Get the free Donation and Gift Policy - Final

Show details

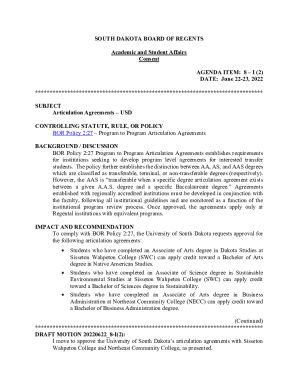

CITY OF GOLETA

DONATION AND GIFT POLICY

Section 1. Purpose

The purpose of this policy is to establish a formal process for acceptance and

documentation of donations made to the City. This policy provides

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign donation and gift policy

Edit your donation and gift policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your donation and gift policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit donation and gift policy online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit donation and gift policy. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

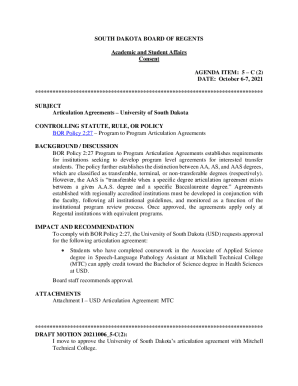

How to fill out donation and gift policy

How to create a donation and gift policy:

01

Identify the purpose and goals: Clearly define why your organization is accepting donations and gifts. Determine the specific areas or projects that will benefit from these contributions.

02

Set guidelines for acceptance: Establish criteria for accepting donations and gifts to ensure they align with your organization's mission and values. Consider factors such as the nature and source of the gift, legal and ethical implications, and any potential conflicts of interest.

03

Define the types of donations and gifts: Specify the different forms of contributions you are willing to accept, such as monetary donations, in-kind gifts, stocks, or property. Outline any restrictions or limitations associated with each type.

04

Establish procedures for accepting donations: Create a step-by-step process for accepting donations and gifts. This may include completing a donation form, conducting due diligence on large contributions, acknowledging and thanking donors, and recording the donation in your financial records.

05

Determine reporting requirements: Identify how your organization will report and disclose donations and gifts. This could involve reporting to regulatory bodies, providing tax receipts to donors, or disclosing major contributions in annual reports.

06

Address potential conflicts of interest: Develop a policy to address situations where a donor's contribution may influence decision-making or create conflicts of interest within your organization. Clearly outline how these situations will be handled to ensure transparency and integrity.

Who needs a donation and gift policy:

01

Nonprofit organizations: Nonprofits rely heavily on donations and gifts to support their mission and activities. A donation and gift policy helps ensure that contributions are obtained and used in a manner consistent with the organization's objectives.

02

Educational institutions: Schools, colleges, and universities often receive donations and gifts from alumni, families, and corporate entities. Having a policy in place ensures these contributions are directed towards areas that enhance the educational experience.

03

Government agencies: Some government entities accept donations and gifts for specific programs or projects. A donation and gift policy provides guidelines for transparency, fairness, and accountability in managing such contributions.

04

Businesses and corporations: Companies may establish donation and gift policies to govern their philanthropic activities, including corporate giving programs, sponsorships, or partnerships with nonprofit organizations. Such policies help align the organization's giving efforts with its values and goals.

In conclusion, creating a donation and gift policy involves defining the purpose, setting guidelines, specifying types of contributions, establishing procedures, determining reporting requirements, and addressing conflicts of interest. Nonprofit organizations, educational institutions, government agencies, and businesses may all benefit from having a donation and gift policy in place.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my donation and gift policy directly from Gmail?

donation and gift policy and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I complete donation and gift policy online?

Easy online donation and gift policy completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I make changes in donation and gift policy?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your donation and gift policy to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

What is donation and gift policy?

Donation and gift policy is a set of guidelines and procedures regarding the acceptance, reporting, and handling of donations and gifts received by an organization.

Who is required to file donation and gift policy?

All organizations that receive donations and gifts are required to have a donation and gift policy in place.

How to fill out donation and gift policy?

Donation and gift policy can be filled out by outlining the organization's procedures for accepting, reporting, and handling donations and gifts, as well as any restrictions or guidelines on acceptance.

What is the purpose of donation and gift policy?

The purpose of donation and gift policy is to ensure transparency, accountability, and compliance with regulations in the handling of donations and gifts.

What information must be reported on donation and gift policy?

Information that must be reported on donation and gift policy includes the procedures for accepting donations, reporting requirements, restrictions on acceptance, and how donations and gifts are used or allocated.

Fill out your donation and gift policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Donation And Gift Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.