Get the free NonParticipating Royalty Interest - Texas - dob texas

Show details

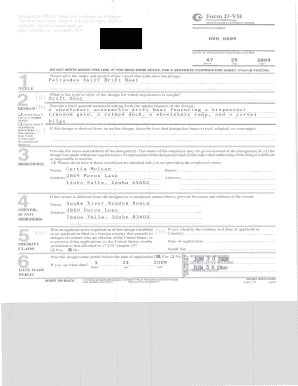

Reset Form TEXAS DEPARTMENT OF BANKING APPLICATION TO HOLD NONPARTICIPATING ROYALTY INTEREST AS PERSONAL PROPERTY (October 2013) Instructions: 1. Review Texas Finance Code 34.004 to determine whether

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nonparticipating royalty interest

Edit your nonparticipating royalty interest form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nonparticipating royalty interest form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nonparticipating royalty interest online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit nonparticipating royalty interest. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nonparticipating royalty interest

How to fill out nonparticipating royalty interest:

01

Begin by gathering all the necessary documentation, such as the contract or agreement that outlines the terms of the nonparticipating royalty interest. Make sure you have a clear understanding of the rights and obligations involved.

02

Carefully read through the contract, paying attention to any specific instructions or requirements for filling out the nonparticipating royalty interest. Take note of any deadlines or additional forms that may be needed.

03

Identify the key details that need to be included in the nonparticipating royalty interest form. This may include your personal information, such as your name and contact information, as well as details about the property or assets covered by the royalty interest.

04

Fill out the form accurately and completely. Double-check all information provided to ensure its accuracy. If you are unsure about any details, consult the contract or seek professional advice.

05

Review the completed nonparticipating royalty interest form to ensure that everything is filled out correctly. Make any necessary corrections or additions before submitting the form.

06

Submit the form according to the instructions provided. This may involve sending it by mail, fax, or electronically, depending on the requirements outlined in the contract.

Who needs nonparticipating royalty interest?

01

Individuals or entities who hold a royalty interest in a property or assets but do not have the right to participate in the management or decision-making process related to the property. This means they receive a portion of the income or revenue generated from the property without having a say in how it is operated.

02

Nonparticipating royalty interest can be valuable to individuals or entities who want to invest in a property without the responsibilities and risks associated with management decisions. It allows passive income generation without active involvement.

03

Nonparticipating royalty interest is commonly used in industries like oil and gas, where property owners may choose to lease their land to operators in exchange for a royalty interest in the production or revenue generated from the operations. By holding nonparticipating royalty interest, individuals or entities can benefit from these operations without taking on the burden of direct participation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit nonparticipating royalty interest from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including nonparticipating royalty interest. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I sign the nonparticipating royalty interest electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your nonparticipating royalty interest in seconds.

How do I complete nonparticipating royalty interest on an Android device?

On Android, use the pdfFiller mobile app to finish your nonparticipating royalty interest. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is nonparticipating royalty interest?

Nonparticipating royalty interest is a type of royalty interest where the owner receives a royalty payment from the production of minerals on a property but does not have the right to participate in the exploration or development of the property.

Who is required to file nonparticipating royalty interest?

The owner of the nonparticipating royalty interest is required to file the necessary paperwork and documentation.

How to fill out nonparticipating royalty interest?

To fill out nonparticipating royalty interest, the owner must provide relevant information such as the property details, production data, and royalty payment information.

What is the purpose of nonparticipating royalty interest?

The purpose of nonparticipating royalty interest is to provide a stream of income to the owner based on the production of minerals on a property without the need for active involvement in the mining operations.

What information must be reported on nonparticipating royalty interest?

The information that must be reported on nonparticipating royalty interest includes details about the property, production volume, royalty payment calculations, and any relevant agreements.

Fill out your nonparticipating royalty interest online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nonparticipating Royalty Interest is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.