Get the free Purchase Price Allocation Impacts on Taxes and

Show details

WWW.consulting.compilation observations

Purchase Price Allocation Impacts on Taxes and

Financial Statements Craig T. Hickey, CFA

and Tyler W. Mains, CPA

A time of transition can be a stressful one

for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign purchase price allocation impacts

Edit your purchase price allocation impacts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your purchase price allocation impacts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

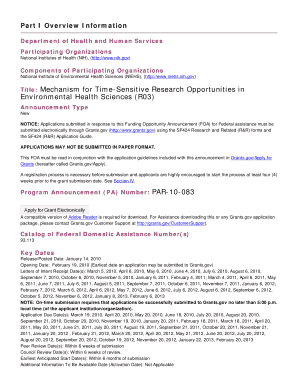

Editing purchase price allocation impacts online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit purchase price allocation impacts. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out purchase price allocation impacts

How to fill out purchase price allocation impacts:

01

Identify the assets being acquired: Start by listing all the assets that are being acquired as part of the purchase. This may include tangible assets like buildings, equipment, and inventory, as well as intangible assets like patents, trademarks, and customer relationships.

02

Determine the fair value of each asset: Once you have identified the assets, you need to determine their fair value. This can be done through various valuation methods, such as market comparables, income approach, or cost approach. Consult with a valuation specialist if needed to ensure accurate determination of fair value.

03

Allocate the purchase price to each asset: Once the fair value of each asset is determined, you can allocate the purchase price accordingly. This involves assigning a portion of the total purchase price to each asset based on its fair value. The total purchase price should equal the sum of fair values of all the assets.

04

Consider any liabilities assumed: In addition to assets, you also need to consider any liabilities assumed as part of the acquisition. These may include debts, obligations, or contingent liabilities. Allocate a portion of the purchase price to cover these liabilities as well.

05

Document the allocation: It is crucial to document the purchase price allocation for future reference and compliance purposes. This documentation should include a breakdown of the purchase price allocation for each asset, as well as the rationale behind the allocation decisions.

Who needs purchase price allocation impacts?

01

Acquiring companies: Companies that are acquiring other businesses or assets need purchase price allocation impacts to accurately record the transaction in their financial statements. This information helps in determining the value of the assets acquired and the amount to be allocated to each asset.

02

Accounting professionals: Accounting professionals, such as financial analysts, auditors, and valuation specialists, require purchase price allocation impacts to ensure accurate financial reporting and compliance with accounting standards. They rely on this information to assess the fair value of tangible and intangible assets acquired.

03

Investors and stakeholders: Investors and stakeholders interested in the acquiring company's financial performance and asset valuation rely on purchase price allocation impacts. This information can provide insights into the financial impact of the acquisition and the potential value of the acquired assets.

In summary, filling out purchase price allocation impacts involves identifying the assets, determining their fair value, allocating the purchase price, considering liabilities, and documenting the allocation. This information is needed by acquiring companies, accounting professionals, investors, and stakeholders to facilitate accurate financial reporting and assessment of asset values.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my purchase price allocation impacts in Gmail?

purchase price allocation impacts and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I complete purchase price allocation impacts online?

Easy online purchase price allocation impacts completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an eSignature for the purchase price allocation impacts in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your purchase price allocation impacts and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is purchase price allocation impacts?

Purchase price allocation impacts refer to the process of allocating the purchase price of an acquisition among the assets acquired and liabilities assumed.

Who is required to file purchase price allocation impacts?

The acquirer or the company that has acquired another business is required to file purchase price allocation impacts.

How to fill out purchase price allocation impacts?

Purchase price allocation impacts are typically filled out by financial analysts or accountants using historical financial data and fair value measurements.

What is the purpose of purchase price allocation impacts?

The purpose of purchase price allocation impacts is to provide a clear understanding of the allocation of purchase price among different assets and liabilities, which can impact financial reporting and tax implications.

What information must be reported on purchase price allocation impacts?

Information such as the fair value of assets acquired, liabilities assumed, goodwill, and any intangible assets must be reported on purchase price allocation impacts.

Fill out your purchase price allocation impacts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Purchase Price Allocation Impacts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.