Get the free Revolving Loan Fund Application

Show details

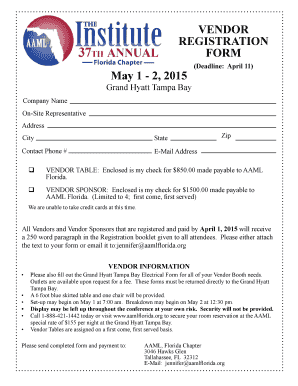

This document serves as an application for businesses seeking assistance from the City of McHenry's Revolving Loan Fund, including sections for business information, project descriptions, job impact,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign revolving loan fund application

Edit your revolving loan fund application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your revolving loan fund application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing revolving loan fund application online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit revolving loan fund application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out revolving loan fund application

How to fill out Revolving Loan Fund Application

01

Gather necessary documentation: financial statements, business plan, tax returns.

02

Download or request the Revolving Loan Fund Application form from the appropriate agency.

03

Fill in your personal and business information accurately.

04

Describe the purpose of the loan and how the funds will be used.

05

Provide detailed financial projections and repayment plan.

06

Compile required attachments, such as resumes, business licenses, and any relevant contracts.

07

Review the application for completeness and accuracy.

08

Submit the application by the specified deadline via the chosen submission method (online, mail, in-person).

Who needs Revolving Loan Fund Application?

01

Small business owners seeking capital for growth or operations.

02

Startups looking for funding to launch their business.

03

Nonprofit organizations that require financial support for projects.

04

Individuals seeking to invest in community development or improvement projects.

Fill

form

: Try Risk Free

People Also Ask about

What does RLF stand for?

RLF stands for “Radio Link Failure” in LTE, which occurs when the radio link between the user equipment (UE) and the eNodeB (base station) is lost. This can happen due to various reasons such as interference, coverage issues, handover failures, or equipment malfunction.

What is RLF in medical terms?

Retrolental fibroplasia (RLF) remains as a leading cause of visual impairment in infants. The pathophysiology of RLF is discussed as well as the significant risk factors.

What is RLF indication in LTE?

Revolving loan funds (RLFs) use a source of capital, typically offered by a local or state government, to make direct loans to borrowers for clean energy projects. Proceeds from loan repayments flow back into the fund and become available to lend again.

What is revolving fund in English?

A revolving fund is a fund or account that remains available to finance an organization's continuing operations without any fiscal year limitation, because the organization replenishes the fund by repaying money used from the account. Revolving funds have been used to support both government and non-profit operations.

What is RLF?

A revolving loan or line facility allows a business to borrow money as needed for funding working capital needs and continuing operations. A revolving line is especially helpful during times of revenue fluctuations, since bills and unexpected expenses can be paid by drawing from the loan.

What is a revolving loan fund?

Revolving loan funds (RLFs) use a source of capital, typically offered by a local or state government, to make direct loans to borrowers for clean energy projects. Proceeds from loan repayments flow back into the fund and become available to lend again.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Revolving Loan Fund Application?

A Revolving Loan Fund Application is a formal request to access a financial resource that provides loans to eligible borrowers, which can then be paid back and loaned out again, creating a continuous cycle of funding.

Who is required to file Revolving Loan Fund Application?

Entities such as businesses, non-profits, or local governments seeking financial assistance through a revolving loan fund are typically required to file this application.

How to fill out Revolving Loan Fund Application?

To fill out the application, provide accurate details about the organization, the purpose of the loan, financial statements, and project plans. Attach any required documents and ensure all information is complete before submission.

What is the purpose of Revolving Loan Fund Application?

The purpose of the application is to obtain funding for projects or activities that promote economic development, support community services, or assist in business growth, ensuring sustainable financial support.

What information must be reported on Revolving Loan Fund Application?

The application must report information such as applicant details, loan amount requested, purpose of the loan, financial projections, current financial status, and any collateral offered.

Fill out your revolving loan fund application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Revolving Loan Fund Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.