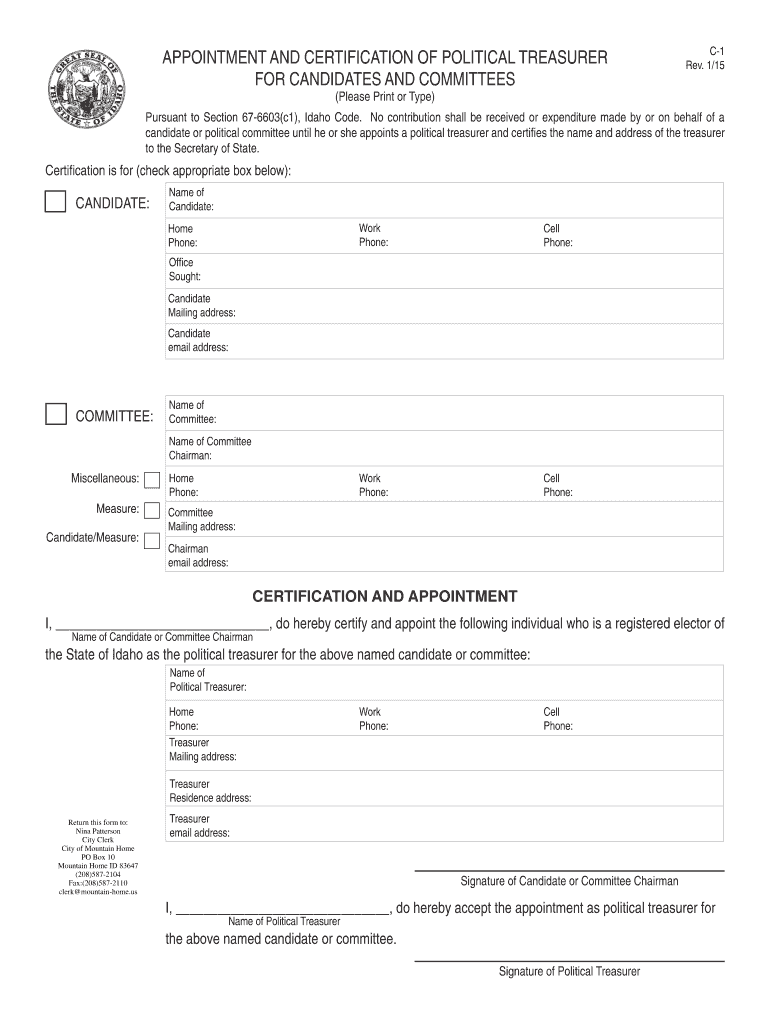

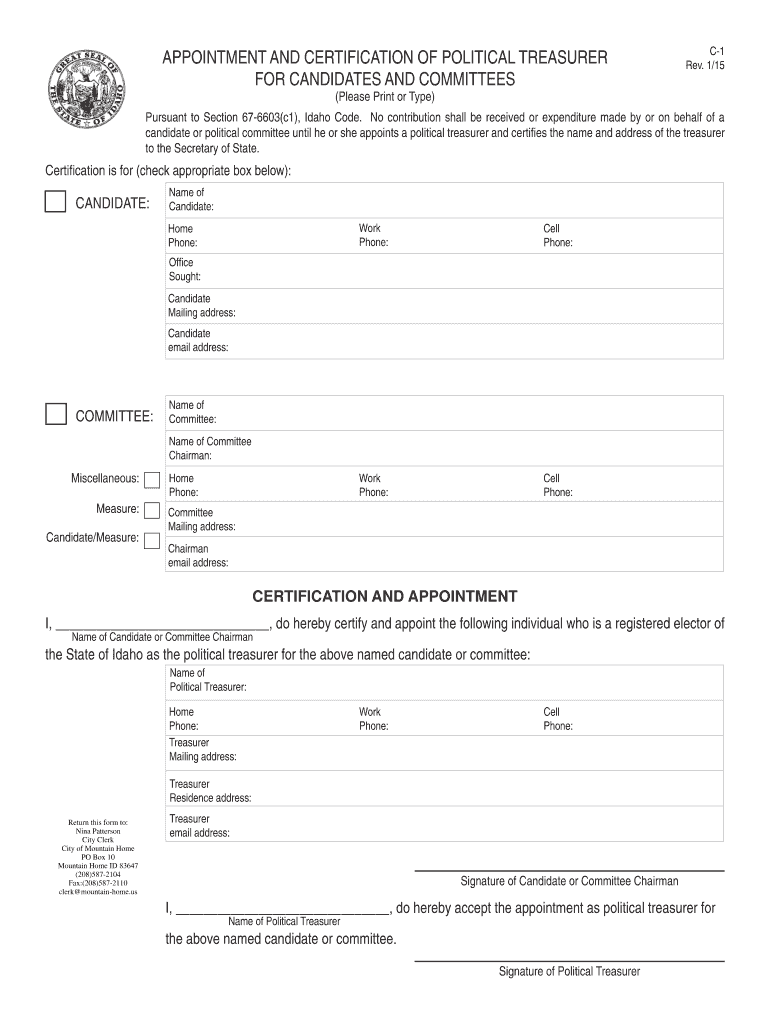

Get the free No contribution shall be received or expenditure made by or on behalf of a candidate...

Show details

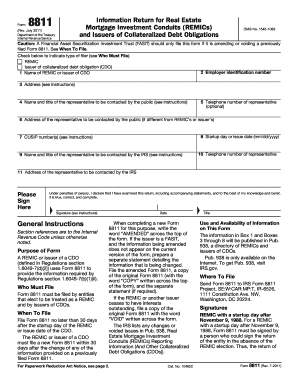

Home. Phone: Work. Phone: Cell. Phone: Office. Sought: District. Number: Party: Candidate ... Treasurer email address: COMMITTEE: Name of. Committee: Home. Phone: Work. Phone: Cell ... Fax:(208)587-2110

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign no contribution shall be

Edit your no contribution shall be form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your no contribution shall be form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing no contribution shall be online

To use our professional PDF editor, follow these steps:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit no contribution shall be. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out no contribution shall be

01

Understand the purpose: Before filling out the "No contribution shall be" form, it is important to understand the purpose behind it. This form is typically used in legal or contractual situations where individuals or organizations are unable or not required to contribute anything.

02

Obtain the form: The "No contribution shall be" form can usually be obtained from the relevant authority or institution that requires it. This could be a government office, a legal professional, or an organization overseeing the specific agreement.

03

Read the instructions: Carefully read through the form's instructions. Understanding what information is required and any specific guidelines will help ensure accurate completion.

04

Fill in the personal information: Start by providing your personal information, such as your full name, address, phone number, and any other identifying details requested. Make sure to double-check for any errors or omissions before moving on.

05

Indicate the purpose or agreement: Clearly state the purpose or agreement where the "No contribution shall be" clause is applicable. This can vary depending on the context, such as a partnership agreement, a contract, or a legal document.

06

Explain the reason for no contribution: In the designated section, explain in detail why there should be no contribution required. This could be due to financial limitations, specific terms outlined in the agreement, or any other valid reasons.

07

Provide supporting documentation (if required): Depending on the situation, supporting documentation may be necessary to substantiate the reason for no contribution. This could include financial statements, legal documents, or any other relevant evidence. Ensure that all supporting documents are included and properly referenced.

08

Review and proofread: Once you have completed filling out the form, review it carefully to check for any errors, inconsistencies, or missing information. Make sure all sections are answered appropriately and that the form accurately conveys your intentions or circumstances.

Who needs no contribution shall be?

01

Individuals unable to contribute financially: Some individuals may be facing financial constraints or hardships that prevent them from making any contributions. This could include people experiencing unemployment, extreme poverty, or other financial difficulties.

02

Non-profit organizations relying on donations: Non-profit organizations or charities that heavily rely on donations may also require a "No contribution shall be" option. This allows them to receive support through other means, such as sponsorships, partnerships, or grants, rather than direct financial contributions.

03

Specific contractual agreements: In certain contractual agreements, there may be clauses or situations where no contribution is required. This could be due to predetermined terms, special conditions, or specific arrangements between parties involved.

Remember, the specific individuals or entities that need the "No contribution shall be" option will vary depending on the situation, agreement, or context in which it is being used. It is important to assess the specific circumstances and requirements of the given situation before determining who needs to fill out this form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in no contribution shall be?

With pdfFiller, it's easy to make changes. Open your no contribution shall be in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I sign the no contribution shall be electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your no contribution shall be in seconds.

How do I complete no contribution shall be on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your no contribution shall be by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is no contribution shall be?

No contribution shall be indicates that no contribution was made during a specific period.

Who is required to file no contribution shall be?

Anyone who did not make any contributions during the specified period is required to file a no contribution shall be.

How to fill out no contribution shall be?

To fill out a no contribution shall be, simply indicate that no contributions were made during the specified period.

What is the purpose of no contribution shall be?

The purpose of a no contribution shall be is to inform the relevant authorities that no contributions were made during the specified period.

What information must be reported on no contribution shall be?

The only information required to be reported on a no contribution shall be is the confirmation that no contributions were made.

Fill out your no contribution shall be online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

No Contribution Shall Be is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.