Get the free 2015 Bankruptcy c ollections Seminars

Show details

CREDIT UNION LEAGUE

2015 Bankruptcy & Collections

Seminars

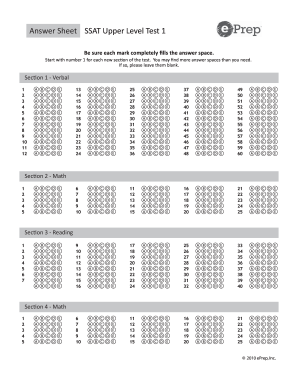

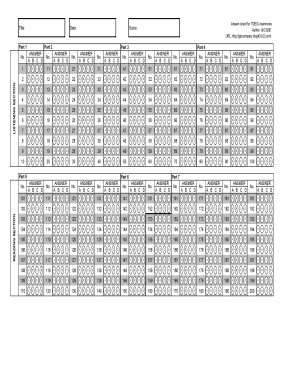

Schedule for

Bankruptcy

Seminars*

8 8:30 a.m.

Registration &

Continental Breakfast

8:30 11:30 a.m.

Session

11:30 a.m. 12:30 p.m.

Networking

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2015 bankruptcy c ollections

Edit your 2015 bankruptcy c ollections form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2015 bankruptcy c ollections form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2015 bankruptcy c ollections online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2015 bankruptcy c ollections. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2015 bankruptcy c ollections

How to fill out 2015 bankruptcy collections:

01

Gather all necessary documentation: Before starting the process, collect all relevant financial documents, such as income statements, bank statements, tax returns, and a list of all your debts and creditors.

02

Determine your eligibility: Consult with a legal professional or bankruptcy attorney to determine if you qualify for bankruptcy under the 2015 bankruptcy laws. They will assess your financial situation and guide you through the process.

03

Choose the appropriate bankruptcy chapter: There are different chapters of bankruptcy, such as Chapter 7 and Chapter 13. Each chapter has specific eligibility criteria and implications. Your attorney will help you decide which chapter is best suited for your situation.

04

Complete the necessary forms: Fill out the required bankruptcy forms accurately and thoroughly. These forms include a petition, schedules, statements of financial affairs, and a means test, among others. Make sure to provide all the requested information.

05

File the bankruptcy forms: After completing the forms, file them with the bankruptcy court in your jurisdiction. Pay attention to the filing deadlines and any associated fees. Providing the necessary filing fee is crucial to initiate your case.

06

Attend the meeting of creditors: After filing, you'll be required to attend a meeting of creditors, also known as a 341 meeting. During this meeting, creditors will have the opportunity to ask questions about your financial situation and bankruptcy claims.

07

Comply with any additional requirements: Depending on your specific circumstances, the bankruptcy court may require additional documentation or steps to fulfill. Be sure to comply with any such requests in a timely manner to avoid any delays in the process.

Who needs 2015 bankruptcy collections:

01

Individuals facing overwhelming debt: If you are struggling with unmanageable debt and have exhausted all other options, bankruptcy may be a viable solution to help you gain a fresh start financially.

02

Businesses in financial distress: Small businesses or corporations that are no longer able to meet their financial obligations may need to consider bankruptcy as a means of reorganizing or liquidating their assets.

03

Those seeking legal protection: Filing for bankruptcy can provide individuals or businesses with legal protection against creditor harassment, wage garnishments, foreclosures, and other adverse actions.

Note: It is important to consult with a legal professional or bankruptcy attorney to understand the specific requirements and implications of filing for bankruptcy under the 2015 bankruptcy laws in your jurisdiction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the 2015 bankruptcy c ollections electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I create an eSignature for the 2015 bankruptcy c ollections in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your 2015 bankruptcy c ollections and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How can I fill out 2015 bankruptcy c ollections on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your 2015 bankruptcy c ollections. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is bankruptcy collections seminars?

Bankruptcy collections seminars are educational sessions designed to provide guidance and information on how to navigate bankruptcy proceedings related to debt collection.

Who is required to file bankruptcy collections seminars?

Individuals or businesses going through bankruptcy proceedings and dealing with debt collection are required to file bankruptcy collections seminars.

How to fill out bankruptcy collections seminars?

To fill out bankruptcy collections seminars, individuals or businesses must provide detailed information about their debt collection situation, assets, income, and expenses.

What is the purpose of bankruptcy collections seminars?

The purpose of bankruptcy collections seminars is to ensure that individuals or businesses going through bankruptcy proceedings understand their rights, responsibilities, and options when it comes to debt collection.

What information must be reported on bankruptcy collections seminars?

Information such as details of creditors, outstanding debts, assets, income, and expenses must be reported on bankruptcy collections seminars.

Fill out your 2015 bankruptcy c ollections online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2015 Bankruptcy C Ollections is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.