Get the free Local Debt Recovery Program Memorandum - urbanaillinois

Show details

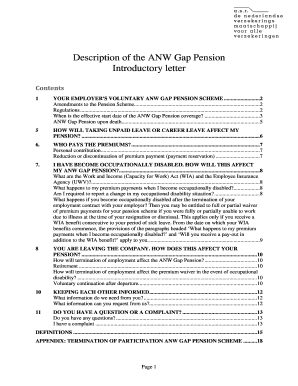

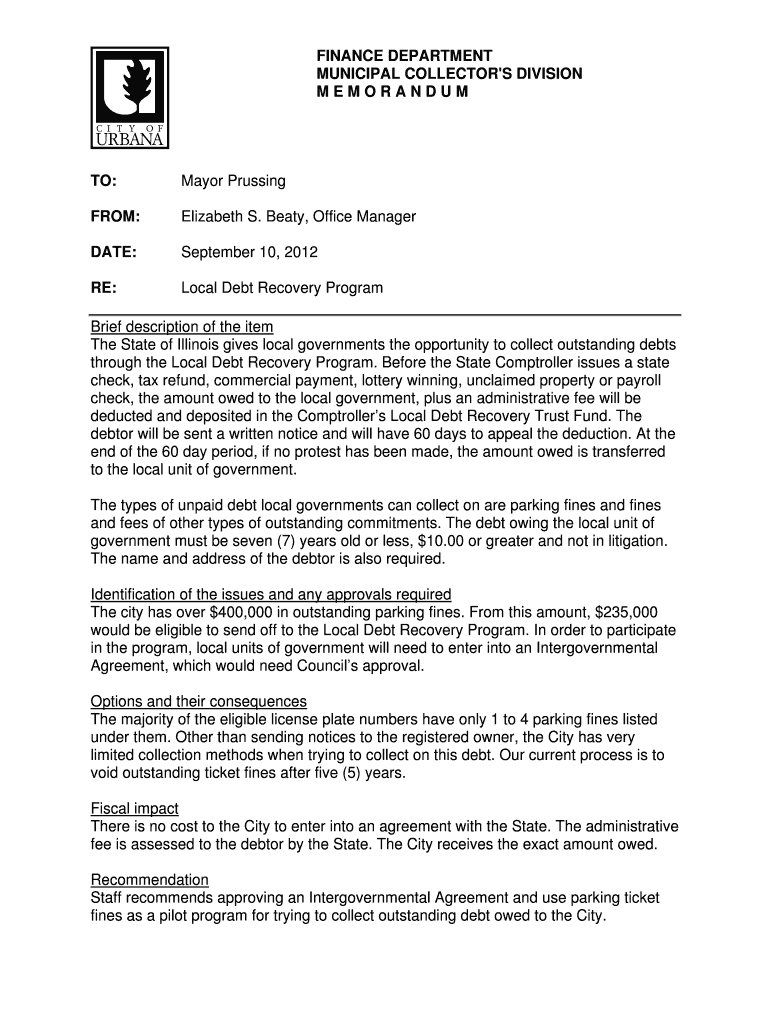

A memorandum regarding the Local Debt Recovery Program in Illinois that outlines procedures for local governments to collect outstanding debts through the program.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign local debt recovery program

Edit your local debt recovery program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your local debt recovery program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing local debt recovery program online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit local debt recovery program. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out local debt recovery program

How to fill out Local Debt Recovery Program Memorandum

01

Obtain the Local Debt Recovery Program Memorandum form from the appropriate agency.

02

Fill out the top section with your name, contact information, and the date.

03

Provide a detailed description of the debt being recovered, including the amount owed and the debtor's information.

04

Attach any necessary documentation that supports your claim, such as invoices or agreements.

05

Review the completed memorandum for accuracy and completeness.

06

Sign and date the memorandum at the designated area.

07

Submit the memorandum to the local agency managing the debt recovery program as per their submission guidelines.

Who needs Local Debt Recovery Program Memorandum?

01

Individuals or businesses seeking to recover outstanding debts owed to them.

02

Creditors looking for formal assistance in managing and processing debt recovery.

03

Entities involved in debt recovery operations under local regulations.

Fill

form

: Try Risk Free

People Also Ask about

What happens if you never pay your debt back?

If you have not paid your debt after multiple notices, a creditor or debt collector may file a lawsuit against you. This is one of the most severe actions they can take and typically involves a formal complaint filed in a court of law.

What is the local debt recovery program in Illinois?

LDRP offers local governments, at no charge, a unique opportunity to utilize the Illinois Office of Comptroller (IOC) to help collect unpaid debts such as parking tickets, ordinance violations, traffic fines, court fines, administrative judgements, utility bills, community college tuition and fees that otherwise might

Can you ignore debt recovery?

If you don't, your creditor might take more action to get the money back. For example, they might ask the court to send bailiffs to your home or take money from your wages. After the judgment, your creditor might ask the court to secure the debt against your home - this is called a 'charging order'.

What is a debt recovery letter?

The letter is usually sent for the creditor by a debt recovery agency. A debt collection letter acts as a formal notice to the person in debt that they have a legal obligation to clear the debt in full.

Is debt recovery the same as debt collection?

Collection refers to the process of a business attempting to collect on debts owed by its customers. In contrast, recovery refers to the process of a third-party attempting to collect money owed to another creditor or business.

What happens if you ignore debt recovery?

They could file a judgment against you and if you don't show up in court they can get a default judgment that can allow them to start garnishing your wages or place a lien on your house. They eventually give up and sell your debt to another debt collector who will start all over again trying to collect the debt.

What's the worst a debt collector can do?

DEBT COLLECTORS CANNOT: contact you at unreasonable places or times (such as before 8:00 AM or after 9:00 PM local time); use or threaten to use violence or criminal means to harm you, your reputation or your property; use obscene or profane language;

What happens if I just ignore debt collectors?

Here are some of the biggest consequences of ignoring debt collectors: - Your credit score will fall, which makes it harder to get new credit and sometimes even employment or housing - Debt collectors may get more aggressive in trying to contact you or your friends or family (though they're limited in what they can say

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Local Debt Recovery Program Memorandum?

The Local Debt Recovery Program Memorandum is a document used by local governments to outline procedures for the collection of debts owed to them, ensuring that there is a structured approach to recovering outstanding amounts.

Who is required to file Local Debt Recovery Program Memorandum?

Local governments and municipalities that engage in debt collection activities are required to file a Local Debt Recovery Program Memorandum to formalize their processes and compliance.

How to fill out Local Debt Recovery Program Memorandum?

To fill out the Local Debt Recovery Program Memorandum, one must enter pertinent information such as the local entity's details, types of debts being collected, the processes in place, and any legal frameworks or regulations that govern these activities.

What is the purpose of Local Debt Recovery Program Memorandum?

The purpose of the Local Debt Recovery Program Memorandum is to establish clear guidelines for collecting debts, ensuring transparency and accountability in the collection process, while also protecting the rights of debtors.

What information must be reported on Local Debt Recovery Program Memorandum?

The memorandum must report information such as the types of debts included, methods of collection, timelines for collection efforts, compliance with applicable laws, and details about any partnerships with collection agencies.

Fill out your local debt recovery program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Local Debt Recovery Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.