Get the free 2016 Annual Practitioner Fee Exemption Form Exempt

Show details

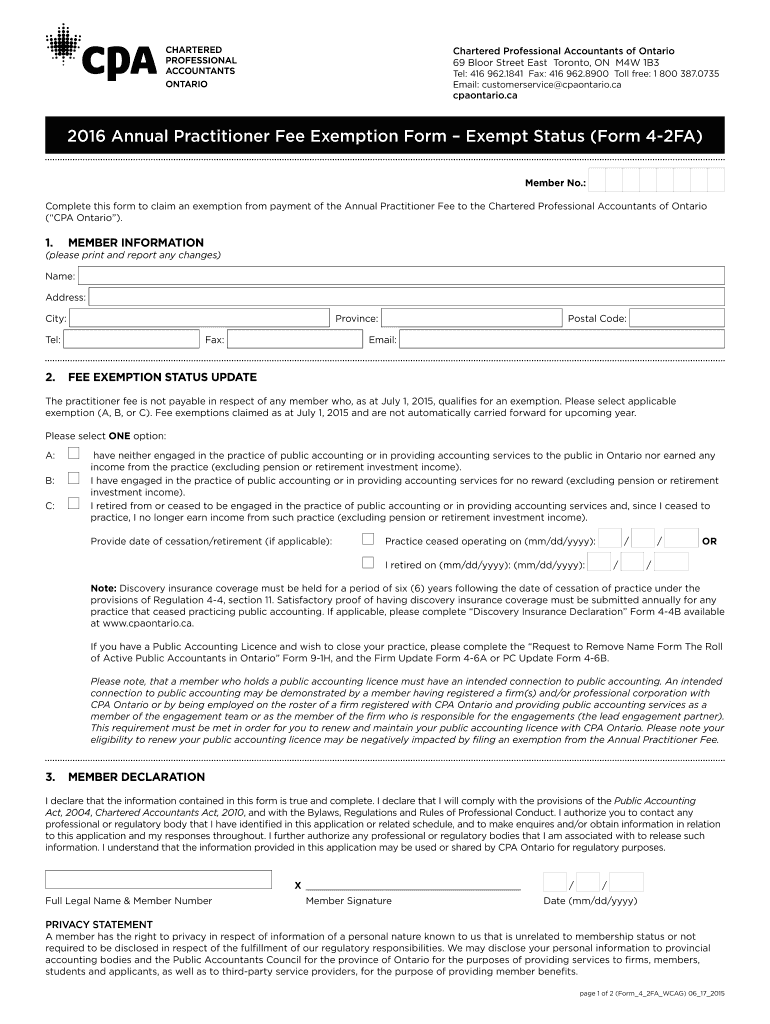

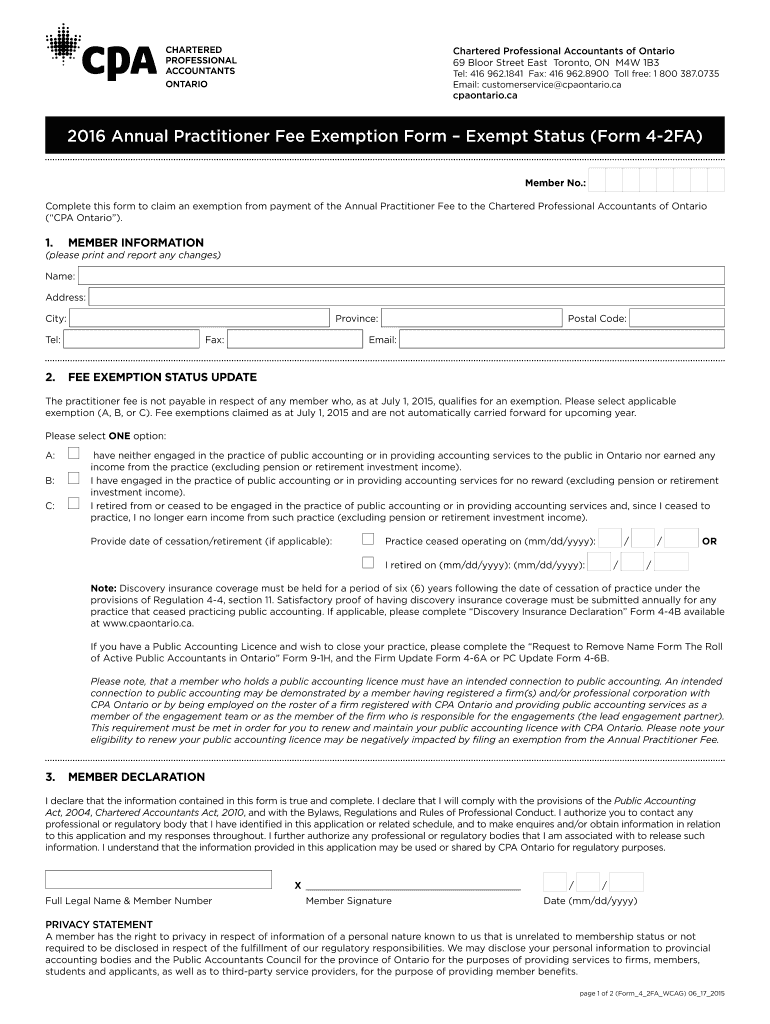

Chartered Professional Accountants of Ontario 69 Bloor Street East Toronto, ON M4W 1B3 Tel: 416 962.1841 Fax: 416 962.8900 Toll free: 1 800 387.0735 Email: customer service Ontario.ca Ontario.ca 2016

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2016 annual practitioner fee

Edit your 2016 annual practitioner fee form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2016 annual practitioner fee form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2016 annual practitioner fee online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2016 annual practitioner fee. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2016 annual practitioner fee

How to fill out 2016 annual practitioner fee:

01

Begin by gathering all relevant documents such as tax forms, financial statements, and receipts related to your practice for the year 2016.

02

Access the appropriate form for the annual practitioner fee for the year 2016. This form is typically provided by the relevant governing body or professional association.

03

Carefully read the instructions provided on the form to ensure you understand the requirements and any specific information needed.

04

Fill out the personal information section of the form, including your name, contact information, and any identification numbers or codes required.

05

Provide details about your practice for the year 2016, including the type of services offered, number of patients treated, and any other relevant information.

06

Calculate the total income generated from your practice in 2016 and enter this amount in the appropriate section of the form.

07

Deduct any allowable expenses related to your practice for the year 2016, such as rent, insurance, and professional development.

08

Calculate the net income from your practice by subtracting the total expenses from the total income.

09

Enter the net income amount in the designated section of the form, ensuring accuracy and proper formatting as required.

10

Review the completed form to make sure all information is correct and accurate.

11

Sign and date the form, attesting to the accuracy of the information provided.

12

Submit the filled out 2016 annual practitioner fee form to the appropriate authority or governing body by the specified deadline.

Who needs 2016 annual practitioner fee?

01

Any healthcare professional who was practicing in the year 2016 and is required to pay an annual fee to the relevant governing body or professional association.

02

This may include doctors, dentists, nurses, therapists, and other medical practitioners who operate in both private practices and institutional settings.

03

Professionals who are self-employed and those who are employed by organizations may both be obligated to pay the annual practitioner fee for the given year.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2016 annual practitioner fee directly from Gmail?

2016 annual practitioner fee and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Where do I find 2016 annual practitioner fee?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific 2016 annual practitioner fee and other forms. Find the template you need and change it using powerful tools.

How do I fill out 2016 annual practitioner fee using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign 2016 annual practitioner fee and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is annual practitioner fee exemption?

The annual practitioner fee exemption is a provision that allows certain practitioners to be exempt from paying the annual fee required for practicing their profession.

Who is required to file annual practitioner fee exemption?

Practitioners who meet the criteria for exemption set by the regulatory body are required to file for annual practitioner fee exemption.

How to fill out annual practitioner fee exemption?

To fill out annual practitioner fee exemption, practitioners need to complete the designated form provided by the regulatory body and submit it along with any required documentation.

What is the purpose of annual practitioner fee exemption?

The purpose of annual practitioner fee exemption is to provide relief to practitioners who may face financial challenges in paying the annual fee.

What information must be reported on annual practitioner fee exemption?

The annual practitioner fee exemption form typically requires information such as practitioner's name, contact details, profession, reason for exemption, and supporting documentation.

Fill out your 2016 annual practitioner fee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2016 Annual Practitioner Fee is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.