Get the free Q3 Have you previously smoked cigarettes

Show details

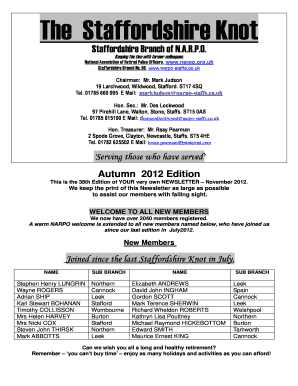

ACT Government Community Consultation on Personal Vaporizers #26 PAGE 2: General Information Q1: Contact details Anonymous Name Address Cityffown State/Province ZIP/Postal Code Country Email Address

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign q3 have you previously

Edit your q3 have you previously form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your q3 have you previously form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing q3 have you previously online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit q3 have you previously. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out q3 have you previously

How to fill out q3 have you previously:

01

Read the question carefully and understand what it is asking. Make sure you fully comprehend the meaning behind "have you previously."

02

Consider your past experiences or actions that are relevant to the question. Reflect on any previous instances or situations that may be applicable to answering this question.

03

Be honest and transparent when answering. If you have previously done something or have prior experience in a particular area, provide a truthful response.

04

If you haven't previously done or experienced what is being asked in q3, simply answer with a "no" or "not applicable".

05

Double-check your answer before submitting to ensure accuracy and clarity.

Who needs q3 have you previously:

01

Individuals applying for a job or internship may be asked this question to assess their prior experience and qualifications.

02

Students applying for scholarships or educational programs may encounter q3 to evaluate their previous academic achievements.

03

Applicants for licenses or certifications might come across this question to verify their prior training or practical experience in a specific field.

04

Researchers or survey participants may be asked q3 to gather information about previous habits, behaviors, or experiences for data analysis purposes.

It is important to note that the specific context and purpose of q3 may vary depending on the situation in which it is being asked.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is q3 have you previously?

q3 refers to the third quarter of a reporting period, commonly used in business and financial contexts.

Who is required to file q3 have you previously?

Companies, organizations, and individuals who are required to report their financial performance or other relevant information for the specified reporting period.

How to fill out q3 have you previously?

Q3 reports can be filled out manually or through software tools that are compatible with the reporting standards. It's important to gather all necessary information and provide accurate data.

What is the purpose of q3 have you previously?

The purpose of filing q3 reports is to provide transparency and accountability regarding the financial performance and activities of the reporting entity during the specified quarter.

What information must be reported on q3 have you previously?

Information such as revenue, expenses, profits, losses, investments, and other financial metrics relevant to the reporting period.

How can I modify q3 have you previously without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your q3 have you previously into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an electronic signature for the q3 have you previously in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your q3 have you previously in minutes.

How do I edit q3 have you previously on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute q3 have you previously from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your q3 have you previously online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

q3 Have You Previously is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.