Get the free BUSINESS INCOME TAX RETURN BI-470 PAYMENT VOUCHER - tax vermont

Show details

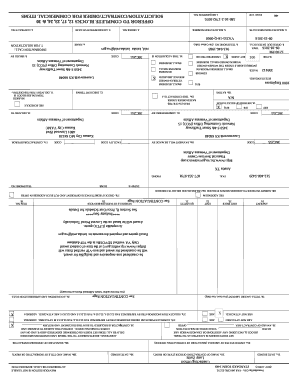

Vermont Department of Taxes Phone: (802) 8285723 VT Form BI470 133 State Street Montpelier, VT 056331401 144701100* BUSINESS INCOME TAX RETURN PAYMENT VOUCHER * 1 4 4 7 0 1 1 0 0 * USE THIS FORM IF

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business income tax return

Edit your business income tax return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business income tax return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business income tax return online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit business income tax return. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business income tax return

How to Fill Out Business Income Tax Return:

01

Gather all necessary documents: Before filling out your business income tax return, you need to collect all relevant documents, such as income statements, expense receipts, and any tax forms related to your business operations.

02

Understand the forms: Familiarize yourself with the specific tax forms required for reporting business income. This may vary depending on your business structure (sole proprietorship, partnership, corporation, etc.). Common forms include Schedule C, Form 1065, or Form 1120.

03

Determine your filing status: Choose the appropriate filing status for your business, such as single, married filing jointly, or married filing separately. This will influence your tax liability and potential deductions.

04

Report your business income: Fill out the designated sections on the tax forms to report your business income accurately. Include revenue from sales, services, or any other sources related to your business activities. Ensure that you correctly calculate and report all income figures.

05

Deduct eligible expenses: Identify and deduct eligible business expenses to reduce your taxable income. Examples of deductible expenses may include rent, utilities, employee salaries, marketing costs, or office supplies. Review the tax laws for deductible expenses and keep detailed records.

06

Factor in depreciation: If applicable, account for depreciation of business assets. Certain long-term assets, such as buildings, vehicles, or equipment, lose value over time. Consult tax guidelines or a tax professional to determine the appropriate depreciation method.

07

Complete additional schedules: Depending on your business activities, you may need to complete additional schedules or forms to report specific types of income or claim certain deductions. Examples include Schedule K-1 for partnerships or Schedule E for rental income.

08

Double-check accuracy: Before submitting your business income tax return, ensure that all calculations are accurate and all relevant sections are complete. Mistakes or omissions can lead to penalties or delays in processing your return.

09

File the tax return: Once you are confident that your business income tax return is complete and accurate, file it with the appropriate tax authorities. Consider filing electronically for faster processing and to receive any potential refunds sooner.

Who needs a business income tax return?

01

Sole proprietors: If you are the sole owner of your business and it is not registered as a separate legal entity, you need to file a business income tax return. This includes reporting your business income and expenses on Schedule C in your personal tax return.

02

Partnerships: Partnerships must file an annual tax return using Form 1065, even if the business did not make a profit. This form reports each partner's share of the business's income and expenses.

03

Limited liability companies (LLCs): Depending on the number of members in an LLC, it can be treated as either a partnership or a corporation for tax purposes. In most cases, multi-member LLCs file Form 1065, similar to partnerships, while single-member LLCs report business income on Schedule C of their personal tax return.

04

Corporations: C-corporations and S-corporations are separate legal entities from their owners, and they must file their own tax returns using Form 1120 or Form 1120S, respectively. These returns report the corporation's income and expenses and calculate the tax liability.

05

Non-profit organizations: Non-profit organizations, such as charities or educational institutions, also have specific tax reporting requirements and may need to file Form 990.

06

Foreign businesses: Foreign businesses operating in the United States may be subject to U.S. tax laws and may need to file a business income tax return, depending on their activities and income sources.

It is crucial to consult with a tax professional or review the specific tax guidelines for your business structure and location to ensure compliance with all tax obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is business income tax return?

A business income tax return is a form that a business must file with the government to report its income and expenses for the year.

Who is required to file business income tax return?

Any business that generates income during the year is required to file a business income tax return.

How to fill out business income tax return?

To fill out a business income tax return, you will need to gather information about your business's income, expenses, and deductions, and then follow the instructions on the specific tax form.

What is the purpose of business income tax return?

The purpose of a business income tax return is to calculate the amount of tax that a business owes to the government based on its income and expenses.

What information must be reported on business income tax return?

On a business income tax return, you must report details about your business's income, expenses, deductions, assets, and liabilities.

How do I complete business income tax return online?

Filling out and eSigning business income tax return is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit business income tax return online?

The editing procedure is simple with pdfFiller. Open your business income tax return in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I edit business income tax return on an Android device?

You can make any changes to PDF files, like business income tax return, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your business income tax return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Income Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.