Get the free All Loans Received

Show details

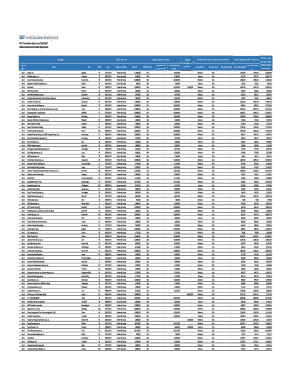

07/06/2008 16 : 58 Image# 28932115554 REPORT OF RECEIPTS AND DISBURSEMENTS FEC FORM 3X 1. For Other Than An Authorized Committee. NAME OF COMMITTEE (in full) Office Use Only USE FEC MAILING LABEL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign all loans received

Edit your all loans received form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your all loans received form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit all loans received online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit all loans received. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out all loans received

How to fill out all loans received:

01

Gather all relevant information: Begin by collecting all the necessary documents related to the loans received. This may include loan agreements, promissory notes, statements, and other financial records.

02

Review the loan agreements: Carefully read through each loan agreement to understand the terms and conditions. Take note of important details such as interest rates, repayment schedules, and any penalties for late payments.

03

Organize the loan information: Create a spreadsheet or document where you can input all the details of the loans received. Include the loan amount, interest rate, repayment dates, and any other relevant information.

04

Calculate total loan amount: Add up the loan amounts to determine your total outstanding debt. This will give you a clear picture of your financial obligations and help you plan your repayment strategy.

05

Track repayment progress: Monitor your payments and update your loan document accordingly. Keep a record of each payment made, including the date, amount, and any additional fees or charges. This will help you stay on top of your repayment schedule and ensure accuracy in your records.

06

Seek professional advice if needed: If you find the process overwhelming or if you are facing difficulties in repaying your loans, consider consulting a financial advisor or a credit counselor. They can provide guidance on debt management strategies and help you navigate through any challenges.

Who needs all loans received?

01

Individuals with multiple loans: Anyone who has taken out several loans from different lenders will benefit from keeping track of all loans received. This helps in managing repayment schedules, avoiding missed payments, and understanding the overall financial picture.

02

Small business owners: Small businesses often rely on loans to fund their operations. In order to stay organized and effectively manage their financial obligations, business owners need to keep track of all loans received. This allows them to plan their budgets, assess their cash flow, and meet their repayment obligations on time.

03

Financial institutions and lenders: Banks, credit unions, and other financial institutions that lend money to individuals or businesses also need to keep a record of all loans received. Maintaining accurate loan records helps them in assessing the creditworthiness of borrowers, monitoring repayment schedules, and evaluating the overall portfolio risk.

In conclusion, filling out all loans received requires careful organization, thorough understanding of loan agreements, and consistent tracking of payments. It is an important task for individuals with multiple loans, small business owners, and financial institutions to effectively manage their debts and maintain accurate records.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is all loans received?

All loans received refers to any financial assistance received in the form of loans.

Who is required to file all loans received?

Individuals or entities who have received loans are required to file all loans received.

How to fill out all loans received?

All loans received can be filled out by providing detailed information about the loans received, including the amount, terms, and purpose.

What is the purpose of all loans received?

The purpose of all loans received is to accurately report and document all financial assistance received in the form of loans.

What information must be reported on all loans received?

Information such as the amount of the loan, lender's information, terms of the loan, and any other relevant details must be reported on all loans received.

How can I modify all loans received without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your all loans received into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I edit all loans received on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing all loans received right away.

How do I edit all loans received on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign all loans received on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your all loans received online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

All Loans Received is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.