Get the free Do It Yourself Credit Repair

Show details

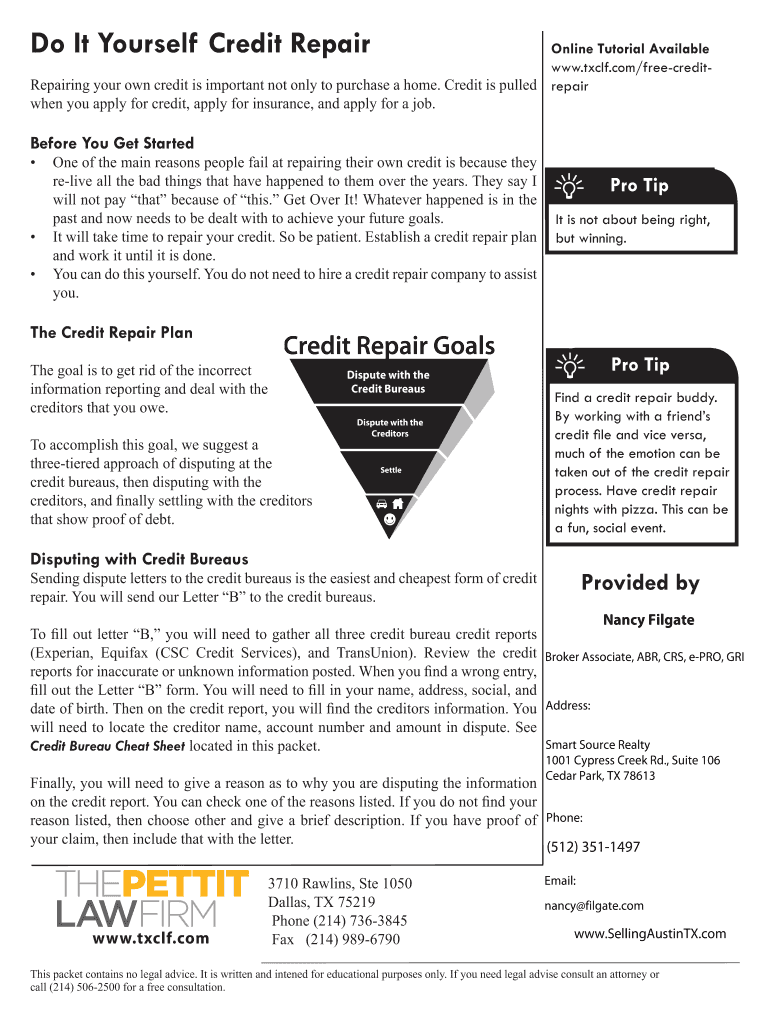

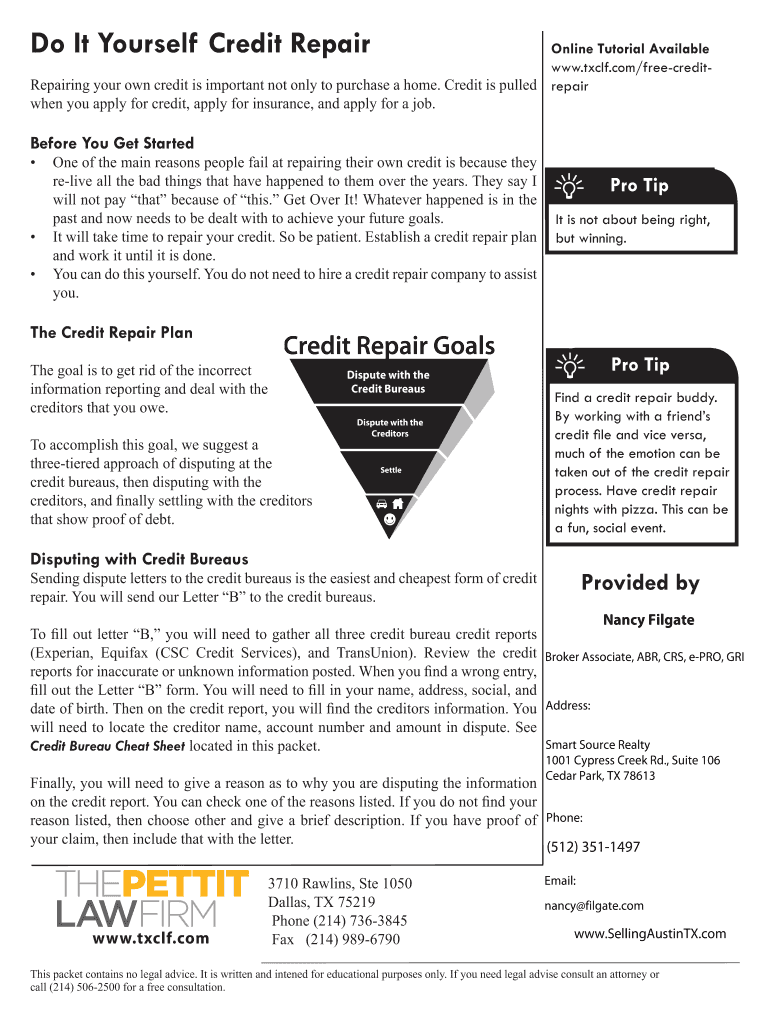

Do It Yourself Credit Repair Online Tutorial Available www.txclf.com/freecreditRepairing your own credit is important not only to purchase a home. Credit is pulled repair when you apply for credit,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign do it yourself credit

Edit your do it yourself credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your do it yourself credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit do it yourself credit online

Follow the guidelines below to benefit from a competent PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit do it yourself credit. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out do it yourself credit

How to Fill Out Do It Yourself Credit:

01

Gather all necessary documents: Before starting the process, make sure you have all the required documents in place. This may include your identification cards, income statements, bank statements, and any other relevant financial documents.

02

Review your credit report: Obtain a copy of your credit report from one of the major credit bureaus. It's important to review your credit history and check for any errors or discrepancies that may negatively impact your credit score.

03

Assess your financial situation: Before applying for any credit, it's crucial to assess your financial situation. Determine your income, expenses, and existing debts to get a clear picture of your financial health. This will help you make informed decisions and avoid taking on unnecessary debt.

04

Research different credit options: There are various types of credit available, such as personal loans, credit cards, and mortgages. Research different options and consider their interest rates, repayment terms, and eligibility requirements. Choose the type of credit that best suits your needs and financial situation.

05

Complete the application accurately: When filling out the credit application, provide accurate and truthful information. Mistakes or inaccuracies can delay the approval process or even lead to a denial. Double-check all the information before submitting the application.

06

Submit required documents: Along with the application, you may be required to submit additional documents to support your credit application. This could include proof of income, proof of residence, or any other documentation specific to the type of credit you're applying for. Ensure you attach all necessary documents to avoid delays in the processing of your application.

Who Needs Do It Yourself Credit:

01

Individuals with financial discipline: Do it yourself credit is suitable for individuals who have the financial discipline to handle credit responsibly. It requires a level of self-control to make timely payments and not overspend, as irresponsible credit usage can lead to debt and financial stress.

02

People looking to build credit history: If you have limited or no credit history, a do it yourself credit approach can help you establish a positive credit history. By responsibly using credit and making timely payments, you can demonstrate your creditworthiness to lenders and increase your chances of obtaining credit in the future.

03

Those aiming to improve their credit score: If you have a low credit score, a do it yourself credit approach can help you improve it over time. By consistently paying off debts, reducing credit utilization, and demonstrating responsible credit behavior, you can boost your credit score and improve your overall financial standing.

In conclusion, filling out do it yourself credit involves gathering necessary documents, reviewing your credit report, assessing your financial situation, researching credit options, accurately completing the application, and submitting any required documents. This approach is beneficial for individuals with financial discipline, those looking to build credit history, and those aiming to improve their credit score.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit do it yourself credit from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your do it yourself credit into a dynamic fillable form that you can manage and eSign from anywhere.

Can I sign the do it yourself credit electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I complete do it yourself credit on an Android device?

Complete do it yourself credit and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is do it yourself credit?

Do-it-yourself credit refers to the process of individuals managing their own credit repair and improvement without the help of professional credit repair services.

Who is required to file do it yourself credit?

Anyone looking to improve their credit score or repair their credit history can take advantage of do-it-yourself credit methods.

How to fill out do it yourself credit?

To fill out a do-it-yourself credit report, individuals need to gather information about their credit history, identify any inaccuracies, and take steps to improve their credit score, such as paying off debts and establishing positive payment history.

What is the purpose of do it yourself credit?

The purpose of do-it-yourself credit is to empower individuals to take control of their own credit repair and improvement efforts, rather than relying on expensive professional services.

What information must be reported on do it yourself credit?

Information such as personal identifying information, credit card accounts, loan accounts, payment history, and any negative marks on the credit report must be reported on a do-it-yourself credit report.

Fill out your do it yourself credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Do It Yourself Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.