Get the free 403b TAX SHELTERED ANNUITY PROGRAM

Show details

EMAIL 2015 403(b) TAX SHELTERED ANNUITY PROGRAM Agreement for Salary Reduction by and between (Participant) and (Employer) CAL POLY POMONA FOUNDATION, INC. New Change Cancel, effective date The Employer

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 403b tax sheltered annuity

Edit your 403b tax sheltered annuity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 403b tax sheltered annuity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 403b tax sheltered annuity online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 403b tax sheltered annuity. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 403b tax sheltered annuity

How to fill out 403b tax sheltered annuity:

01

Start by obtaining the necessary documents: To fill out a 403b tax sheltered annuity, you will need to gather the required paperwork. This typically includes the annuity provider's application form, beneficiary designation form, and any other relevant documents.

02

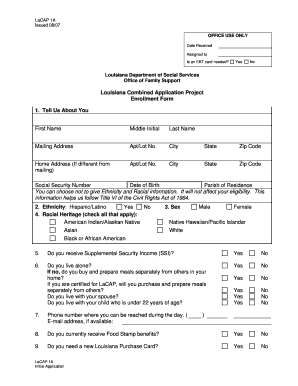

Provide personal information: Begin by filling out your personal information accurately and completely. This includes your full name, address, date of birth, Social Security number, and contact details. Make sure to double-check the information for any errors before submitting the form.

03

Determine contribution amount: Decide on the amount of money you want to contribute to your 403b tax sheltered annuity. This may be a percentage of your salary or a fixed dollar amount. Take into consideration any limits set by the IRS for annual contributions.

04

Choose investment options: Select the investment options that align with your financial goals and risk tolerance. This could involve investing in mutual funds, annuities, or other investment vehicles offered by the annuity provider. Consider seeking professional advice if you are unsure about the best investment choices for your situation.

05

Review and designate beneficiaries: Ensure that you review and designate your beneficiaries correctly. It is important to clearly specify who will receive the benefits in the event of your death. Consult with an attorney or financial advisor if you have complex beneficiary arrangements.

06

Understand the terms and conditions: Carefully read and understand the terms and conditions of the 403b tax sheltered annuity. Pay close attention to details like fees, surrender charges, withdrawal restrictions, and any potential penalties for early withdrawals. Seek clarification from the annuity provider if anything is unclear.

07

Submit the completed forms: Once you have accurately filled out all the necessary forms and reviewed them, submit them to the annuity provider. Ensure that you keep copies of all documents for your records.

Who needs 403b tax sheltered annuity:

01

Employees of certain tax-exempt organizations: A 403b tax sheltered annuity is primarily available to employees of specific organizations, generally including public schools, universities, colleges, hospitals, churches, and other nonprofit organizations recognized by the IRS.

02

Individuals seeking tax advantages for retirement savings: The 403b tax sheltered annuity offers tax benefits to individuals looking to save for retirement. Contributions made to a 403b plan are typically tax-deferred, meaning they are deducted from your taxable income in the year they are made, potentially lowering your current tax burden.

03

Those wanting to supplement their retirement income: A 403b annuity can provide an additional source of retirement income by allowing individuals to contribute a portion of their salary to the plan throughout their working years. The accumulated funds can then be used to supplement other retirement savings, such as Social Security or pensions.

Remember, it is always recommended to consult with a financial advisor or tax professional for personalized advice regarding your specific financial situation and retirement goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 403b tax sheltered annuity?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the 403b tax sheltered annuity in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I complete 403b tax sheltered annuity online?

Easy online 403b tax sheltered annuity completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit 403b tax sheltered annuity on an Android device?

You can edit, sign, and distribute 403b tax sheltered annuity on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is 403b tax sheltered annuity?

A 403b tax-sheltered annuity is a retirement savings plan offered to employees of certain non-profit organizations, public schools, and churches.

Who is required to file 403b tax sheltered annuity?

Employees of eligible organizations who wish to contribute to a tax-sheltered retirement account are required to file a 403b tax-sheltered annuity.

How to fill out 403b tax sheltered annuity?

Employees can typically fill out a 403b tax-sheltered annuity enrollment form provided by their employer or financial institution.

What is the purpose of 403b tax sheltered annuity?

The purpose of a 403b tax-sheltered annuity is to provide a tax-advantaged way for employees of certain organizations to save for retirement.

What information must be reported on 403b tax sheltered annuity?

Information such as employee contributions, employer contributions, investment choices, and beneficiary designations must be reported on a 403b tax-sheltered annuity.

Fill out your 403b tax sheltered annuity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

403b Tax Sheltered Annuity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.