local tax assessor's office or downloaded from their website.

02

Read the instructions carefully: Once you have the forms, carefully read the instructions provided. Make sure you understand what information is required and how to accurately complete each section.

03

Gather the required documentation: To complete the senior parcel tax exemption form, you will likely need certain documents, such as proof of age (such as a birth certificate or driver's license), proof of ownership or occupancy of the property (such as a deed or lease), and income verification (such as tax returns or social security statements). Collect these documents before starting the filling process.

04

Complete personal information section: Begin by filling out the personal information section of the form, which may include your name, address, contact information, and any other requested details. Make sure to provide accurate and up-to-date information.

05

Provide proof of age: Next, attach the necessary documents that prove your age eligibility for the senior parcel tax exemption. This may include a copy of your birth certificate, driver's license, passport, or any other acceptable identification.

06

Provide proof of ownership or occupancy: If required, provide appropriate documentation to prove your ownership or occupancy of the property for which you are seeking the tax exemption. This may include a copy of the property deed, lease agreement, or other relevant documents.

07

Provide income verification: Depending on the requirements of the tax assessor's office, you may need to provide income verification to demonstrate your eligibility for the senior parcel tax exemption. This can include recent tax returns, social security benefit statements, or any other documentation that proves your income status.

08

Double-check the form: Before submitting the form, review all the information you have provided. Ensure that everything is accurate, legible, and complete. Make any necessary revisions or additions before submitting.

Who needs senior parcel tax exemption?

01

Seniors on fixed incomes: Senior citizens who rely on fixed incomes, such as retirement pensions or social security benefits, may choose to apply for a senior parcel tax exemption to alleviate the burden of additional property taxes.

02

Low-income seniors: Seniors with limited financial resources may be eligible for a senior parcel tax exemption. The exemption provides financial assistance by reducing or eliminating the property tax obligation, allowing low-income seniors to better manage their expenses.

03

Homeowners meeting age requirements: Homeowners who meet the age requirement set by their local tax assessor's office may be eligible for the senior parcel tax exemption. In many places, the minimum age is typically 65, but it may vary depending on the jurisdiction.

04

Occupants of the property: Depending on the specific guidelines of the senior parcel tax exemption, both homeowners and renters who meet the age and income requirements may be eligible. Renters may need to provide proof of occupancy and relevant documentation to demonstrate their eligibility.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit senior parcel tax exemption from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including senior parcel tax exemption, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send senior parcel tax exemption to be eSigned by others?

senior parcel tax exemption is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit senior parcel tax exemption on an iOS device?

Create, modify, and share senior parcel tax exemption using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your senior parcel tax exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Senior Parcel Tax Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.