Get the free voluntary escrow prepayment designation

Get, Create, Make and Sign voluntary escrow prepayment designation

How to edit voluntary escrow prepayment designation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out voluntary escrow prepayment designation

How to fill out voluntary escrow prepayment designation:

Who needs voluntary escrow prepayment designation?

Instructions and Help about voluntary escrow prepayment designation

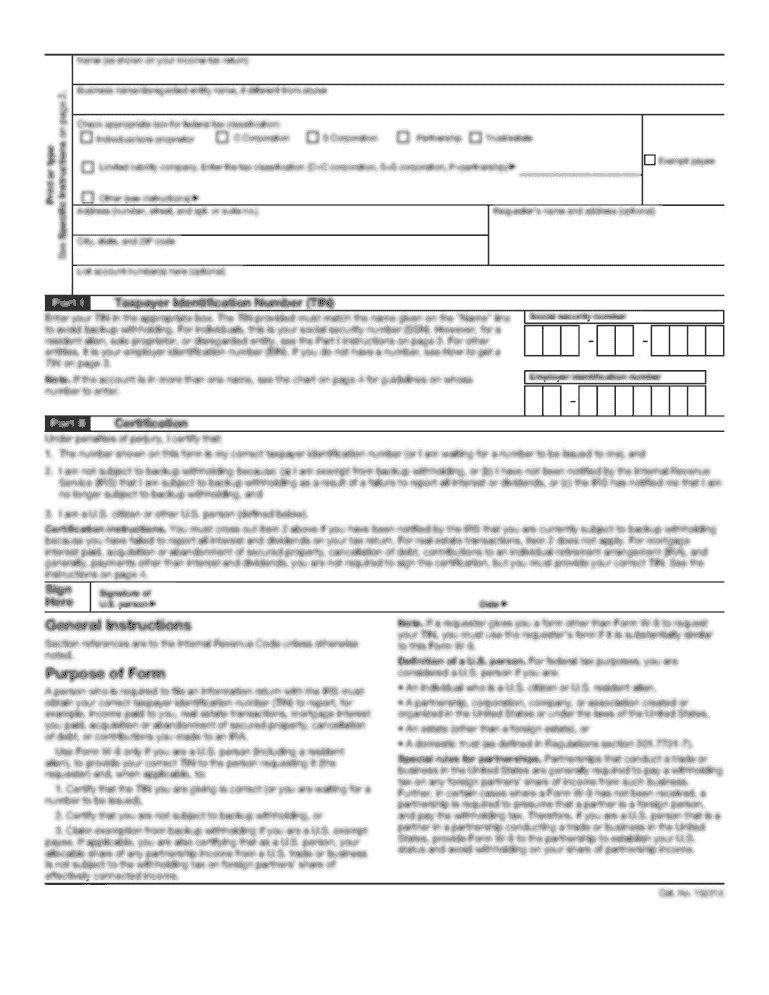

Hello it#39’s Stephanie Johnson at the Johnson theme of service first mortgage, and we are to the most exciting part of your process is getting ready to the closest wanted to take a couple of minutes to go through the closing disclosure with you and kind of how to read it best practices on going through all of this of course any additional questions Weill goes through your individual closing disclosure, but the flow of most these are going to be the same, or I want to make sure that that makes sense firsthand foremost before then so in this situation we#39’ve got just an example hardhat we#39’ve taken the pertinent information off for privacy, but this will be the same for yours with everything filled out the new closing disclosure replaces the hud-1 settlement statement from a couple of years ago so you#39’ve closed a house in the past thesis the new form much easier to read butchered#39’s a couple pieces in here Chandon#39’t make a lot of sense as farms where they flow that we want to make sure that we go through with you top section just like the loan estimatedidn'’t list everything from your closing date your information sellers information our information the product type the know loan in number all of that information on the top then we#39;begot your loan amount your interest rate will be filled out your monthly principal and interest which of courses a fixed loan will never change that your loan does not have a prepayment penalty or a balloon feature next section in the middle you just like your loan estimate broken out into two years if you do have a loan that has mortgage insurance you#39’ll notice that the first column here has the 69 79 and PMI the second column has a zero why that is that#39’s your automatic drop point for PMI of course as we spoke about before if you feel like you#39’re in a situation that you have an eighty percent loan to value before you get to this point do reach out to us that something would be loved to assist you with dropping the mortgage insurance early so that#39’s something that can happen with your request again you have to submit a request through customer service, and we will assist you with that process the next section in the bottom is just going to be what#39’s included and your estimated taxes insurance and assessments so the property taxes insurance or the only ones on this item here if the other is checked generally that#39’s homeowners association dues so if the that is checked the for6646 would be different from what#39’s in escrow because we do not escrow for Hodges in this case their#39’s none, so it is the same the next section here for your closing documentation it#39’s going to have your closing costs as we spoke about on the loan estimate there is that#39’s figure before any credits, so before the seller pays their portion of property taxes before they pay title insurance or anything that they have agreed to pay SOA very high not really true estimated cash to close figure but something...

People Also Ask about

Can you add an escrow account to an existing mortgage?

Should I pay my escrow shortage in full?

Should I add additional escrow or principal?

How do I add an escrow account to my mortgage?

Can you have an escrow account without a mortgage?

Can I pay my escrow in advance?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get voluntary escrow prepayment designation?

How do I edit voluntary escrow prepayment designation in Chrome?

How do I complete voluntary escrow prepayment designation on an Android device?

What is voluntary escrow prepayment designation?

Who is required to file voluntary escrow prepayment designation?

How to fill out voluntary escrow prepayment designation?

What is the purpose of voluntary escrow prepayment designation?

What information must be reported on voluntary escrow prepayment designation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.