Get the free SELF EMPLOYED PERSONS PERSONAL DETAILS

Show details

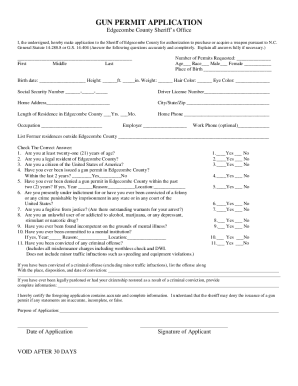

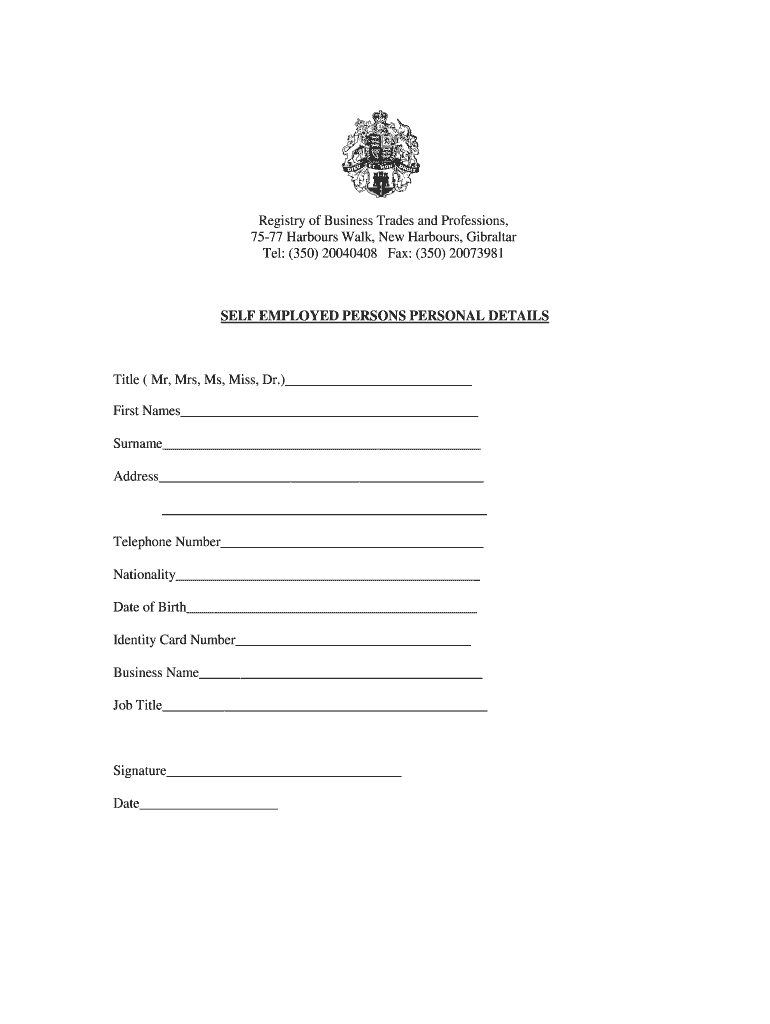

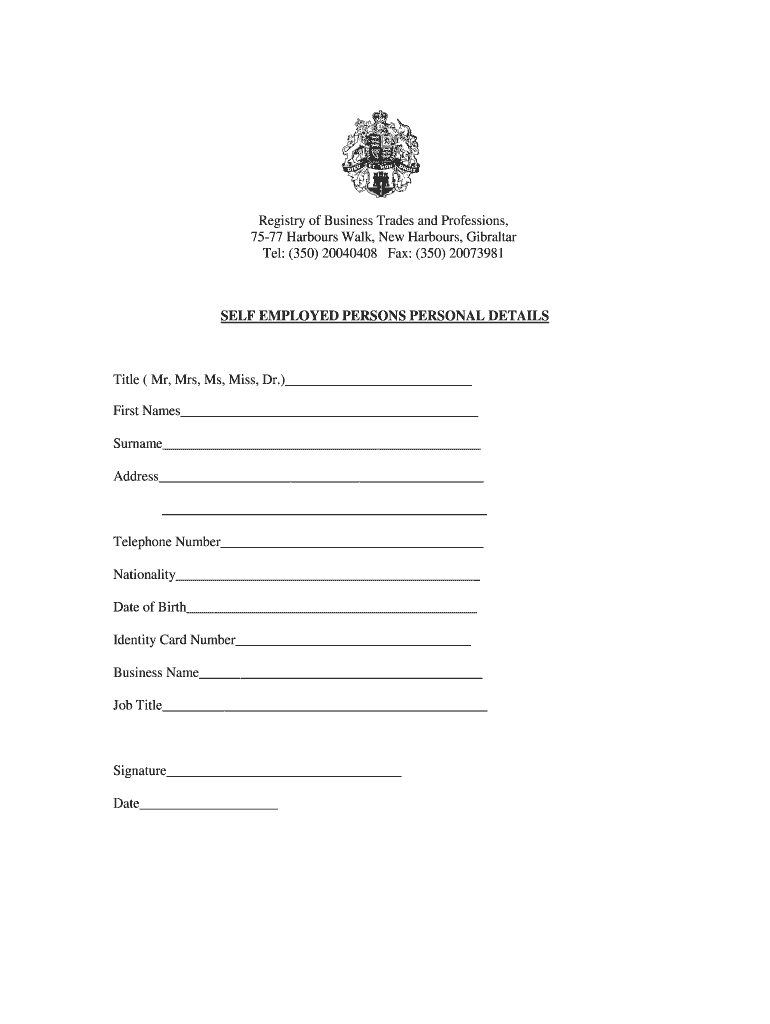

Registry of Business Trades and Professions, 7577 Harbors Walk, New Harbors, Gibraltar Tel: (350) 20040408 Fax: (350) 20073981 SELF EMPLOYED PERSONS PERSONAL DETAILS Title (Mr, Mrs, Ms, Miss, Dr.)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign self employed persons personal

Edit your self employed persons personal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self employed persons personal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit self employed persons personal online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit self employed persons personal. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out self employed persons personal

How to fill out self-employed persons personal:

01

Gather necessary personal information: Begin by collecting all relevant personal details such as your full name, address, contact information, social security number, and any other identifying information required.

02

Determine your income sources: As a self-employed individual, you may have multiple income streams. Identify and list all sources of income, including freelance work, contract jobs, or any other ventures generating income.

03

Calculate your total earnings: Sum up all your income sources to determine your total earnings for the specified period, whether it's monthly, quarterly, or annually. Ensure accuracy by cross-checking your financial records or invoices.

04

Deduct business expenses: Self-employed individuals are eligible for deducting business expenses that are necessary for their trade or profession. Keep track of your expenses such as office supplies, travel costs, internet bills, or marketing expenses, and deduct them accordingly.

05

Report self-employment tax: Self-employed individuals are responsible for paying self-employment tax, which includes both Social Security and Medicare taxes. Calculate the self-employment tax using the appropriate IRS forms or consult a tax professional for assistance.

06

Fill out relevant tax forms: Depending on your country's tax regulations, fill out the necessary tax forms for self-employed individuals. In the United States, this may include Form 1040, Schedule C, and Schedule SE. Ensure you accurately report your income, deductions, and self-employment tax.

Who needs self-employed persons personal?

01

Self-employed individuals: The most obvious group that needs to fill out self-employed persons personal information is self-employed individuals themselves. This information is vital for accurately reporting their income, expenses, and tax liabilities.

02

Tax authorities: Government tax authorities require self-employed persons' personal information to ensure compliance with tax laws, verify income, and appropriately assess taxes owed. Properly filled out personal information assists in efficient tax administration.

03

Financial institutions: Self-employed individuals may require personal information when applying for business loans, opening business bank accounts, or other financial transactions. Lenders and financial institutions need this information to assess creditworthiness and verify identity.

04

Insurance companies: Self-employed individuals may need to provide personal information to insurance companies when seeking coverage for health insurance, liability insurance, or other types of coverage relevant to their self-employment activities.

Remember to consult with tax professionals or experts in your specific jurisdiction for accurate and up-to-date information regarding self-employment tax obligations and reporting requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send self employed persons personal to be eSigned by others?

Once you are ready to share your self employed persons personal, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for the self employed persons personal in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your self employed persons personal in minutes.

How do I edit self employed persons personal straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing self employed persons personal.

What is self employed persons personal?

Self employed persons personal refers to the individual tax return filed by self employed individuals who earn income directly from their business or trade.

Who is required to file self employed persons personal?

Self employed individuals who earn income directly from their business or trade are required to file self employed persons personal.

How to fill out self employed persons personal?

Self employed persons personal can be filled out by providing information on income, expenses, deductions, and credits related to the self employment activities.

What is the purpose of self employed persons personal?

The purpose of self employed persons personal is to report the income and expenses of self employed individuals for tax purposes.

What information must be reported on self employed persons personal?

Information such as income, expenses, deductions, and credits related to the self employment activities must be reported on self employed persons personal.

Fill out your self employed persons personal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self Employed Persons Personal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.