Get the free Grand Rapids City Treasurer Fax Credit Card Payment Advice - grcity

Show details

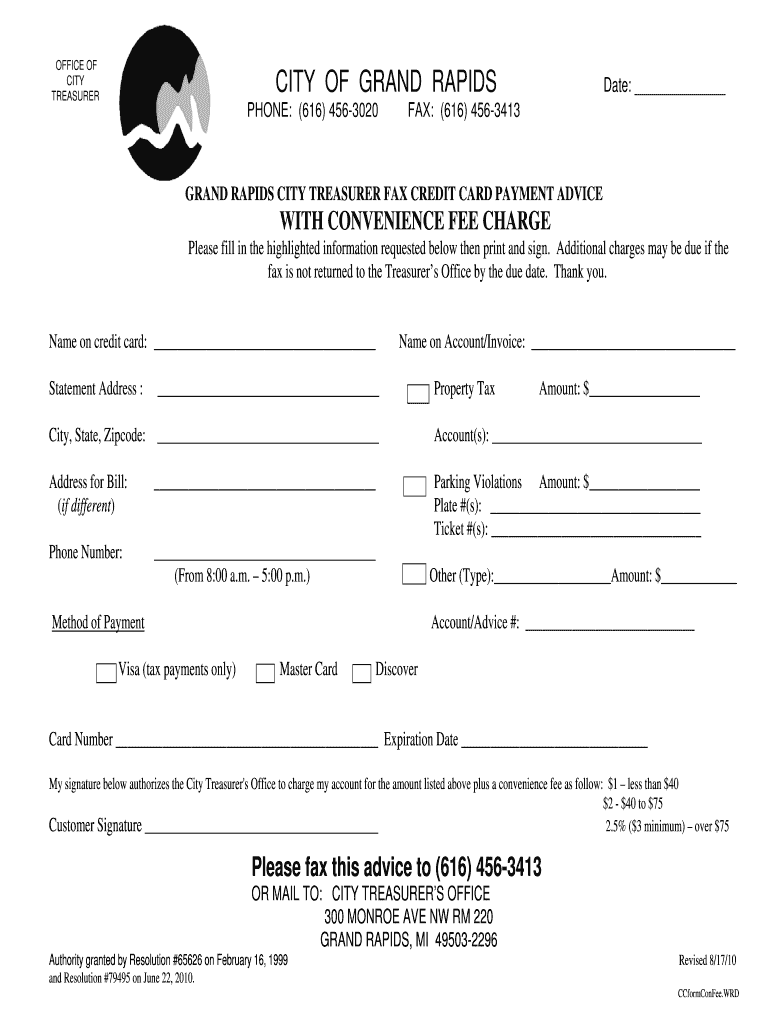

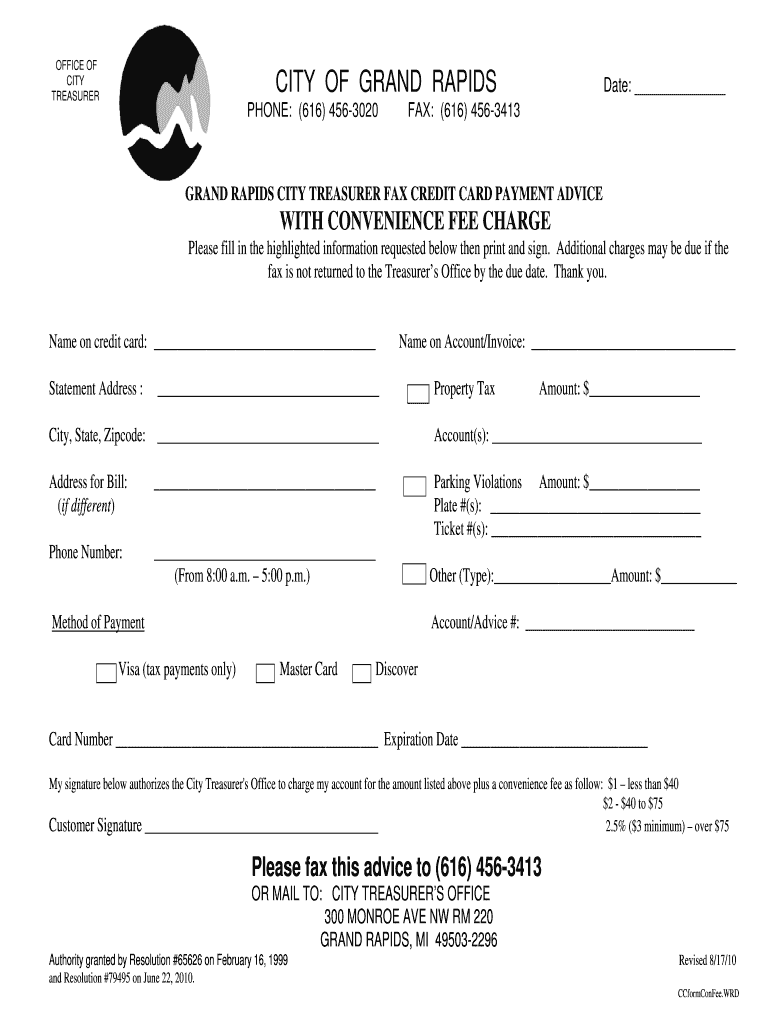

This document serves as a payment advice form for submitting credit card payments to the Grand Rapids City Treasurer's Office, including instructions for filling out the form and fee information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign grand rapids city treasurer

Edit your grand rapids city treasurer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your grand rapids city treasurer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit grand rapids city treasurer online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit grand rapids city treasurer. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out grand rapids city treasurer

How to fill out Grand Rapids City Treasurer Fax Credit Card Payment Advice

01

Obtain the Grand Rapids City Treasurer Fax Credit Card Payment Advice form from the official City website or office.

02

Fill in your name and contact details at the top of the form.

03

Provide your address and account number for accurate processing.

04

Specify the amount you are paying via credit card.

05

Choose the type of credit card you will be using (Visa, MasterCard, etc.).

06

Fill in your credit card number, expiration date, and security code.

07

Sign and date the form to authorize the payment.

08

Review the completed form for accuracy.

09

Fax the form to the designated number provided on the form.

Who needs Grand Rapids City Treasurer Fax Credit Card Payment Advice?

01

Residents and property owners in Grand Rapids who have outstanding payments or fees.

02

Businesses operating within Grand Rapids that need to make payments to the city.

03

Anyone who prefers to make credit card payments for services, permits, or taxes owed to the City of Grand Rapids.

Fill

form

: Try Risk Free

People Also Ask about

How to pay Grand Rapids property taxes?

We accept cash, check, money order and credit/debit cards (Visa, MasterCard, Discover, or American Express) for in person payments. Be prepared to pay upto a 2.98% convenience fee ($1.50 minimum) if you pay with a credit/debit card. Check out the property tax payment options to decide which one works best for you.

Can I pay Michigan taxes online?

The ePayments system is secure, fast, and convenient. You can make your Michigan Individual Income Tax payments electronically by check, debit, or credit card.

Does Grand Rapids require local tax withholding?

You will need to withhold if you are an employer who meets any of the following: If you have a location in the city. If you are “doing business” in the city, even if you don't have a location in the city. If you have locations both in and out of the city.

Can I pay Grand Rapids City tax online?

You can pay online with a bank account or a credit or debit card (Visa, MasterCard, or Discover). There's a 3% convenience fee to pay online using credit or debit with a $1.50 minimum.

How do I pay my Grand Rapids city tax?

Phone Prepare your payment. We accept credit/debit cards (Visa, MasterCard, or Discover) for phone payments. Keep in mind that we charge a 3% fee ($1.50 minimum) for payments over the phone. Call to make payment. Call our office at 616-456-3415 to make your payment by phone.

What is the phone number for Grand Rapids PayIt?

Check your balance You can find your account balance, tip history and recycle cart history in your GR PayIt account. If you don't have a GR PayIt account, call 311 or 616-456-3000. We'll give you your account information.

Does Grand Rapids have a city income tax?

0:00 1:53 And state taxes. City tax returns aren't due until April 30th. This can change if due dates areMoreAnd state taxes. City tax returns aren't due until April 30th. This can change if due dates are extended by the IRS. Make sure you submit on time to avoid any late fees.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Grand Rapids City Treasurer Fax Credit Card Payment Advice?

The Grand Rapids City Treasurer Fax Credit Card Payment Advice is a document used to provide notification of credit card payments made to the City Treasurer's office in Grand Rapids, ensuring proper record-keeping and processing of those payments.

Who is required to file Grand Rapids City Treasurer Fax Credit Card Payment Advice?

Individuals or organizations making credit card payments to the City of Grand Rapids are required to file the Grand Rapids City Treasurer Fax Credit Card Payment Advice to confirm their payments and facilitate accounting processes.

How to fill out Grand Rapids City Treasurer Fax Credit Card Payment Advice?

To fill out the Grand Rapids City Treasurer Fax Credit Card Payment Advice, users should provide their payment details, including the total amount paid, credit card information, billing address, and any relevant account numbers or references to identify the payment clearly.

What is the purpose of Grand Rapids City Treasurer Fax Credit Card Payment Advice?

The purpose of the Grand Rapids City Treasurer Fax Credit Card Payment Advice is to ensure that credit card payments are accurately recorded by the Treasurer's office, facilitating proper tracking and management of funds received.

What information must be reported on Grand Rapids City Treasurer Fax Credit Card Payment Advice?

The information that must be reported on the Grand Rapids City Treasurer Fax Credit Card Payment Advice includes the payer's name, contact information, payment amount, date of payment, credit card type, last four digits of the credit card number, and any specific account or reference numbers associated with the payment.

Fill out your grand rapids city treasurer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Grand Rapids City Treasurer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.