Get the free Tax Relief Services

Show details

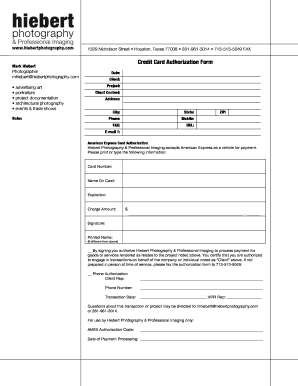

Tax Relief Services The Tax Relief YoureLookingFor! 1259 South Batavia St., Suite 2 Honolulu, HI 96814 TEL: 808.5892322 FAX: 808.5892422 Print Clear Credit Card Authorization Dear Client, Please complete

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax relief services

Edit your tax relief services form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax relief services form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax relief services online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax relief services. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax relief services

How to Fill out Tax Relief Services:

01

Gather all necessary documents: Collect all your tax-related documents such as W-2 forms, 1099 forms, receipts, and any other documentation relevant to your tax situation.

02

Review your financial information: Carefully examine your financial records to ensure accuracy and gather any additional information that may be required for tax relief services.

03

Understand eligibility requirements: Educate yourself about the eligibility criteria for tax relief services. This may include factors such as income level, tax debt amount, or specific circumstances that qualify for relief.

04

Consult with a tax professional: It is highly recommended to seek the advice of a knowledgeable tax professional who specializes in tax relief services. They can guide you through the process, answer your questions, and provide expert assistance.

05

Determine the appropriate relief option: There are various tax relief options available, such as installment plans, offer in compromise, innocent spouse relief, or penalty abatement. Identify which option is most suitable for your specific tax situation.

06

Complete the necessary forms: Based on the chosen tax relief option, you may need to fill out specific forms such as Form 9465 for installment agreements or Form 656 for offers in compromise. Ensure that you accurately complete all required fields and provide all requested information.

07

Documentation submission: Compile all completed forms and supporting documents and submit them to the appropriate tax authority. Ensure that you keep copies of all submitted paperwork for your records.

08

Follow up and track progress: Stay in touch with the tax authority to track the progress of your tax relief application. It is important to respond promptly to any requests or inquiries they may have during the process.

09

Seek professional assistance in case of challenges: If you encounter any challenges or receiving a denial, consider seeking professional assistance to review your case, identify any possible errors, and explore alternative solutions.

Who needs tax relief services?

01

Individuals with overwhelming tax debt: Those who are struggling with a significant amount of tax debt that they cannot pay in full may need tax relief services to explore options for reducing their tax liability.

02

Taxpayers facing economic hardship: Individuals who are experiencing a financial crisis, such as loss of income, job loss, or medical expenses, may require tax relief services to alleviate their tax burden during difficult times.

03

Taxpayers with tax-related penalties or interest: Individuals who have accumulated tax penalties or interest due to late filing, underpayment, or other tax-related mistakes may benefit from tax relief services to negotiate penalty abatement or reduction.

04

Business owners with tax liabilities: Small business owners or self-employed individuals who are struggling to meet their tax obligations may seek tax relief services to explore options for reducing their tax liability and avoiding potential legal consequences.

05

Taxpayers facing audits or tax disputes: Individuals who are undergoing a tax audit or facing tax disputes with the tax authorities may find tax relief services valuable in navigating the complex process and ensuring fair treatment.

06

Taxpayers with a complex tax situation: Those with complicated tax situations such as multiple sources of income, investments, or international tax obligations may seek the assistance of tax relief services to ensure compliance and optimize their tax position.

07

Individuals seeking professional advice: Even if someone does not have a pressing tax issue, they may still benefit from tax relief services by consulting with tax professionals who can provide expert advice, identify potential tax savings opportunities, and ensure accurate tax filing.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get tax relief services?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific tax relief services and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How can I edit tax relief services on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing tax relief services, you need to install and log in to the app.

How do I complete tax relief services on an Android device?

Complete your tax relief services and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is tax relief services?

Tax relief services are programs or services designed to help individuals or businesses reduce the amount of taxes owed to the government.

Who is required to file tax relief services?

Individuals or businesses who are looking to reduce their tax liabilities or seek relief from tax debts may consider filing for tax relief services.

How to fill out tax relief services?

Tax relief services can be filled out by gathering all relevant financial information, assessing eligibility for different tax relief programs, and submitting the necessary forms to the appropriate tax authorities.

What is the purpose of tax relief services?

The purpose of tax relief services is to help individuals or businesses reduce the amount of taxes they owe, alleviate financial burdens, and provide assistance in resolving tax disputes with the government.

What information must be reported on tax relief services?

Information such as income, expenses, deductions, credits, and any tax liabilities or debts must be reported on tax relief services.

Fill out your tax relief services online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Relief Services is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.