Get the free Discretionary trust - Old Mutual Wealth

Show details

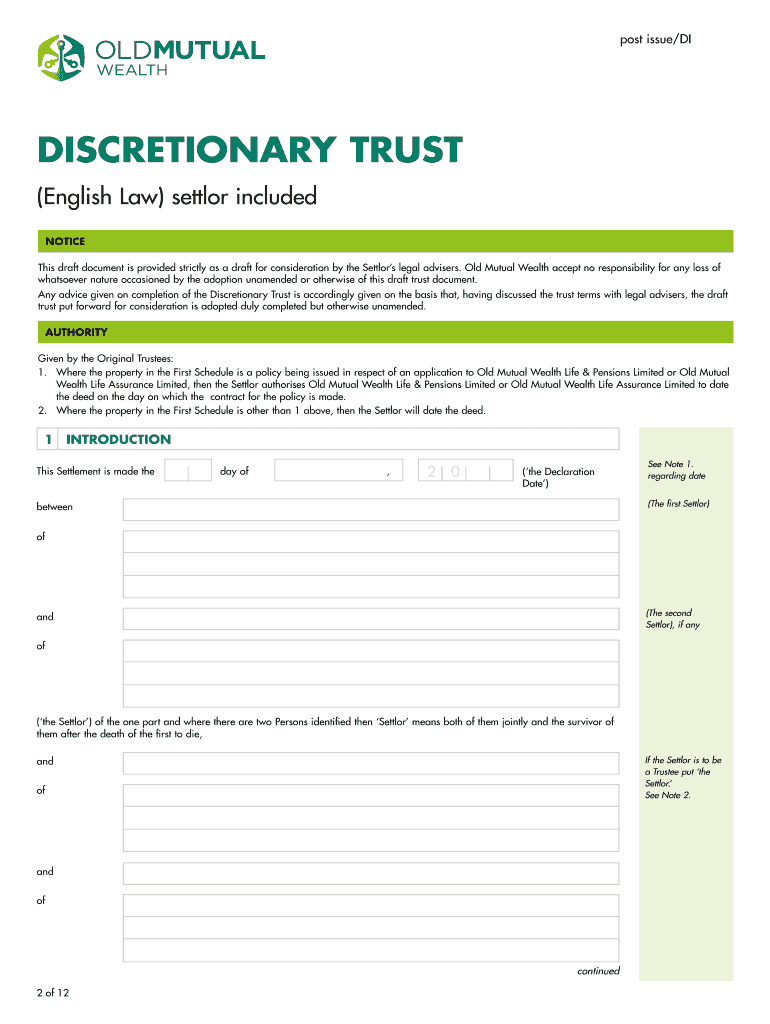

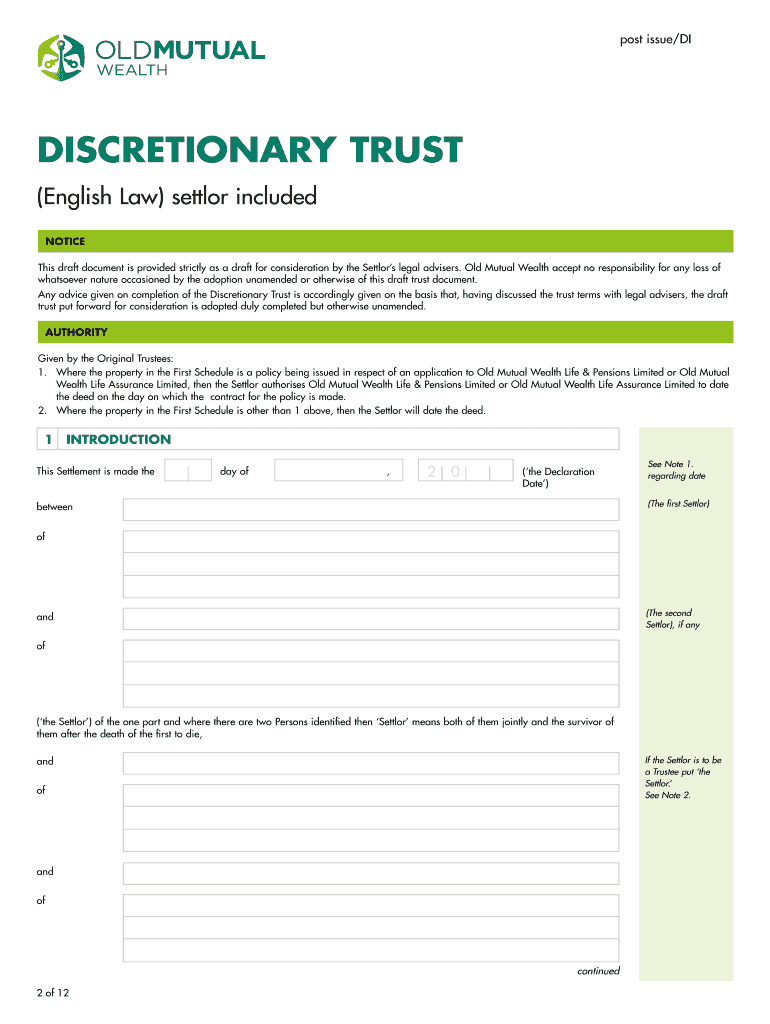

Post issue/D1 discretionary trust (English Law) settler included Notes for completion 1. A Settler Included trust is not suitable for Inheritance Tax mitigation. 2. submitting this document then,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign discretionary trust - old

Edit your discretionary trust - old form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your discretionary trust - old form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing discretionary trust - old online

Follow the steps down below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit discretionary trust - old. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out discretionary trust - old

How to Fill Out Discretionary Trust - Old:

01

Begin by gathering all necessary legal documentation, including the trust agreement, any amendments or supplements, and any related forms or schedules.

02

Review the trust agreement carefully, paying attention to the specific instructions provided for filling out the trust. Take note of any required information, such as the names and contact details of the trustee(s), beneficiaries, and any other relevant parties.

03

Fill out the trust agreement using a pen or typewriter, following the instructions provided. Ensure that all information is accurately and clearly stated.

04

If there are any blanks or spaces in the trust agreement that need to be filled, make sure to use the appropriate information and include it in the designated areas.

05

Double-check all the details and confirm that there are no errors or omissions. Any mistakes in the trust agreement could lead to legal complications in the future.

06

Sign and date the trust agreement in the presence of a notary public or witnesses, as required by the applicable laws in your jurisdiction. Make sure to follow all legal formalities to ensure the validity of the document.

07

Once the trust agreement is properly filled out, make copies for all relevant parties, including the trustee(s), beneficiaries, and your own records. Keep the original document in a safe and secure location.

08

Consider seeking legal advice or assistance from a qualified attorney or estate planning professional if you have any concerns or questions throughout the process of filling out the discretionary trust.

Who Needs Discretionary Trust - Old:

01

Individuals with significant assets or wealth who wish to provide for the long-term financial needs of their loved ones and future generations.

02

High-net-worth individuals who want to protect their assets from potential risks such as lawsuits, creditors, or inheritance taxes.

03

Families with complex family dynamics, such as blended families, where a discretionary trust can help manage and distribute assets in a fair and equitable manner.

04

Business owners who want to ensure the continuity and succession of their business in the event of their incapacity or death. A discretionary trust can provide a mechanism for the orderly transfer or management of business assets.

05

Individuals who want to support charitable causes or organizations, as a discretionary trust can offer flexibility in determining when and how distributions are made for charitable purposes.

06

Those who want to maintain control and discretion over how their assets are managed and distributed after their death, allowing for flexibility and customization based on the individual needs and circumstances of beneficiaries.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my discretionary trust - old directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your discretionary trust - old and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Where do I find discretionary trust - old?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the discretionary trust - old. Open it immediately and start altering it with sophisticated capabilities.

How do I edit discretionary trust - old straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing discretionary trust - old.

What is discretionary trust - old?

A discretionary trust - old is a legal arrangement where the trustee has the discretion to decide how income and capital should be distributed to beneficiaries.

Who is required to file discretionary trust - old?

The trustee of a discretionary trust - old is required to file the necessary tax forms and reports.

How to fill out discretionary trust - old?

To fill out a discretionary trust - old, the trustee must gather all relevant financial information and complete the required tax forms accurately.

What is the purpose of discretionary trust - old?

The purpose of a discretionary trust - old is to protect and distribute assets to beneficiaries according to the terms set out in the trust deed.

What information must be reported on discretionary trust - old?

Information such as income, expenses, capital gains, distributions, and beneficiaries must be reported on a discretionary trust - old.

Fill out your discretionary trust - old online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Discretionary Trust - Old is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.