Get the free Audit report under section 12A(b) of the Incometax Act, 1961, in the case of charita...

Show details

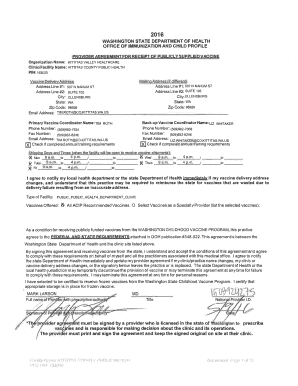

FORM NO. 10B See rule 17B Audit report under section 12A(b) of the Income tax Act, 1961, in the case of charitable or religious trusts or institutions I have examined the balance sheet of Center FOR

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign audit report under section

Edit your audit report under section form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your audit report under section form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit audit report under section online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit audit report under section. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out audit report under section

How to fill out an audit report under section:

01

Start by carefully reviewing the relevant section that pertains to the audit report. This will provide guidance on what information needs to be included and what format should be followed.

02

Gather all necessary supporting documents and evidence to support the findings and conclusions mentioned in the report. This may include financial statements, invoices, receipts, and other relevant records.

03

Clearly state the purpose and scope of the audit report. This should explain why the audit was conducted, what areas were examined, and any limitations or restrictions that may have impacted the audit process.

04

Present the findings of the audit in a logical and organized manner. Use headings, subheadings, and bullet points where appropriate to enhance readability and comprehension.

05

Include a summary of the audit findings, highlighting any significant issues or observations. This can be done in a separate section or as an executive summary at the beginning of the report.

06

Provide detailed explanations and analysis for each finding, including the impact it may have on the auditee and any recommendations for improvement or corrective actions.

07

Use clear and concise language, avoiding technical jargon or ambiguous terms. It is important to communicate the findings and conclusions in a way that is easily understood by the intended audience.

08

Proofread and edit the report for grammar, spelling, and formatting errors. A well-presented and error-free audit report will enhance its credibility and professionalism.

Who needs an audit report under section?

01

Organizations that are required by law or regulation to undergo audits, such as publicly traded companies, government agencies, and certain non-profit organizations.

02

Businesses that want to demonstrate their financial stability and compliance with industry standards to potential investors, lenders, or partners.

03

Internal stakeholders within an organization, such as executives, board members, and shareholders, who need accurate and reliable information to make informed decisions and ensure accountability.

In summary, filling out an audit report under section requires a thorough understanding of the auditing process, careful review of relevant guidelines, and the ability to effectively communicate findings and recommendations. This report is typically necessary for organizations subject to legal or regulatory requirements, as well as those seeking to demonstrate financial stability and compliance to internal and external stakeholders.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is audit report under section?

Audit report under section is a document that includes detailed information about the financial statements of a company and the audit conducted by an independent auditor.

Who is required to file audit report under section?

Companies that fall under the specified criteria laid out in the applicable laws and regulations are required to file audit reports under section.

How to fill out audit report under section?

Audit reports under section are usually filled out by the company's auditor, who reviews the financial statements and provides an opinion on their accuracy and compliance with accounting standards.

What is the purpose of audit report under section?

The purpose of audit report under section is to provide assurance to shareholders, investors, and regulators that the company's financial statements are reliable and free from material misstatements.

What information must be reported on audit report under section?

Audit reports under section must include the auditor's opinion on the financial statements, any significant findings during the audit process, and any recommendations for improvement.

How can I edit audit report under section from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your audit report under section into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an electronic signature for the audit report under section in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your audit report under section in seconds.

How can I edit audit report under section on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing audit report under section right away.

Fill out your audit report under section online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Audit Report Under Section is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.