Get the free of his trust

Show details

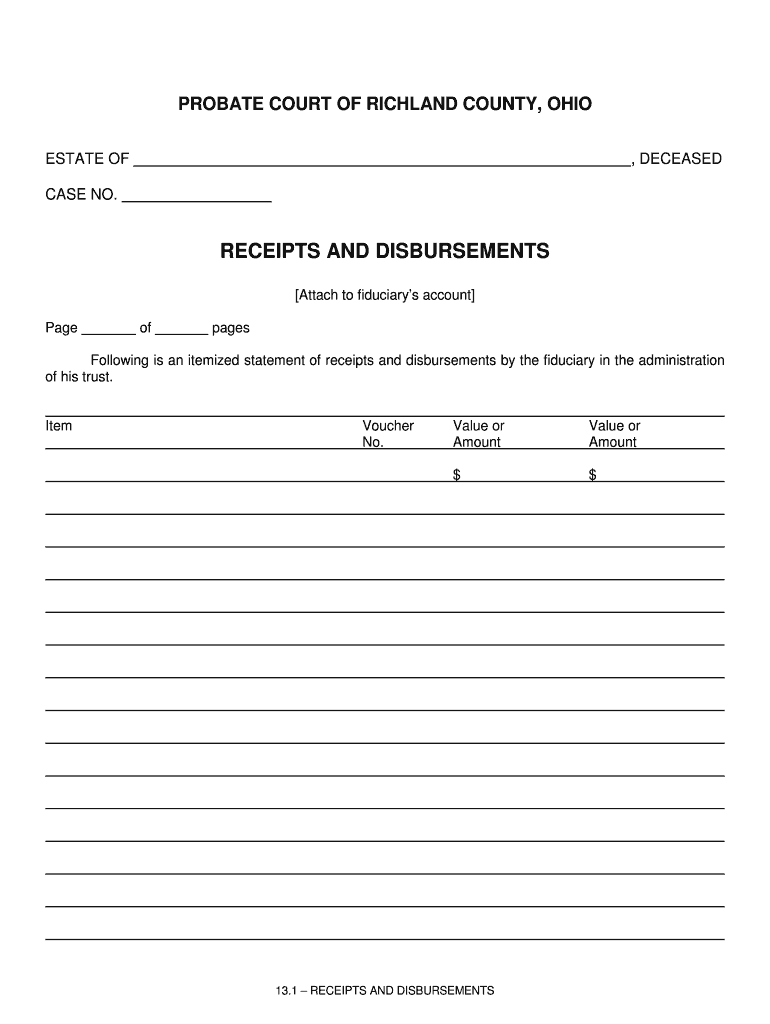

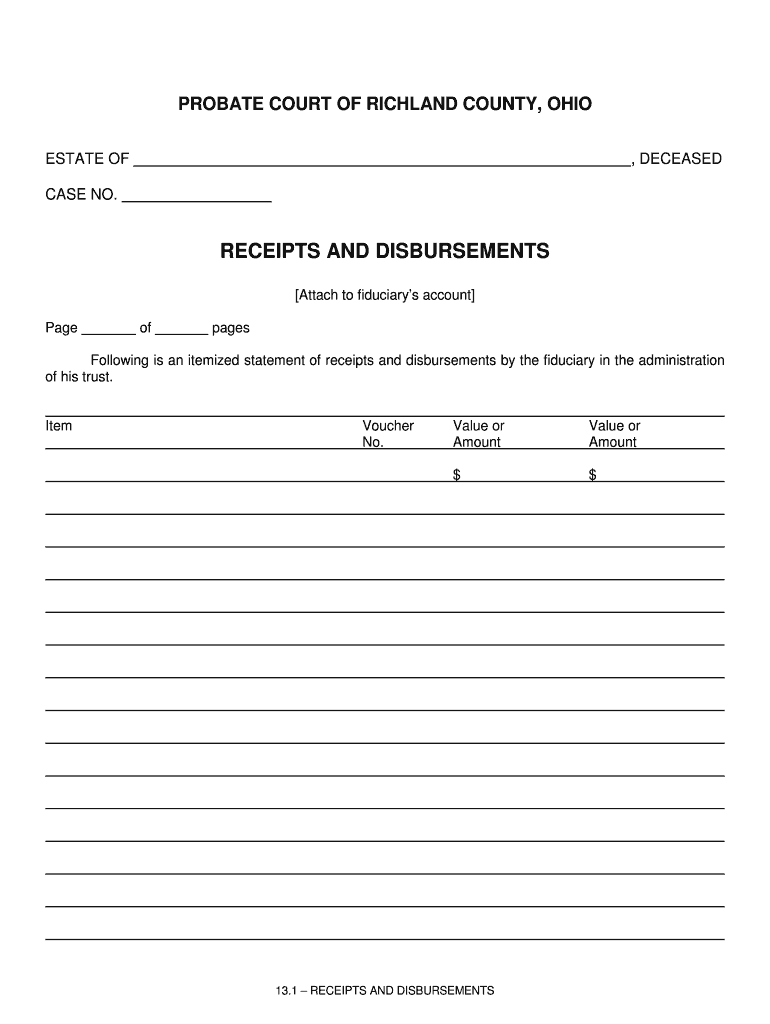

PROBATE COURT OF RICHLAND COUNTY, OHIO, DECEASED ESTATE OF CASE NO. RECEIPTS AND DISBURSEMENTS Attach to fiduciaries account Page of pages Following is an itemized statement of receipts and disbursements

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign of his trust

Edit your of his trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your of his trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing of his trust online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit of his trust. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out of his trust

How to fill out a trust:

01

Understand the purpose of a trust: Familiarize yourself with the concept of a trust and its benefits. A trust is a legal arrangement where a trustee holds and manages assets for the benefit of someone else, known as the beneficiary.

02

Determine the type of trust: There are various types of trusts, such as revocable trusts, irrevocable trusts, living trusts, and testamentary trusts. Consult with an attorney or financial advisor to determine the most suitable type of trust for your specific needs and goals.

03

Gather necessary documents: Collect important documents such as identification, social security numbers, property deeds, bank statements, and any other relevant financial information that will be transferred into the trust.

04

Select a trustee: Choose someone trustworthy and capable of managing the assets in the trust. The trustee can be an individual, a professional trustee, or a financial institution, depending on your preferences.

05

Draft the trust document: Work with an attorney experienced in estate planning to draft a legally binding trust document. Ensure that the document includes all necessary provisions, such as the beneficiaries, assets to be included, instructions for distribution, and any specific wishes or conditions.

06

Fund the trust: Transfer ownership of assets into the trust by changing the titles and registrations accordingly. This may involve updating property deeds, re-registering bank accounts, and assigning beneficiaries to insurance policies.

07

Review and update periodically: Regularly review and update the trust to ensure it aligns with any changes in your personal circumstances, such as new assets, births, deaths, or shifts in financial goals. It is recommended to review the trust document at least every few years.

Who needs a trust:

01

Individuals with substantial assets: Trusts are commonly used by individuals with significant wealth or assets to protect and manage their holdings. It allows for better control, tax planning opportunities, and smooth distribution of assets upon their passing.

02

Parents with minor children: Trusts can be beneficial for parents who want to ensure proper management and distribution of assets for their minor children. It allows them to appoint a trustee who will handle the assets until the children reach a certain age or milestone.

03

Individuals with specific wishes: If you have specific instructions on how you want your assets to be distributed or utilized, a trust can address those wishes more effectively than a standard will. This provides peace of mind that your assets will be managed according to your preferences.

04

Estate planning purposes: Trusts are an essential tool in estate planning, allowing individuals to reduce estate taxes, avoid probate, and maintain privacy. It ensures a smooth transition of assets to beneficiaries and minimizes potential conflicts or disputes.

Note: Consulting with an attorney or financial advisor experienced in trust planning is highly recommended to ensure that the trust is created and managed legally and in accordance with your specific circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit of his trust from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your of his trust into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit of his trust on an iOS device?

Create, edit, and share of his trust from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I fill out of his trust on an Android device?

On an Android device, use the pdfFiller mobile app to finish your of his trust. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is of his trust?

His trust is a legal arrangement where a person (trustor) transfers assets to another person or organization (trustee) to manage and distribute for the benefit of a third party (beneficiary).

Who is required to file of his trust?

The trustee is required to file his trust.

How to fill out of his trust?

His trust can be filled out by providing detailed information about the trust assets, beneficiaries, and distribution instructions.

What is the purpose of of his trust?

The purpose of his trust is to protect and distribute assets according to the wishes of the trustor.

What information must be reported on of his trust?

Information such as trust assets, beneficiaries, trustees, and distribution instructions must be reported on his trust.

Fill out your of his trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Of His Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.