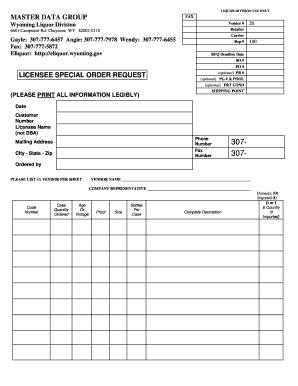

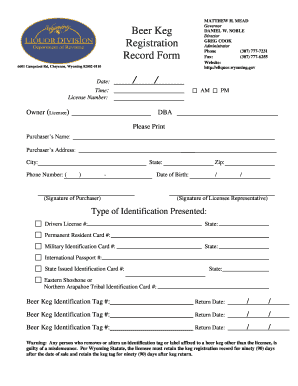

Get the free sample lease vs buy analysis form

Show details

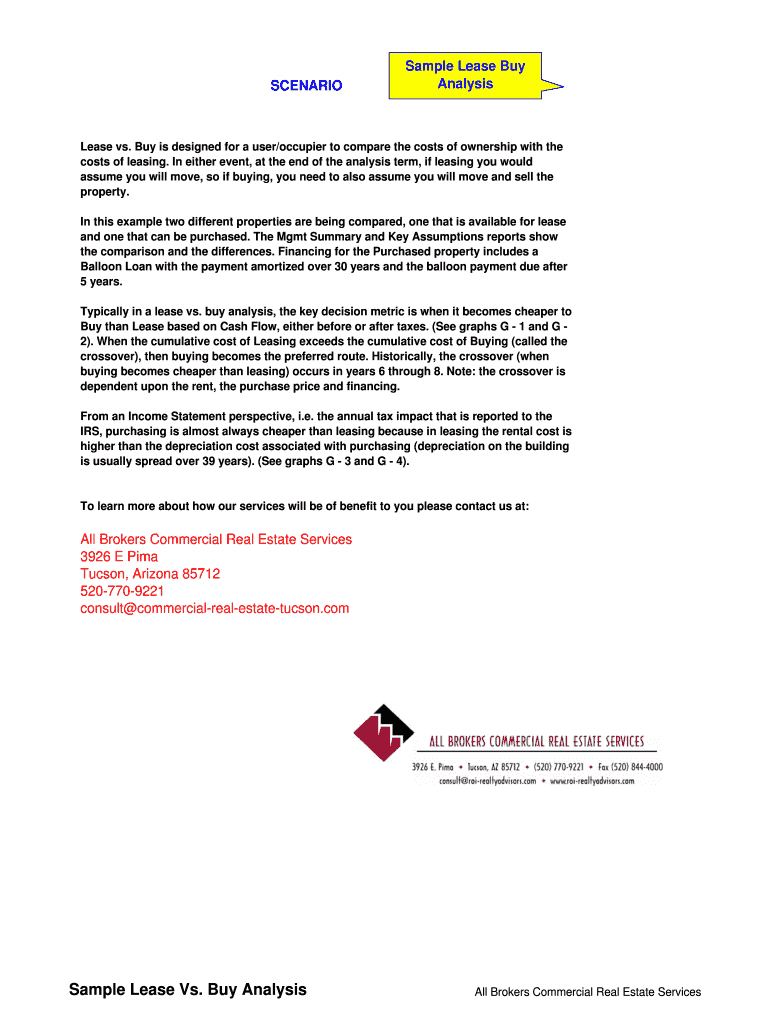

SCENARIO Sample Lease Buy Analysis Lease vs. Buy is designed for a user/occupier to compare the costs of ownership with the costs of leasing. In either event at the end of the analysis term if leasing you would assume you will move so if buying you need to also assume you will move and sell the property. In this example two different properties are being compared one that is available for lease and one that can be purchased. The Mgmt Summary and ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sample lease vs buy

Edit your sample lease vs buy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sample lease vs buy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sample lease vs buy online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sample lease vs buy. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sample lease vs buy

How to fill out sample lease vs buy:

01

Start by gathering all the necessary information about the item you are considering leasing or buying. This includes the purchase price, lease terms, and any additional costs associated with each option.

02

Carefully evaluate your financial situation and determine your budget. Consider your current income, expenses, and any future financial goals.

03

Analyze the advantages and disadvantages of both leasing and buying. Consider factors such as long-term costs, maintenance responsibilities, and the length of time you plan to use the item.

04

Use the sample lease vs buy form as a template to compare the specific details of each option. Fill in the required fields with the relevant information based on your research and calculations.

05

Review the completed form and double-check all the details to ensure accuracy. Make any necessary adjustments or clarifications before making a final decision.

Who needs sample lease vs buy:

01

Individuals or businesses who are considering acquiring a major asset, such as a car or equipment, and are unsure whether leasing or buying is the better option for their specific needs.

02

Financial advisors or consultants who assist clients in making informed decisions about leasing vs buying, and could use a sample form to guide their analysis and discussions.

03

Researchers or analysts studying consumer behavior or market trends related to the leasing vs buying decision-making process.

Please note that the specific needs and circumstances of individuals may vary, and it is advisable to seek personalized financial advice before making any major purchase or lease decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete sample lease vs buy online?

Easy online sample lease vs buy completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I sign the sample lease vs buy electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your sample lease vs buy in minutes.

How do I complete sample lease vs buy on an Android device?

Use the pdfFiller app for Android to finish your sample lease vs buy. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is sample lease vs buy?

A sample lease vs buy is a financial analysis tool used to compare the costs and benefits of leasing an asset versus purchasing it outright.

Who is required to file sample lease vs buy?

Typically, businesses or individuals considering a significant asset acquisition, such as equipment or real estate, may be required to file a lease vs buy analysis to evaluate their financial options.

How to fill out sample lease vs buy?

To fill out a sample lease vs buy, gather cost details related to both leasing and purchasing the asset, including monthly payments, down payments, maintenance costs, and tax implications, and use this information to calculate total costs over the relevant period.

What is the purpose of sample lease vs buy?

The purpose of a sample lease vs buy is to aid decision-makers in understanding the financial implications of leasing versus buying an asset, allowing them to make an informed choice based on cost-effectiveness.

What information must be reported on sample lease vs buy?

The information typically reported on a sample lease vs buy includes total costs of leasing, total costs of purchasing, maintenance expenses, tax benefits, and the asset's expected lifespan or value at the end of the period.

Fill out your sample lease vs buy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sample Lease Vs Buy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.