Get the free HOTEL/MOTEL TAX REGISTRATION FORM

Show details

This document is used for registering a business that operates as a hotel, motel, or similar establishment for hotel/motel tax purposes in the state of Illinois.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hotelmotel tax registration form

Edit your hotelmotel tax registration form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hotelmotel tax registration form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit hotelmotel tax registration form online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit hotelmotel tax registration form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hotelmotel tax registration form

How to fill out HOTEL/MOTEL TAX REGISTRATION FORM

01

Obtain the HOTEL/MOTEL TAX REGISTRATION FORM from your local tax authority's website or office.

02

Fill in your business information, including the name of the hotel/motel, physical address, and mailing address.

03

Provide details about the ownership structure, indicating whether it's an individual, partnership, or corporation.

04

Include your federal employer identification number (EIN) or social security number if applicable.

05

Specify the type of lodging services offered (e.g., hotel, motel, bed and breakfast).

06

Indicate the start date of business operations.

07

Review the form for accuracy and completeness.

08

Sign and date the form where indicated.

09

Submit the completed form to your local tax authority either in person or via the specified method (e.g., mail, online).

Who needs HOTEL/MOTEL TAX REGISTRATION FORM?

01

All owners or operators of hotels, motels, and lodging establishments that provide accommodation services must complete the HOTEL/MOTEL TAX REGISTRATION FORM.

02

Businesses that are required to collect and remit hotel/motel taxes to the local jurisdiction.

03

New establishments that wish to operate legally in their area.

Fill

form

: Try Risk Free

People Also Ask about

Is lodging tax the same as hotel tax?

Occupancy tax is simply another name for hotel tax, lodging tax and bed tax. It's the name, or one of the names, used by many states, including Alabama, California, Connecticut, Illinois, New Jersey, Tennessee, Texas, Virginia and West Virginia.

Why do I have to pay property tax while staying at an hotel?

The hotel has to pay property taxes, at higher commercial rates than typical residential property taxes, and they will pass that cost onto you in the daily room rate. So, while you won't be paying property taxes directly, you'll pay them as part of your room rate.

How to book a hotel tax free?

You must be on official travel and pay with your Government Travel Charge Card. Individual travelers must use their Individually Billed Account (IBA) to qualify for the state sales tax exemption if there is one. Employment with the federal government doesn't exempt you from lodging tax on personal travel.

How much is hotel tax in Pennsylvania?

Tax rates, penalties, & fees The hotel operator is responsible for collecting the tax from guests. In addition to the City's Hotel Tax, the Commonwealth of Pennsylvania imposes its own 7% Hotel Tax on the amount paid by the guest. The total in-state rate is 15.5%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

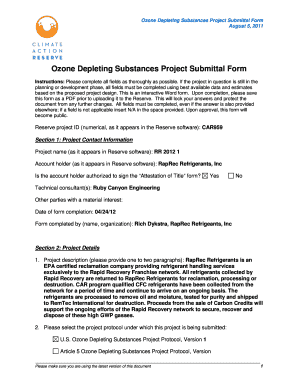

What is HOTEL/MOTEL TAX REGISTRATION FORM?

The HOTEL/MOTEL TAX REGISTRATION FORM is a document required for businesses that operate accommodations such as hotels or motels. It registers the establishment for collecting and remitting hotel or motel tax.

Who is required to file HOTEL/MOTEL TAX REGISTRATION FORM?

Any business that provides lodging accommodations to guests, including hotels, motels, inns, bed and breakfasts, and other similar entities, is required to file this form.

How to fill out HOTEL/MOTEL TAX REGISTRATION FORM?

To fill out the form, enter the business name, address, tax identification number, and details about the accommodations provided. Ensure to read the instructions carefully to complete all sections accurately.

What is the purpose of HOTEL/MOTEL TAX REGISTRATION FORM?

The purpose of the HOTEL/MOTEL TAX REGISTRATION FORM is to register the business with local tax authorities so that it can properly collect and remit hotel or motel taxes from guests.

What information must be reported on HOTEL/MOTEL TAX REGISTRATION FORM?

The form typically requires information such as business name, business address, contact information, tax ID number, the type of accommodations offered, and an estimate of occupancy rates.

Fill out your hotelmotel tax registration form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hotelmotel Tax Registration Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.